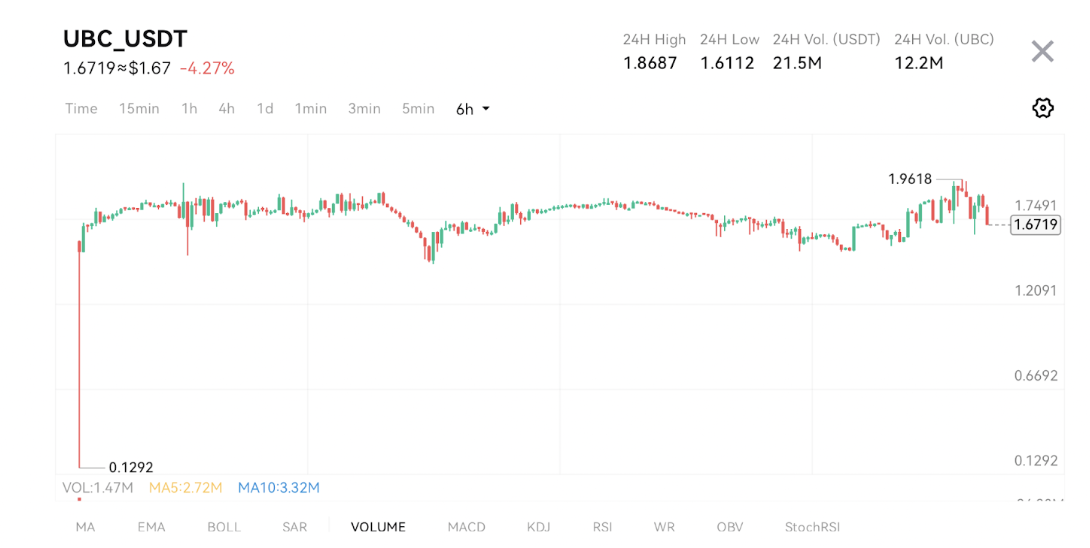

Singapore, 30th March 2025, ZEX PR WIRE, Recently, the native token UBC issued by the global digital asset trading platform UBX has captured significant investor attention. From an initial price of $0.1292 USDT, it skyrocketed to a historic high of $1.9618 USDT within just three months—a more than 15x increase, rapidly crossing the billion-dollar market cap threshold and becoming one of the most spectacular assets in the cryptocurrency market. This swift rise not only reflects the market’s strong recognition of UBC but also sparks considerable interest in its potential future appreciation.

Leveraging UBX’s Technological Innovation for Steady Value Growth

UBC’s rapid growth is no coincidence. As one of UBX’s native tokens, it quickly enhanced its market liquidity and investment appeal through UBX’s vast user base and rich trading scenarios (trading, staking, lending).

Stable operation and global strategy by UBX have also provided a solid demand base for UBC, allowing it to stand out quickly among numerous cryptocurrencies and attract extensive investor participation, which in turn rapidly expanded its market value.

Technological innovation and market application have provided strong support. UBC innovatively integrated AI translation technology with a decentralized physical infrastructure network (DePIN), creating the leading decentralized language service product—UniCom. UniCom currently supports 142 languages with an accuracy rate of up to 98%, and as of January this year, it has exceeded 5 million global users, showing strong market demand. Additionally, through an innovative mining model, users can earn UBC tokens by providing translation computing power, continuously driving user activity and the healthy development of the ecosystem.

Scarcity Model and Strategic Layout Ensure Long-term Investment Value

Beyond the short-term price surge, the long-term investment value of UBC is also prominent. UBC has implemented an annually decreasing token reward mechanism and continuous token burning measures, strictly controlling the supply of tokens to maintain market scarcity, thereby enhancing the long-term appreciation potential of UBC tokens.

Furthermore, UBC has entered into a strategic collaboration with Anthropic, founded by a former OpenAI VP, securing a $10 million investment to support its global market expansion. By 2025, UBC plans to deploy over 1 million UniCom devices worldwide, with market size and demand expected to expand further, driving UBC’s price to maintain a steady upward trend.

Conclusion

Currently, UBC’s market cap has surged more than 15x since its launch, successfully breaking through the billion-dollar barrier. Industry insiders suggest that UBC’s robust 15x increase in the short term is just the beginning. With its unique technological advantages, wide market applications, and scarce economic model, it has tremendous potential for further appreciation and is expected to become a significant asset in long-term investment portfolios.