Apparel and Accessories Stocks Q4 Results: Benchmarking Guess (NYSE:GES)

Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Guess (NYSE: GES) and its peers.

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 16 apparel and accessories stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.7% since the latest earnings results.

Guess (NYSE: GES)

Flexing the iconic upside-down triangle logo with a question mark, Guess (NYSE: GES) is a global fashion brand known for its trendy clothing, accessories, and denim wear.

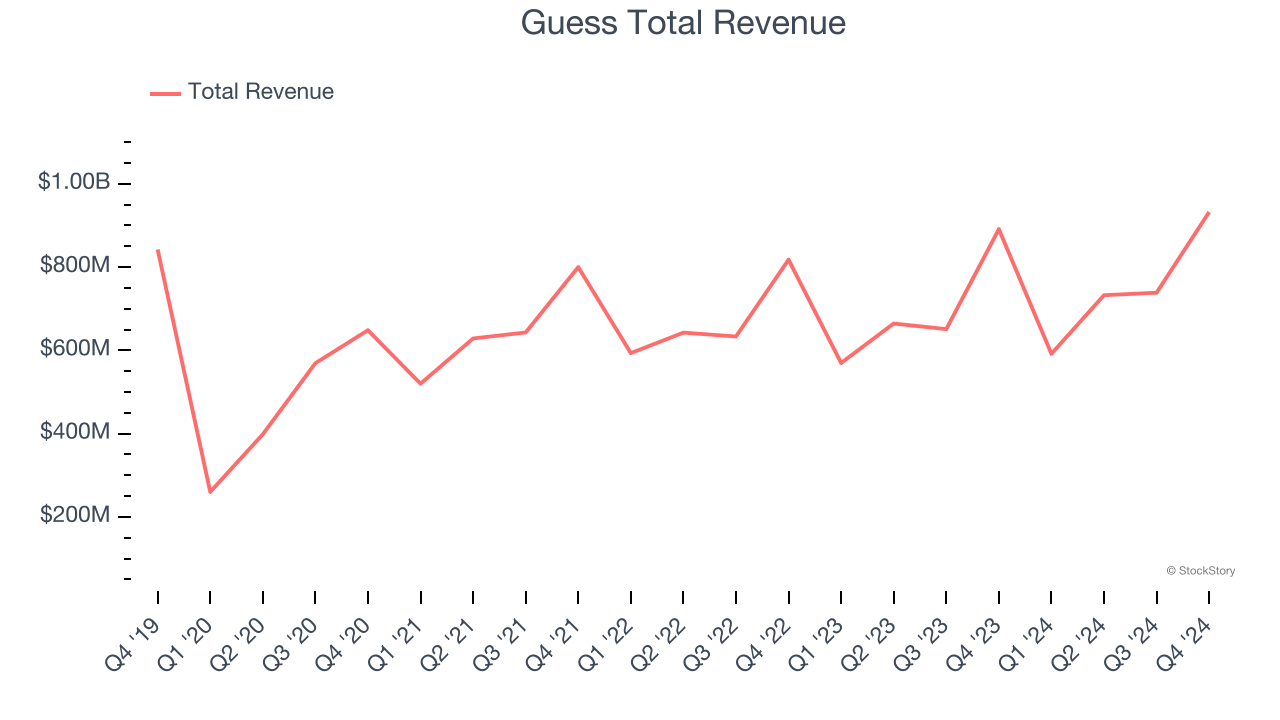

Guess reported revenues of $932.3 million, up 4.6% year on year. This print exceeded analysts’ expectations by 2.9%. Despite the top-line beat, it was still a slower quarter for the company with full-year EPS guidance missing analysts’ expectations.

Carlos Alberini, Chief Executive Officer, commented, “In the fourth quarter, we delivered revenue growth of 5% in U.S. dollars and 9% in constant currency. The growth in the period was primarily driven by the rag & bone acquisition coupled with positive momentum in our wholesale businesses in Europe and the Americas and increased licensing revenues. All of our operating segments posted revenue growth, except for our Asia segment. With this performance, we closed the year with revenue growth of 8% in U.S. dollars and 10% in constant currency. During the year, we delivered solid results with our Licensing segment and our wholesale businesses in Europe and the Americas, but missed our plans for our direct-to-consumer business due to slower customer traffic in North America and Asia. All considered, for the year we reached almost $3 billion in revenues and $174 million and $180 million in GAAP and adjusted operating earnings, respectively. Importantly, this year we reached a significant milestone for our Company, as we executed our first acquisition in Guess’s history, with the addition of rag & bone to our portfolio.”

Unsurprisingly, the stock is down 6.8% since reporting and currently trades at $9.40.

Read our full report on Guess here, it’s free.

Best Q4: VF Corp (NYSE: VFC)

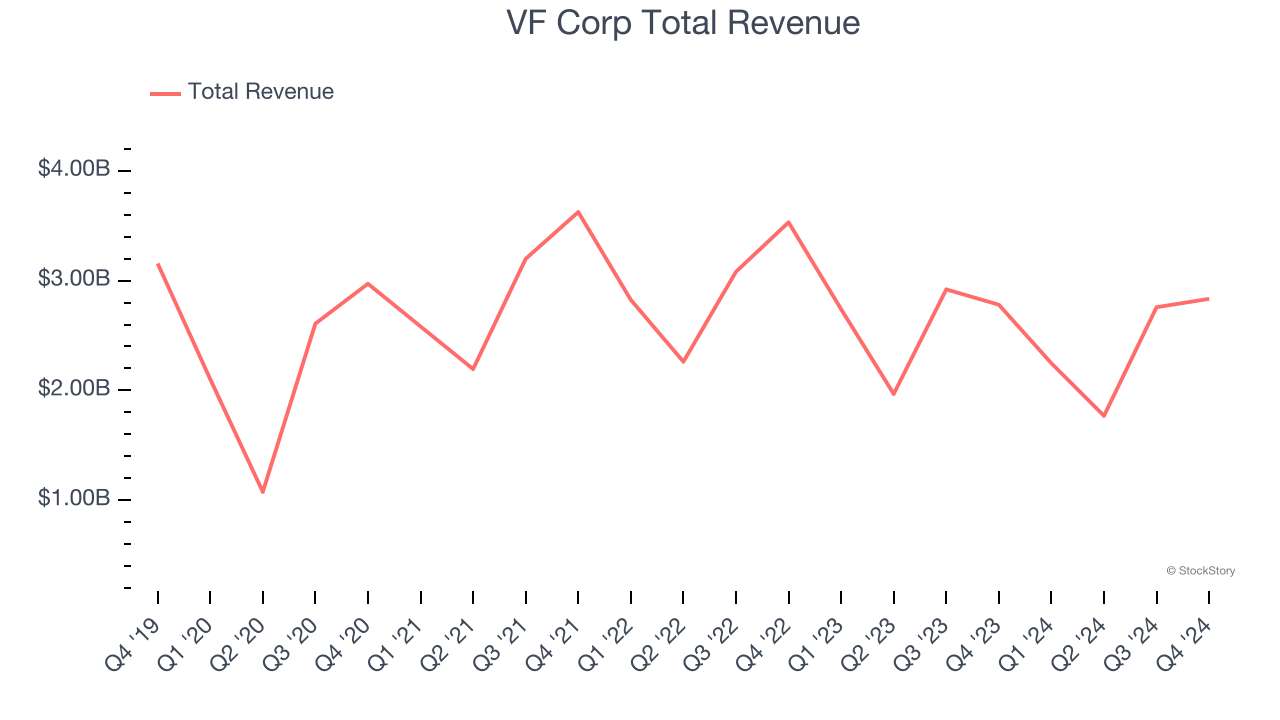

Owner of The North Face, Vans, and Supreme, VF Corp (NYSE: VFC) is a clothing conglomerate specializing in branded lifestyle apparel, footwear, and accessories.

VF Corp reported revenues of $2.83 billion, up 1.9% year on year, outperforming analysts’ expectations by 1.2%. The business had a stunning quarter with a solid beat of analysts’ constant currency revenue and EPS estimates.

The stock is down 59.2% since reporting. It currently trades at $10.83.

Is now the time to buy VF Corp? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Columbia Sportswear (NASDAQ: COLM)

Originally founded as a hat store in 1938, Columbia Sportswear (NASDAQ: COLM) is a manufacturer of outerwear, sportswear, and footwear designed for outdoor enthusiasts.

Columbia Sportswear reported revenues of $1.10 billion, up 3.5% year on year, exceeding analysts’ expectations by 1.4%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 23.9% since the results and currently trades at $65.38.

Read our full analysis of Columbia Sportswear’s results here.

Carter's (NYSE: CRI)

Rumored to sell more than 10 products for every child born in the United States, Carter's (NYSE: CRI) is an American designer and marketer of children's apparel.

Carter's reported revenues of $859.7 million, flat year on year. This print beat analysts’ expectations by 3%. Aside from that, it was a mixed quarter as it also recorded a solid beat of analysts’ same-store sales estimates but full-year EPS guidance missing analysts’ expectations.

The stock is down 31.9% since reporting and currently trades at $35.45.

Read our full, actionable report on Carter's here, it’s free.

Under Armour (NYSE: UAA)

Founded in 1996 by a former University of Maryland football player, Under Armour (NYSE: UAA) is an apparel brand specializing in sportswear designed to improve athletic performance.

Under Armour reported revenues of $1.40 billion, down 5.7% year on year. This number topped analysts’ expectations by 4.5%. It was an exceptional quarter as it also logged an impressive beat of analysts’ constant currency revenue estimates and a solid beat of analysts’ EPS estimates.

Under Armour had the slowest revenue growth among its peers. The stock is down 31.7% since reporting and currently trades at $5.63.

Read our full, actionable report on Under Armour here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.