London, UK, 28th July 2025, ZEX PR WIRE, Pear Protocol, the premier pair trading platform in crypto, has officially launched its native integration with Hyperliquid, unlocking seamless pair trading on top of the Hyperliquid perpetual orderbook.

This launch coincides with the closing of a $4.1M strategic funding round led by Castle Island Ventures, with participation from Compound VC, Florin Digital and Sigil Fund. The raise comes as Pear Protocol nears $1BN in trading volume, powering over 4,000 traders with daily volumes in closed beta already above $5M+.

“Hyperliquid is where the best traders are, and Pear now provides the best way to pair trade on top of that liquidity,” said Huf, Founder of Pear Protocol. “This round marks a turning point – our investors deeply understand the space, and together we’re going full throttle on execution.”

What This Means for Users

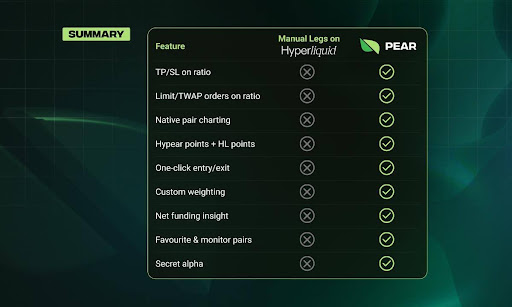

With the Hyperliquid integration now live, traders on Pear can enjoy:

- Continued eligibility for any Hyperliquid Season 3 points and HyPear Points, converting into claimable $HYPE

- One-click entry and exit across both legs of a pair trade

- Limit and TWAP execution on the ratio, optimising entry and exits

- TP/SL logic based on the ratio for superior risk management

- Direct ratio charting, net funding differentials, and custom pair weighting tools

Pear makes advanced strategies simple, mobile-friendly, and capital-efficient – whether you’re trading HYPE/SOL or building custom ETH/BTC trades with beta-weighted logic.

Strategic Use of Funds

The new capital will be deployed to:

- Expand Pear’s institutional-grade product suite

- Launch vaults and APIs on HyperEVM

- Re-launch their spot token with deeper liquidity on Hyperliquid’s Spot Orderbook

- Accelerate user growth and talent acquisition

- Position Pear for long-term sustainability – including optional protocol buybacks and new revenue lines

This round strategically aligns Pear Protocol with some of the most respected players in crypto venture, each bringing ecosystem reach, product insight, and long-term conviction.

“We believe Pear is building trading infrastructure for the next wave of DeFi-native professionals,” said Wyatt Khosrowshahi, Investor at Castle Island Ventures. “They’re connecting deep crypto-native liquidity with intuitive UX, timely education, and novel execution.”

About Pear Protocol

Pear Protocol is the leading DeFi-native pair trading terminal, enabling users to trade one token against another with high capital efficiency. With integrations across major venues including Hyperliquid, GMX and SYMMIO, Pear serves both professional retail and institutional users. Learn more at https://pear.garden

Check out Pear’s Launch Video Here – https://youtu.be/WF8kF1FRxSU