Three Reasons to Avoid JJSF and One Stock to Buy Instead

J&J Snack Foods currently trades at $159.01 per share and has shown little upside over the past six months, posting a small loss of 3.8%. The stock also fell short of the S&P 500’s 6.1% gain during that period.

Is there a buying opportunity in J&J Snack Foods, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We're sitting this one out for now. Here are three reasons why you should be careful with JJSF and a stock we'd rather own.

Why Is J&J Snack Foods Not Exciting?

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ: JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

1. Less Negotiating Power with Suppliers

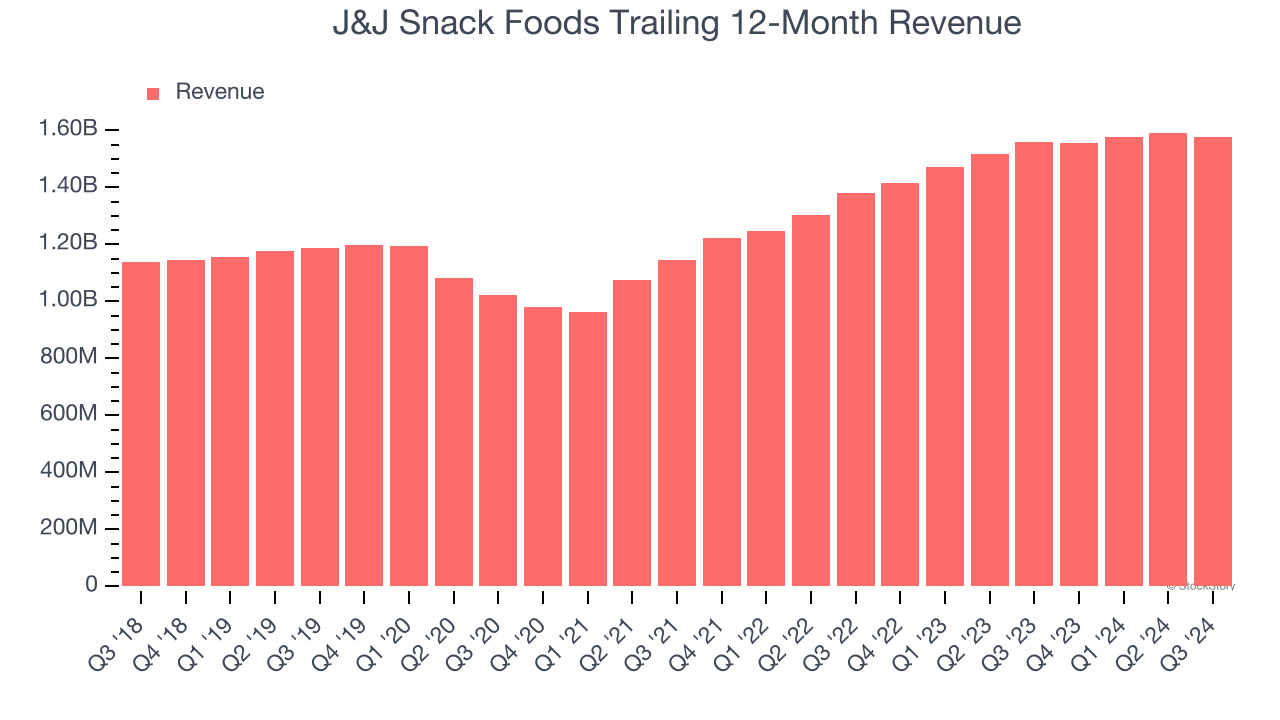

J&J Snack Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage. On the other hand, it can grow faster because it’s working from a smaller revenue base and has a longer runway of untapped store chains to sell into.

2. Weak Operating Margin Could Cause Trouble

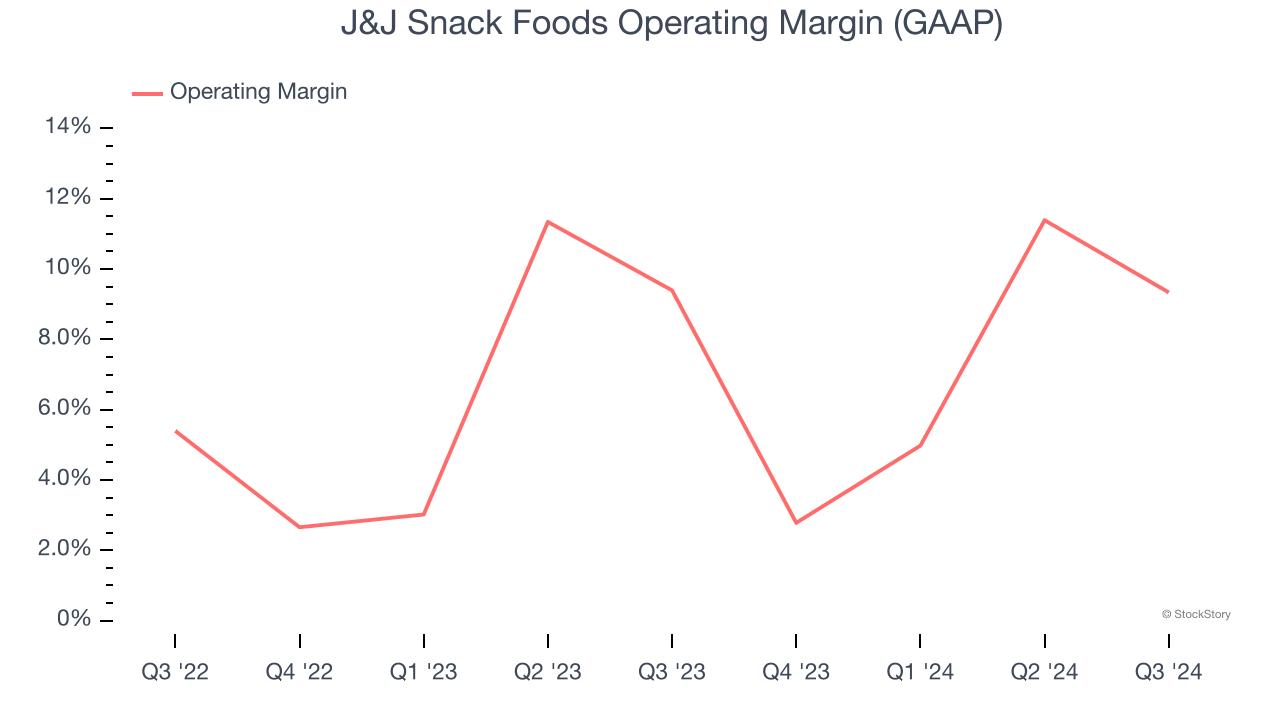

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

J&J Snack Foods was profitable over the last two years but held back by its large cost base. Its average operating margin of 7.2% was weak for a consumer staples business.

3. Previous Growth Initiatives Haven’t Paid Off Yet

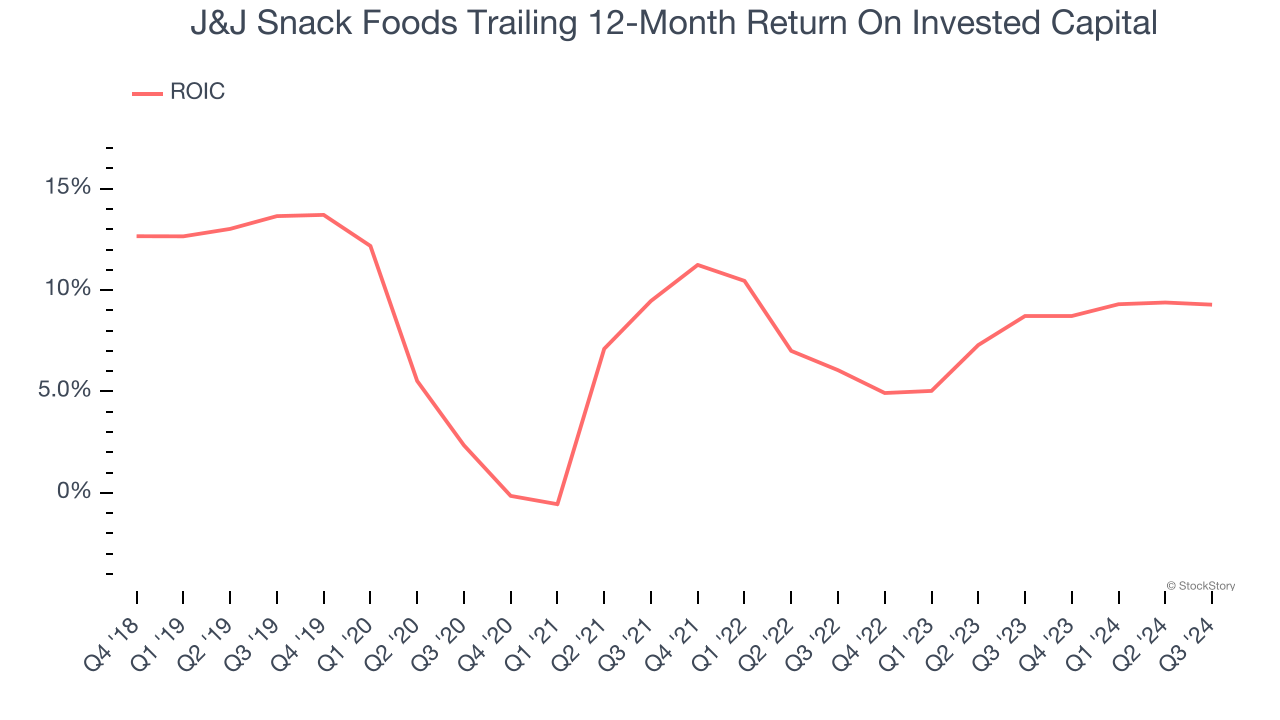

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

J&J Snack Foods historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.2%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

Final Judgment

J&J Snack Foods’s business quality ultimately falls short of our standards. With its shares lagging the market recently, the stock trades at 26.9× forward price-to-earnings (or $159.01 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d suggest looking at KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Would Buy Instead of J&J Snack Foods

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.