Dubai, UAE, 30th June 2025, ZEX PR WIRE, LF Labs (LF Coin) gained momentum today despite broader market pressure, drawing attention as Shiba Inu struggles to reclaim key levels. While SHIB battles resistance, LF Labs pushes ahead by building a full-stack Web3 ecosystem with real-world utility. The project’s growing influence and recent developments position LF Coin as a breakout contender in the crypto space.

LF Labs Builds End-to-End Crypto Tools

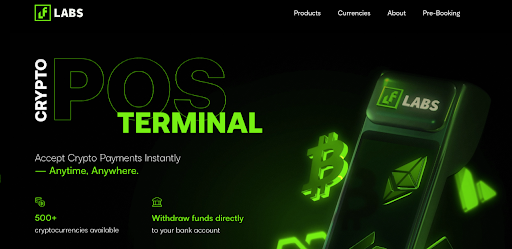

LF Labs is creating a unified Web3 infrastructure by combining its LF Wallet, PoS devices, and a powerful startup accelerator. The Low Frequency Accelerator fuels early-stage projects with both funding and liquidity, helping them sustain growth in volatile markets. Because of this strong foundation, LF Coin offers more than just a digital asset; it supports practical use cases and long-term value.

LF Coin trades at $0.000567 today, with a 24-hour volume of $750,308, showing strong investor engagement despite a 9.13% decline. However, the recent price dip comes amid a wider market pullback, not a specific project weakness. LF Labs continues to build momentum by offering real-world solutions that reduce fragmentation in the Web3 ecosystem and support seamless user access.

By supporting early-stage startups with both capital and trading infrastructure, LF Labs addresses a critical gap in the blockchain space. Unlike typical venture capital models, its program boosts token stability and market presence. As a result, LF Coin gains strategic importance for both retail users and businesses entering crypto.

Shiba Inu Eyes Recovery After Heavy Drop

Shiba Inu trades at $0.0000107, struggling to hold its footing after losing 25% of its monthly value. This decline followed panic selling triggered by US military actions, leading to broad crypto liquidations. However, SHIB is showing signs of a potential reversal from the $0.0000106 support level.

As the price rebounds for the third time in six months, a double-bottom pattern may be forming. If successful, SHIB could rise 64% to retest the $0.000017 neckline formed during its April rally. The key confirmation would come from a weekly close above that level, backed by rising spot volume.

RSI at 38 shows oversold conditions, suggesting buyers might step in soon. But the 50-day SMA above the price keeps short-term momentum bearish for now. Until SHIB breaks $0.0000168, bulls remain cautious despite historical support patterns.

LF Labs now leads in utility-driven growth, while Shiba Inu seeks technical recovery from long-term support. As short interest spikes on SHIB, a potential short squeeze could support upward momentum. But for now, LF Coin stands out as a more stable and practical crypto opportunity.