Financial marketplace platform LendingTree (NASDAQ: TREE) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 18% year on year to $307.8 million. On top of that, next quarter’s revenue guidance ($285 million at the midpoint) was surprisingly good and 7.2% above what analysts were expecting. Its non-GAAP profit of $1.70 per share was 46.8% above analysts’ consensus estimates.

Is now the time to buy LendingTree? Find out by accessing our full research report, it’s free for active Edge members.

LendingTree (TREE) Q3 CY2025 Highlights:

- Revenue: $307.8 million vs analyst estimates of $277.3 million (18% year-on-year growth, 11% beat)

- Adjusted EPS: $1.70 vs analyst estimates of $1.16 (46.8% beat)

- Adjusted EBITDA: $39.8 million vs analyst estimates of $35.19 million (12.9% margin, 13.1% beat)

- Revenue Guidance for Q4 CY2025 is $285 million at the midpoint, above analyst estimates of $265.8 million

- EBITDA guidance for the full year is $127 million at the midpoint, above analyst estimates of $123.2 million

- Operating Margin: 9.3%, up from 3.8% in the same quarter last year

- Free Cash Flow Margin: 8.3%, down from 10.1% in the previous quarter

- Market Capitalization: $704 million

"We are incredibly saddened by the sudden passing of our founder, Chairman and CEO Doug Lebda. Doug was a visionary entrepreneur who created the financial services comparison shopping industry nearly 30 years ago when he founded LendingTree," said Scott Peyree, CEO.

Company Overview

Using the same comparison model that revolutionized travel booking, LendingTree (NASDAQ: TREE) operates an online platform that connects consumers with financial service providers across mortgages, personal loans, credit cards, insurance, and other financial products.

Revenue Growth

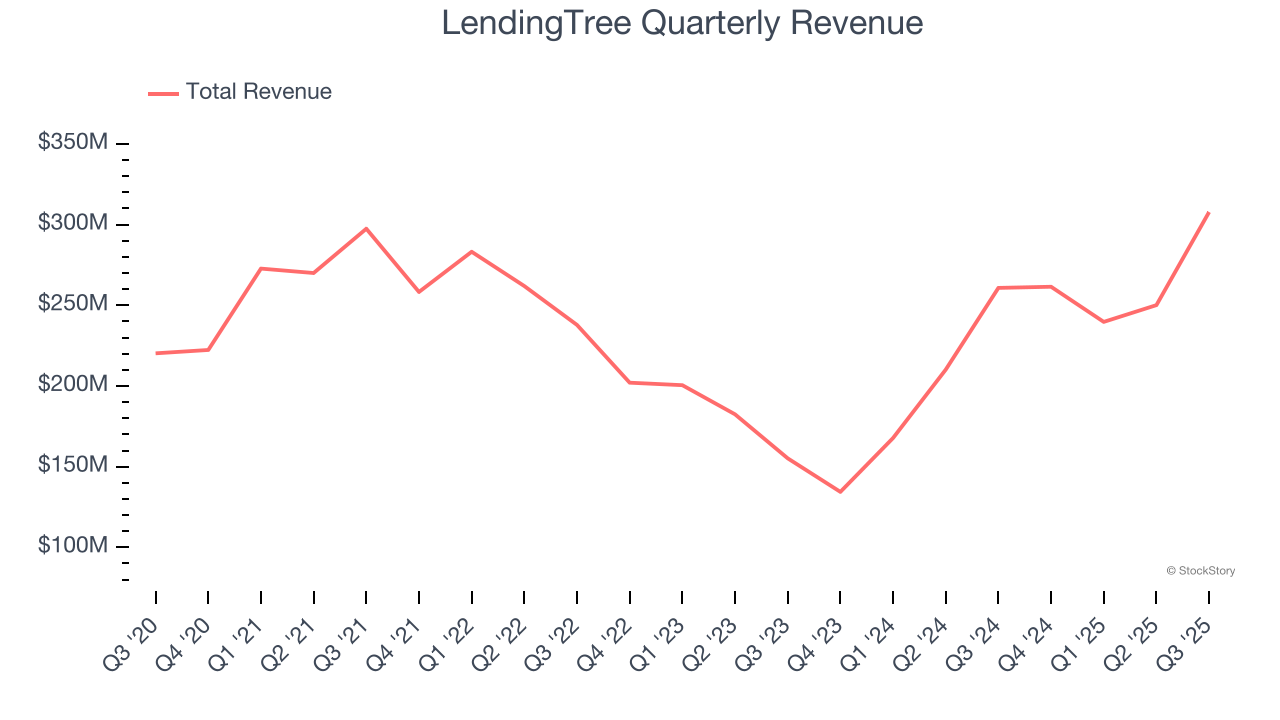

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, LendingTree struggled to consistently increase demand as its $1.06 billion of sales for the trailing 12 months was close to its revenue three years ago. This wasn’t a great result and suggests it’s a low quality business.

This quarter, LendingTree reported year-on-year revenue growth of 18%, and its $307.8 million of revenue exceeded Wall Street’s estimates by 11%. Company management is currently guiding for a 9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

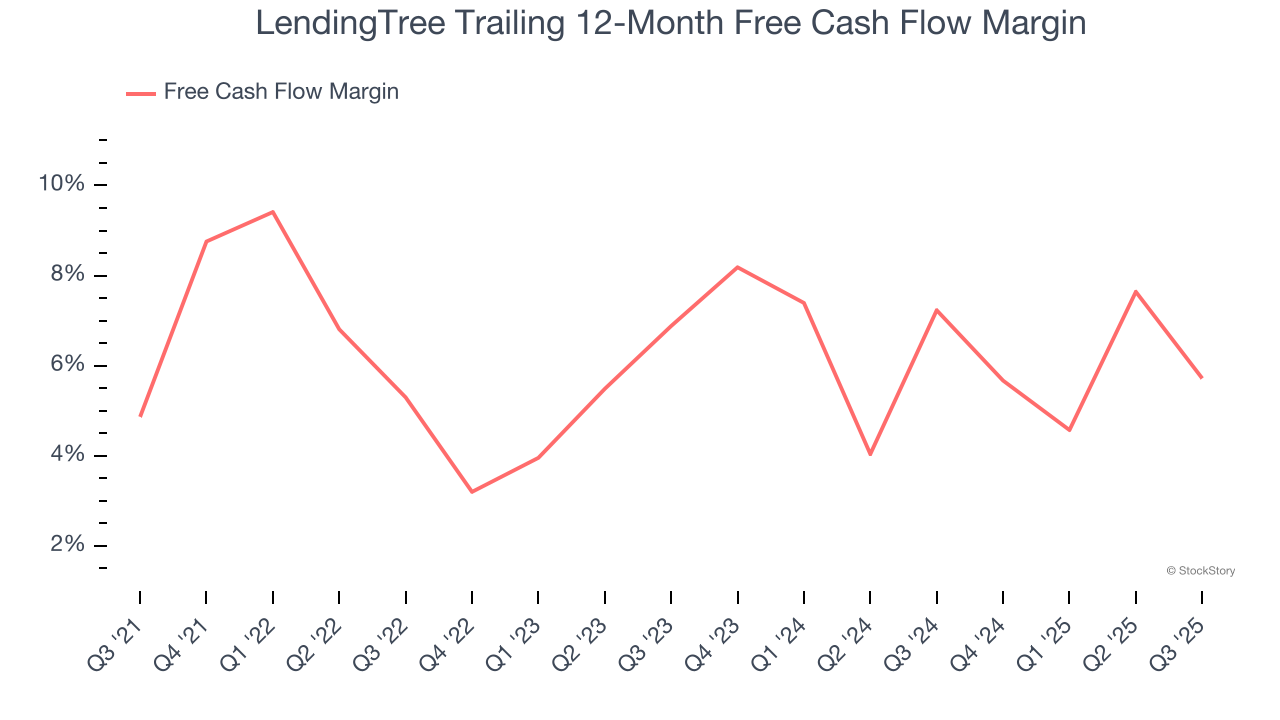

LendingTree has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.4% over the last two years, slightly better than the broader consumer internet sector.

LendingTree’s free cash flow clocked in at $25.57 million in Q3, equivalent to a 8.3% margin. The company’s cash profitability regressed as it was 7.9 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Key Takeaways from LendingTree’s Q3 Results

We were impressed by how significantly LendingTree blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its EBITDA guidance for next quarter missed. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $51.55 immediately after reporting.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.