HVAC and Water Systems Stocks Q4 Earnings: Lennox (NYSE:LII) Firing on All Cylinders

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at hvac and water systems stocks, starting with Lennox (NYSE: LII).

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 9 hvac and water systems stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.4% since the latest earnings results.

Best Q4: Lennox (NYSE: LII)

Based in Texas and founded over a century ago, Lennox (NYSE: LII) is a climate control solutions company offering heating, ventilation, air conditioning, and refrigeration (HVACR) goods.

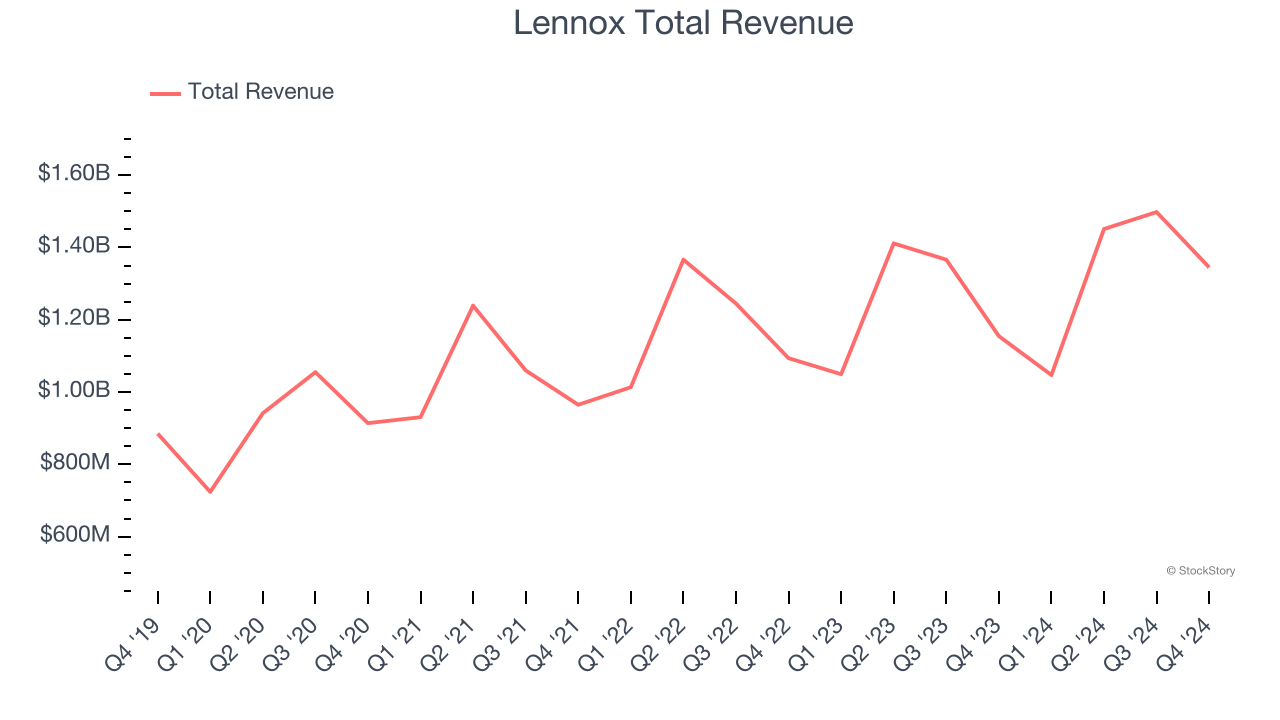

Lennox reported revenues of $1.35 billion, up 16.5% year on year. This print exceeded analysts’ expectations by 8.9%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EPS estimates.

"2024 was a remarkable year filled with record achievements, and last quarter continued that momentum as we delivered impressive results across the board," said CEO, Alok Maskara.

Lennox achieved the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 12.1% since reporting and currently trades at $582.50.

Is now the time to buy Lennox? Access our full analysis of the earnings results here, it’s free.

Trane Technologies (NYSE: TT)

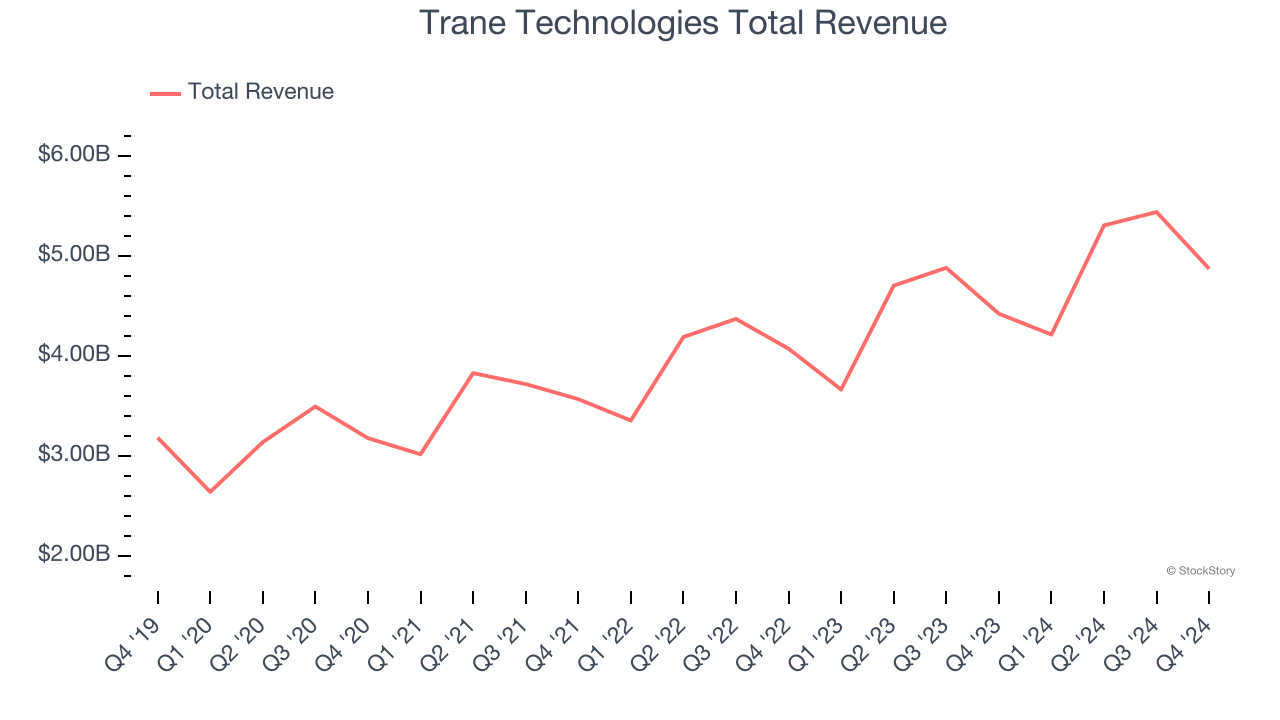

With low-pressure heating systems as the first product, Trane (NYSE: TT) designs, manufactures, and sells HVAC and refrigeration systems, the former to commercial and residential building customers and the latter to commercial truck manufacturers.

Trane Technologies reported revenues of $4.87 billion, up 10.2% year on year, outperforming analysts’ expectations by 1.9%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance slightly topping analysts’ expectations.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 1.9% since reporting. It currently trades at $357.14.

Is now the time to buy Trane Technologies? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: AAON (NASDAQ: AAON)

Backed by two million square feet of lab testing space, AAON (NASDAQ: AAON) makes heating, ventilation, and air conditioning equipment for different types of buildings.

AAON reported revenues of $297.7 million, down 2.9% year on year, falling short of analysts’ expectations by 7.1%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

AAON delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 18.6% since the results and currently trades at $83.10.

Read our full analysis of AAON’s results here.

Zurn Elkay (NYSE: ZWS)

Claiming to have saved more than 30 billion gallons of water, Zurn Elkay (NYSE: ZWS) provides water management solutions to various industries.

Zurn Elkay reported revenues of $370.7 million, up 3.9% year on year. This result topped analysts’ expectations by 0.9%. Zooming out, it was a mixed quarter as it also logged an impressive beat of analysts’ EPS estimates but a significant miss of analysts’ organic revenue estimates.

The stock is down 13.9% since reporting and currently trades at $34.02.

Read our full, actionable report on Zurn Elkay here, it’s free.

CSW (NASDAQ: CSWI)

With over two centuries of combined operations manufacturing and supplying, CSW (NASDAQ: CSWI) offers special chemicals, coatings, sealants, and lubricants for various industries.

CSW reported revenues of $193.6 million, up 10.7% year on year. This print surpassed analysts’ expectations by 0.9%. It was a strong quarter as it also recorded an impressive beat of analysts’ EPS estimates and EBITDA in line with analysts’ estimates.

The stock is down 12.4% since reporting and currently trades at $301.98.

Read our full, actionable report on CSW here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.