The Challenge in Digital Finance

Dubai, UAE, 12th February 2025, ZEX PR WIRE, In today’s rapidly evolving digital finance landscape, investors face a crucial dilemma: how to achieve stable and high-yield returns while ensuring asset security? Traditional stablecoins like USDC and USDT provide stability but lack yield, whereas crypto-backed stablecoins such as DAI suffer from inefficiencies due to over-collateralization. With the rise of RWAFi (Real World Asset Finance), the integration of RWA and DeFi has unlocked trillions of dollars worth of latent yield potential, waiting to be tapped into.

.png)

What is RWAFi?

RWAFi is an emerging financial model that tokenizes real-world assets—such as real estate, bonds, equities, and infrastructure projects—leveraging blockchain technology to enhance yield generation and liquidity in DeFi.

What is BrickBank?

BrickBank is at the forefront of RWAFi innovation, ensuring sustainable and high-yield stablecoin returns. By combining the stability of RWA-backed yield with DeFi-driven yield opportunities, BrickBank introduces R2USD, a secure stablecoin designed to generate consistent and attractive returns.

Why Choose BrickBank?

-

Diversified Asset Portfolio & Attractive Yields

R2USD is backed by a diversified mix of real-world assets and DeFi yield sources, ensuring sustainable returns:

-

Real-World Assets (RWA):

-

Premium real estate rental income (APY ~5%)

-

Regulated tokenized government bonds (APY ~4.5%)

-

-

DeFi Yield Strategies:

-

sUSDe yield strategies (APY ~10%)

-

USDC reserves on DeFi protocols (APY ~3%)

-

Additionally, protocol revenues will supplement user APYs, and the BRICK token’s value growth offers further upside. We continuously seek high-quality RWA yield sources to maximize investor returns while optimizing risk.

-

User-Friendly Experience & Multi-Asset Support

-

Supports deposits in USDC, wBTC, ETH, and stETH, giving users flexible options for yield generation.

-

Seamless minting, staking, and reward distribution mechanisms ensure a frictionless experience.

-

Compliance-First Infrastructure & Transparent Security

BrickBank prioritizes regulatory compliance and security, working with regulated third-party partners to enhance transparency:

-

Institutional onboarding without compliance barriers.

-

Fully transparent on-chain asset management and periodic reporting.

-

Multi-layered security measures:

-

Smart contract security: Audited by reputable firms, with audit reports made public.

-

Third-party audits: Regular evaluations of RWAs and DeFi positions to ensure transparency.

-

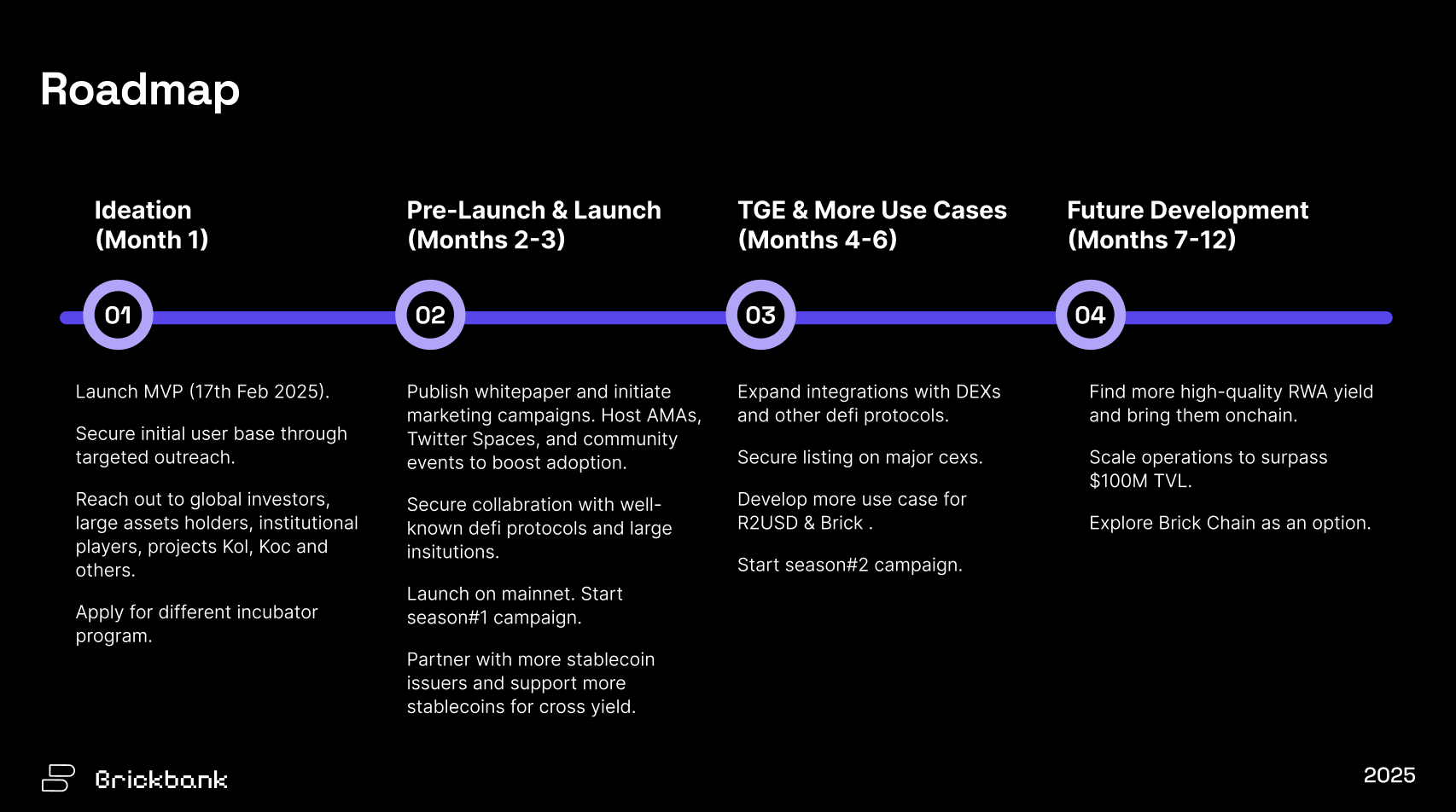

BrickBank Roadmap

Q1 2025

✅ Late February: Testnet & Pre-Season Campaign Launch

✅ Mainnet & Season #1 Launch

✅ Strategic Partnerships:

-

DeFi Collaborations: Integrating with Curve, Pendle, Ethna, Hyperliquid to provide liquidity pools and optimized yield strategies.

-

RWA Yield Providers: Partnering with regulated RWA providers like Ondo Finance and Superstate to onboard high-yield real-world assets.

Q2 2025

✅ Cross-Chain Expansion

-

Initially launching on Ethereum for security and liquidity.

-

Future expansion to Solana and other L1/L2 solutions to enhance scalability and adoption.

✅ Expanding Stablecoin Support & Use Cases

-

Onboarding more major stablecoin protocols to further strengthen R2USD’s adoption and utility.

Community & User Engagement

BrickBank is committed to building an inclusive global community, ensuring long-term value creation for all participants.

Global Expansion Efforts

We are actively expanding community outreach across multiple regions, including long-term collaborations with KOLs and local communities in: Turkey, Japan, Korea, Singapore, China, Malaysia, Indonesia, Vietnam, Thailand, Europe, Russia, and LATAM.

Pre-Season Activities

Our Pre-Season initiatives include:

-

Telegram Bot Campaign & Testnet Campaign: Early community supporters can test product features, stay updated, and provide feedback to shape the protocol’s future.

-

The Testnet Campaign is expected to go live next week.

Season 1 Launch

-

Scheduled to launch alongside the mainnet, bringing new participation mechanisms, incentives, and rewards! ????

At BrickBank, users are not just passive participants—they are core contributors to its growth and evolution. Whether through governance involvement, community feedback, or advocacy, we aim to build a thriving, user-driven ecosystem that generates long-term sustainable value.

Join the BrickBank Community & Be Part of the Future!

Website: https://www.brickbank.finance/

Twitter: https://x.com/BrickBank_

Discord: https://discord.gg/brickbank

Telegram: https://t.me/BrickBankOfficial

GitBook: https://brickbank-finance.gitbook.io/brickbank.finance

Be part of the RWAFi revolution with BrickBank!