Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at LendingTree (NASDAQ: TREE) and its peers.

Financial technology companies benefit from the increasing consumer demand for digital payments, banking, and finance. Tailwinds fueling this trend include e-commerce along with improvements in blockchain infrastructure and AI-driven credit underwriting, which make access to money faster and cheaper. Despite regulatory scrutiny and resistance from traditional financial institutions, fintechs are poised for long-term growth as they disrupt legacy systems by expanding financial services to underserved population segments.

The 4 financial technology stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 5.7% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 16.8% since the latest earnings results.

Best Q3: LendingTree (NASDAQ: TREE)

Using the same comparison model that revolutionized travel booking, LendingTree (NASDAQ: TREE) operates an online platform that connects consumers with financial service providers across mortgages, personal loans, credit cards, insurance, and other financial products.

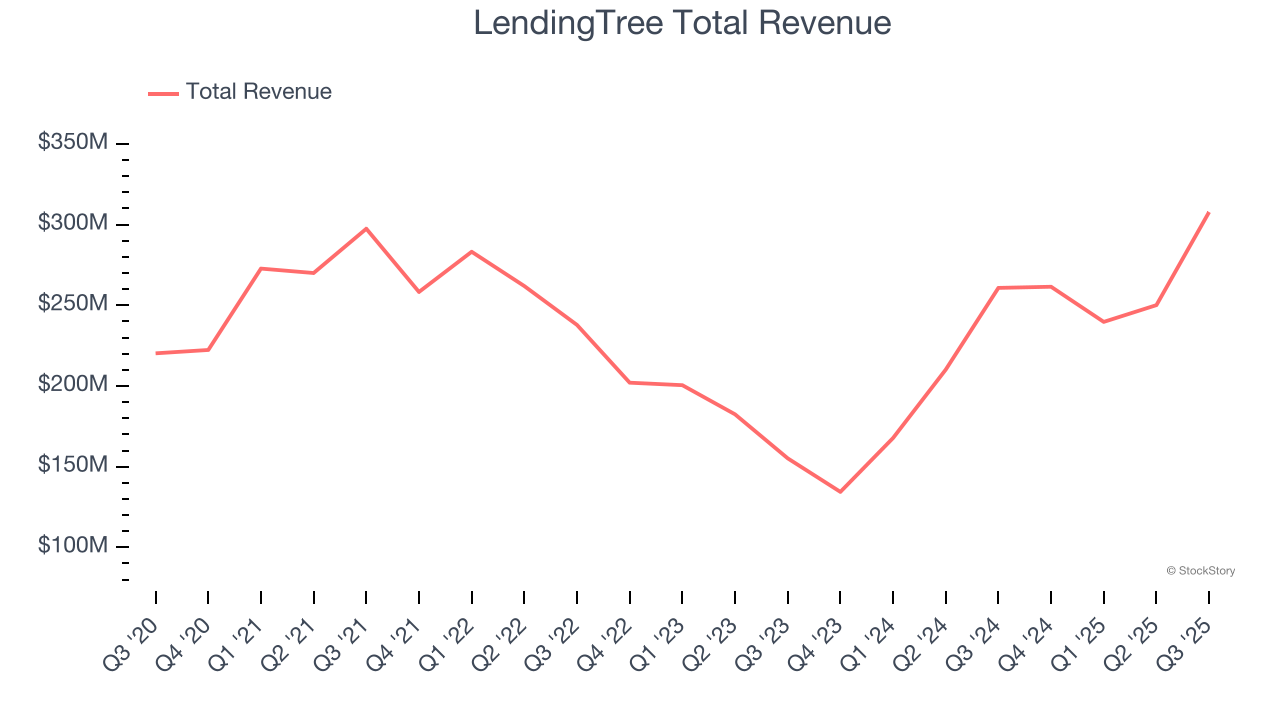

LendingTree reported revenues of $307.8 million, up 18% year on year. This print exceeded analysts’ expectations by 11%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

"We are incredibly saddened by the sudden passing of our founder, Chairman and CEO Doug Lebda. Doug was a visionary entrepreneur who created the financial services comparison shopping industry nearly 30 years ago when he founded LendingTree," said Scott Peyree, CEO.

LendingTree pulled off the biggest analyst estimates beat and highest full-year guidance raise, but had the slowest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 10% since reporting and currently trades at $54.38.

Is now the time to buy LendingTree? Access our full analysis of the earnings results here, it’s free for active Edge members.

Coinbase (NASDAQ: COIN)

Widely regarded as the face of crypto, Coinbase (NASDAQ: COIN) is a blockchain infrastructure company updating the financial system with its trading, staking, stablecoin, and other payment solutions.

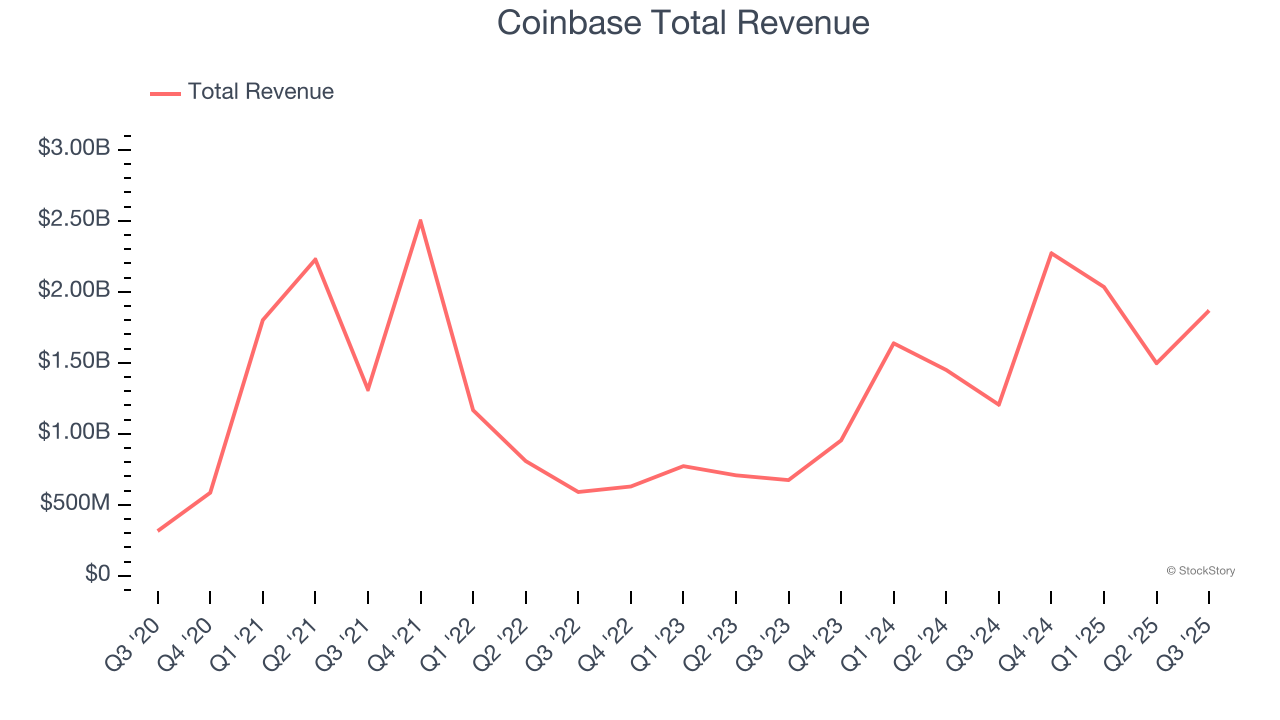

Coinbase reported revenues of $1.87 billion, up 55.1% year on year, outperforming analysts’ expectations by 4.5%. The business had a very strong quarter with a solid beat of analysts’ EBITDA and revenue estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 22.2% since reporting. It currently trades at $255.30.

Is now the time to buy Coinbase? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Remitly (NASDAQ: RELY)

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ: RELY) is an online platform that enables consumers to safely and quickly send money globally.

Remitly reported revenues of $419.5 million, up 24.7% year on year, exceeding analysts’ expectations by 1.4%. Still, it was a mixed quarter as it posted revenue guidance for next quarter slightly missing analysts’ expectations.

Remitly delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. The company reported 8.86 million active customers, up 21.1% year on year. As expected, the stock is down 21.3% since the results and currently trades at $13.22.

Read our full analysis of Remitly’s results here.

Robinhood (NASDAQ: HOOD)

With a mission to democratize finance, Robinhood (NASDAQ: HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Robinhood reported revenues of $1.27 billion, up 100% year on year. This result topped analysts’ expectations by 6%. Zooming out, it was a satisfactory quarter as it also recorded a solid beat of analysts’ revenue estimates but number of funded customers in line with analysts’ estimates.

Robinhood achieved the fastest revenue growth among its peers. The company reported 26.8 million users, up 10.3% year on year. The stock is down 13.8% since reporting and currently trades at $123.11.

Read our full, actionable report on Robinhood here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.