London, UK, 27th August 2025, ZEX PR WIRE, Quantitative trading originated in the 1960s, pioneered by Edward Thorp, a physics professor at UCLA, MIT, and the University of California, Irvine.

It flourished in the 1970s and 1980s, reaching its golden age in the 1990s. Despite challenges after the 2008 financial crisis, quantitative trading remains a favorite in the financial markets.

In the skyscrapers of Wall Street, well-dressed “data wizards” don’t rely on news, rumors, or luck. Instead, they let computers and algorithms execute trades.

(1).png)

The principle is simple: prices differ slightly across exchanges. For example, in the same second, Bitcoin might be priced at 118,500 USDT on OKX and 118,800 USDT on Binance.

An AI-powered trading bot can buy on OKX and sell on Binance within less than a second, instantly profiting from the $300 price difference—all fully automated, with no action required from you.

Today, quantitative trading accounts for over 35% of the total trading volume in global cryptocurrency and stock markets.

With the rise of the 24/7, highly volatile cryptocurrency market, this “secret weapon” has become even more powerful.

It’s like putting an autopilot on a ship navigating stormy seas: whether the market is rising or falling, it helps you seize opportunities.

In the past, only Wall Street hedge funds could use this technology.

For ordinary people, getting into quantitative trading with ABQuant was nearly impossible—it required millions of dollars in startup capital and specialized knowledge in programming and financial modeling.

Now, with ABQuant, everyday investors have the chance to trade like Wall Street professionals. Here’s how:

1.Register an account: It only takes a few seconds to sign up. AB Quantitative Trading offers a $100 registration bonus for new users.

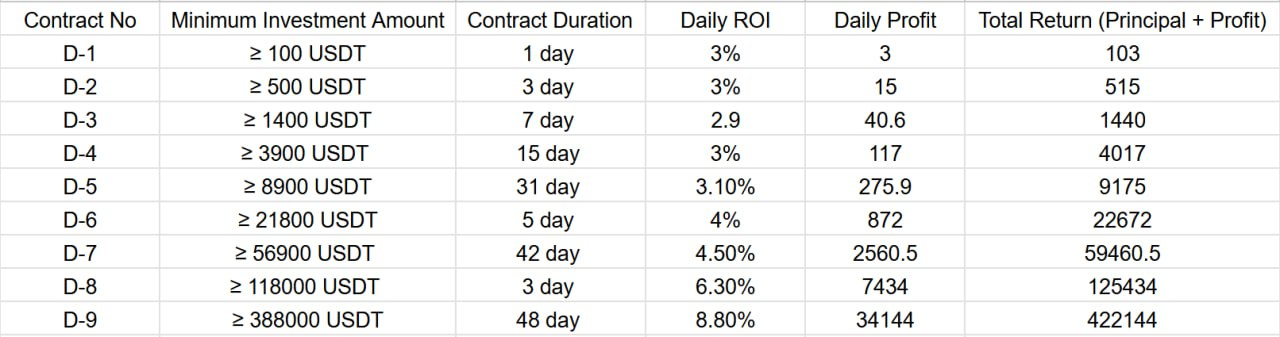

2.Choose a contract: The AB Quantitative Trading platform offers a variety of contracts to meet the needs of investors at different levels.

【Select “Quantitative” at the bottom】

Looking for faster returns? Choose a short-term strategy: 1, 3, or 7 days.

Looking for more stable returns? Choose a long-term strategy: 15, 31, or 42 days.

Popular contracts list:

3.Start quantitative trading: The system will automatically assign a quantitative contract, and daily earnings will be credited to your account starting from the day after the contract is activated.

All profits during the contract period are returned daily, and the principal is fully returned at maturity. Once your account balance reaches $100, you can withdraw or reinvest at any time.

-

4. Withdraw

Go to [Withdraw], enter your receiving wallet address, select the currency, and submit.

Many first-time users are surprised:

“I don’t even check the market, but my account balance grows every day.”

In short:

You don’t need to be a financial genius or stay up all night watching the markets.

Learn how to use [ABQuant] and make your money work for you—just like 35% of the world’s capital already does.

Email: info@abquant.cc

Telegram Group: https://t.me/ABquant95

Official website: https://abquant.vip