Introduction: A Market Holding Its Ground

Etherium (ETH) has also been showing the ability to maintain a significant degree of price stability and is at close to $3,700 at the moment following a few sessions of restrained motion. This stability, at a time when the larger digital markets are still unstable, shows that it is a period of consolidation and not stagnation. These intervals usually indicate that it starts to build up so as to make the market ready to be strategic with the breakout.

This analysis examines ETH’s price behaviour through technical levels, on-chain dynamics, macro drivers, and investigator insights from Poain BlockEnergy Inc. The goal is to provide a clear, data-driven outlook for traders and long-term investors.

Current Price Structure & Technical Zones

ETH is trading within a narrow band of $4000-$5000 dollars, and this is supporting a traditional consolidation zone. The close zone of between $4,000 and $4,200 still appeals to the buyers and the main barrier that fails to allow a break out is the resistance at the $4,800-$5,000 zone.

The recent candles have small volatility, and such a trend usually turns in a direction. It looks like the market is taking in liquidity slowly and the sharp selling pressures are not seen in the market in the past period.

Description:

A diagram of the recent 30-90 days price movement of ETH/USD. The support levels are indicated at a level of $4000 and the resistance levels are at a level of $5000. The chart shows Bollinger bands tightened and volume at its decrease.

Analysis:

The fact that the price action is compressed into a small range will indicate high accumulation. RSI values are also neutral but not in the overbought area but above the oversold one. This equilibrium means that the market is setting itself in the direction of a likely upward break, but it needs a catalyst to do so.

For more information check this link

On-Chain Foundations: What Poain Investigators Identified

Poain BlockEnergy Inc’s analysis points to several stabilizing forces within Ethereum’s network activity:

-

Staking Strength: More than 36 million ETH is currently locked in staking, reducing circulating supply.

-

High Network Utility: Transaction throughput and smart-contract usage remain elevated across DeFi, NFTs, and institutional operations.

-

Whale Accumulation: Large wallets continue to add ETH rather than distribute it, showing confidence in long-term valuation.

-

Stable Liquidity Flow: Exchange inflows remain controlled, limiting aggressive selling pressure.

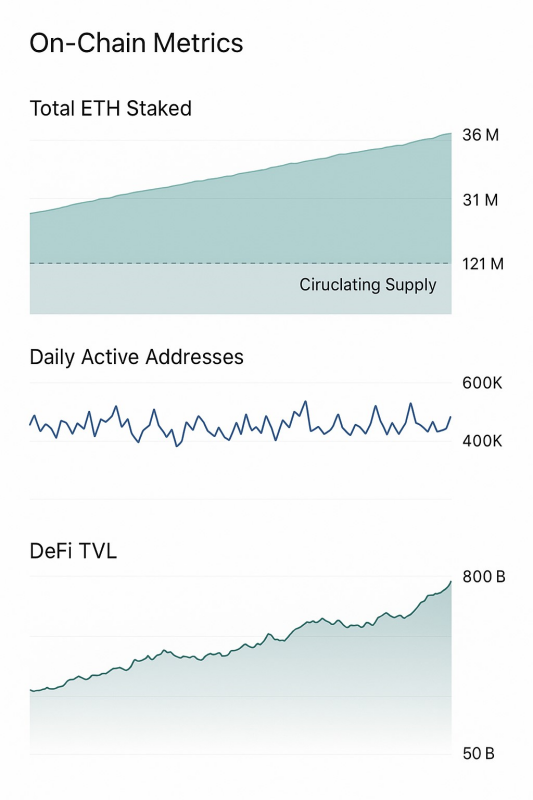

Description:

A graph of the amount of ETH deposited and supply. It shows increased staked ETH of over $36 million, as compared to the total global supply of around $121 million. Other signals include the number of active wallets each day and increased DeFi TVL.

Analysis:

The high staking activity lowers sell side liquidity which is one of the key factors leading to short term pricing stability. The fact that network transactions are active will ensure that the user will not lose interest and this will mean that the Ethereum ecosystem is still essentially robust even after the price consolidation.

Macro Landscape & Forward Outlook

The market environment surrounding Ethereum continues to mature. Global institutional participation, increasing acceptance of ETH-backed financial products, and clearer regulatory conditions create a more predictable trading climate.

-

Institutional accumulation is rising steadily as ETH becomes integrated into institutional portfolios.

-

Ecosystem upgrades enhance transaction efficiency, supporting long-term valuation.

-

Regulatory clarity around staking and asset classification reduces uncertainty for new entrants.

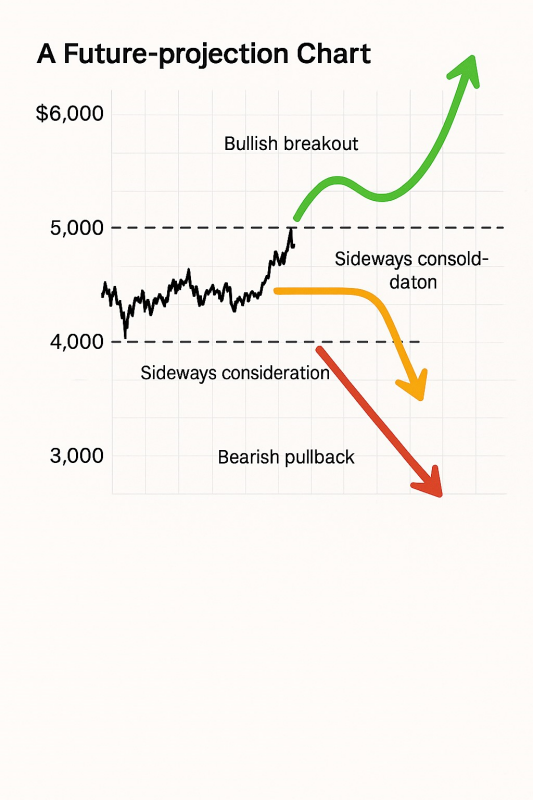

The forecasting models indicate how ETH can hit an all-time high of between $5,500 and $6,000 in case it convincingly breaks the resistance zone of $4,800 and $5,000. However, in the reverse scenario, the weakening of momentum can be followed by a break back at the support line of $4,000 and thereafter a new upward movement may be undertaken.

Description:

A projection chart of the three possible outcomes of ETH: scenario 1- Bullish breakout to $6,000, scenario 2- Sideways between $4,000-$5,000, and scenario 3- Bearish pullback to around $3,800.

Analysis:

Combination of technical compression, good staking fundamentals, and good macro signals skews the chances of the breakout to the bullish side. Nonetheless, trading volume and breakout confirmation is something that should be monitored before getting into leverage and high-risk trading by market players.

Investor Interpretation: What This Stability Really Means

The recent trading pattern of ETH is that of discipline rather than weakness. Price zones stability is a common indicator of structural strength accumulated by:

-

Healthy accumulation

-

Reduced selling pressure

-

Growing real-world utility

-

Mature investor behaviour

The most important level the traders can monitor is the resistance of $4,800. To long-term investors, the current price variation can be a positive stage of staggered buying or staking strategy.

Poain BlockEnergy Inc is dedicated to pre-sale and staking Poain Coin (PEB), which will provide a transparent, secure, and growth-oriented environment in the cryptocurrency market. Our investigative-based strategy will make sure that investors gain transparent knowledge, market data and valuable stakes based on the current dynamic blockchain environment.

The non- volatile price behaviour of ETH highlights a market that is about to make its next strategic step. Ethereium has good on-chain fundamentals, wide institutional backing, and a sound macro environment, which makes it look like it can grow steadily in the near term, as long as it moves out of its consolidation phase.

Poain BlockEnergy Inc remains vigilant to all these circumstances, providing professional insights and avenues of participation to those who wish to have an informed investor in the digital-asset economy.

Media Contact:

Company Name: Poain BlockEnergy Inc.

Official Website: https://poain.com/

The company's main business is the pre-sale and staking of Poain Coin (PEB).

Email: info@poain.com

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

Copyright (c) 2025 TheNewswire - All rights reserved.