Consumer Internet Stocks Q3 Recap: Benchmarking Airbnb (NASDAQ:ABNB)

Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Airbnb (NASDAQ: ABNB) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 50 consumer internet stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Luckily, consumer internet stocks have performed well with share prices up 13.8% on average since the latest earnings results.

Airbnb (NASDAQ: ABNB)

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

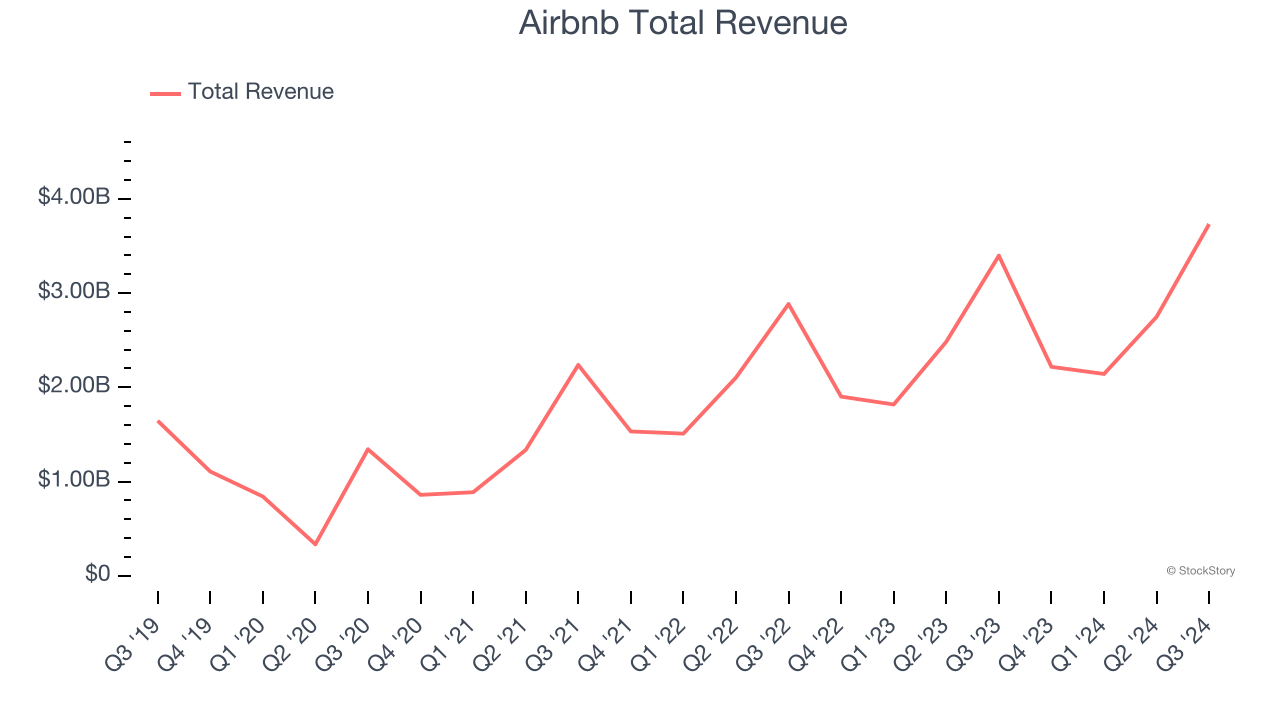

Airbnb reported revenues of $3.73 billion, up 9.9% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with an impressive beat of analysts’ EBITDA estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

Unsurprisingly, the stock is down 10% since reporting and currently trades at $132.65.

Is now the time to buy Airbnb? Access our full analysis of the earnings results here, it’s free.

Best Q3: EverQuote (NASDAQ: EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

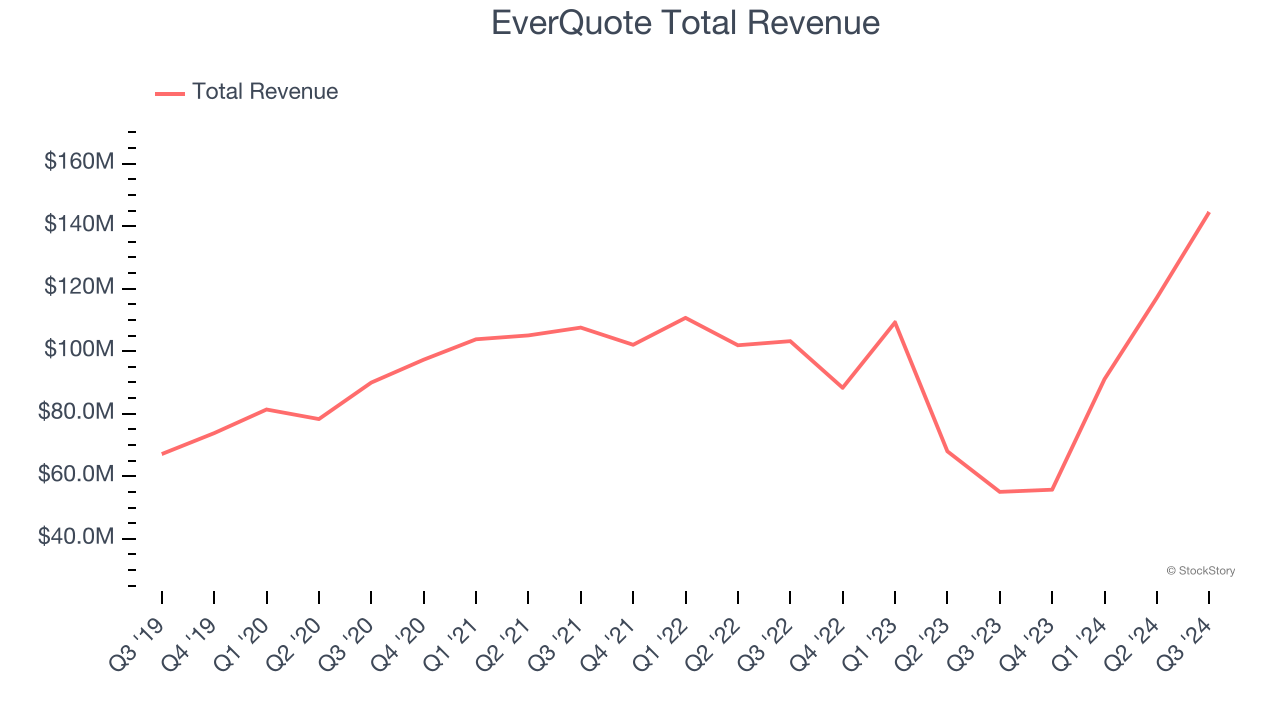

EverQuote reported revenues of $144.5 million, up 163% year on year, outperforming analysts’ expectations by 3%. The business had a stunning quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

EverQuote pulled off the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 13.4% since reporting. It currently trades at $19.65.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Skillz (NYSE: SKLZ)

Taking a new twist at video gaming, Skillz (NYSE: SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $24.56 million, down 32.6% year on year, falling short of analysts’ expectations by 7.9%. It was a disappointing quarter as it posted a decline in its users.

Skillz delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 121,000 monthly active users, down 28% year on year. As expected, the stock is down 8.7% since the results and currently trades at $5.15.

Read our full analysis of Skillz’s results here.

Netflix (NASDAQ: NFLX)

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Netflix reported revenues of $9.82 billion, up 15% year on year. This result beat analysts’ expectations by 0.6%. It was a very strong quarter as it also recorded EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

The company reported 282.7 million users, up 14.4% year on year. The stock is up 32.1% since reporting and currently trades at $908.54.

Read our full, actionable report on Netflix here, it’s free.

Snap (NYSE: SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Snap reported revenues of $1.37 billion, up 15.5% year on year. This print topped analysts’ expectations by 1.1%. Overall, it was a strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and solid growth in its users.

The company reported 443 million daily active users, up 9.1% year on year. The stock is flat since reporting and currently trades at $10.91.

Read our full, actionable report on Snap here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.