Renewable Energy Stocks Q3 Results: Benchmarking Plug Power (NASDAQ:PLUG)

Let’s dig into the relative performance of Plug Power (NASDAQ: PLUG) and its peers as we unravel the now-completed Q3 renewable energy earnings season.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 18 renewable energy stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 5.4% while next quarter’s revenue guidance was 0.6% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 23.5% since the latest earnings results.

Plug Power (NASDAQ: PLUG)

Powering forklifts for Walmart’s distribution centers, Plug Power (NASDAQ: PLUG) provides hydrogen fuel cells used to power electric motors.

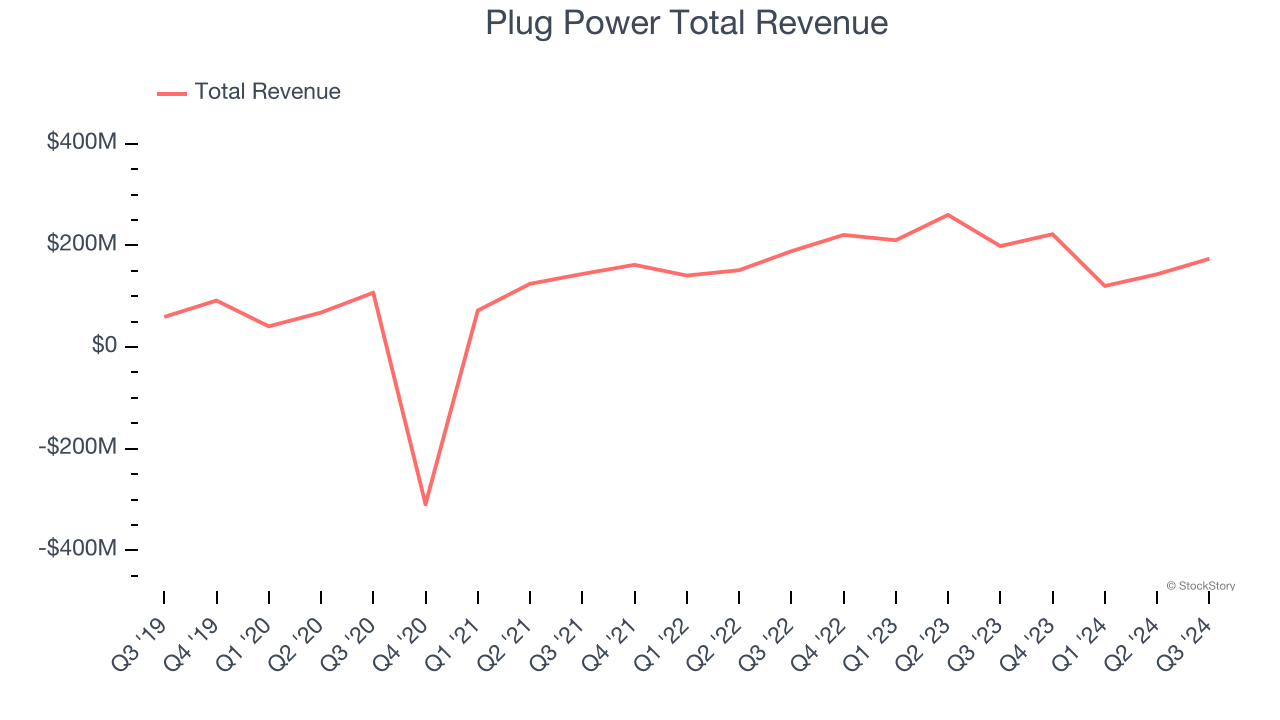

Plug Power reported revenues of $173.7 million, down 12.6% year on year. This print fell short of analysts’ expectations by 18.7%. Overall, it was a disappointing quarter for the company with full-year revenue guidance missing analysts’ expectations significantly.

Plug Power CEO Andy Marsh stated: “Plug Power's performance this quarter underscores our commitment to building a sustainable and profitable hydrogen future. Our progress in electrolyzer deployments, advancements in hydrogen production, and expansion into new markets reflect our team's dedication to leading the build out of the hydrogen economy.”

Unsurprisingly, the stock is down 41.1% since reporting and currently trades at $1.17.

Read our full report on Plug Power here, it’s free.

Best Q3: Bloom Energy (NYSE: BE)

Working in stealth mode for eight years, Bloom Energy (NYSE: BE) designs, manufactures, and markets solid oxide fuel cell systems for on-site power generation.

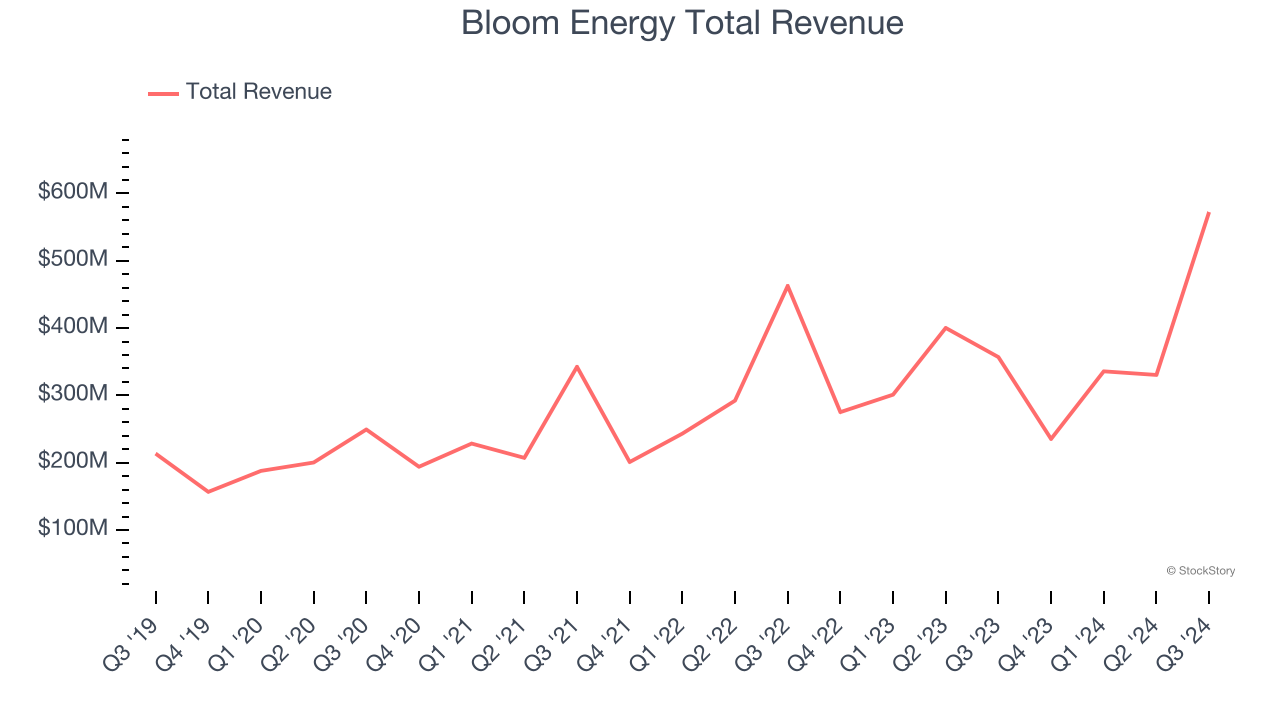

Bloom Energy reported revenues of $572.4 million, up 60.4% year on year, outperforming analysts’ expectations by 12.8%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Bloom Energy pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is down 24.6% since reporting. It currently trades at $17.34.

Is now the time to buy Bloom Energy? Access our full analysis of the earnings results here, it’s free.

TPI Composites (NASDAQ: TPIC)

Founded in 1968, TPI Composites (NASDAQ: TPIC) manufactures composite wind turbine blades and provides related precision molding and assembly systems.

TPI Composites reported revenues of $346.5 million, up 16.7% year on year, falling short of analysts’ expectations by 5%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

As expected, the stock is down 43.3% since the results and currently trades at $0.82.

Read our full analysis of TPI Composites’s results here.

FuelCell Energy (NASDAQ: FCEL)

Founded in 1969, FuelCell Energy (NASDAQ: FCEL) is a leading manufacturer and developer of carbonate fuel cell technology for stationary power generation.

FuelCell Energy reported revenues of $19 million, up 13.8% year on year. This print missed analysts’ expectations by 47.6%. Overall, it was a softer quarter as it also produced a significant miss of analysts’ adjusted operating income estimates.

The stock is down 36.3% since reporting and currently trades at $4.05.

Read our full, actionable report on FuelCell Energy here, it’s free.

SolarEdge (NASDAQ: SEDG)

Established in 2006, SolarEdge (NASDAQ: SEDG) creates advanced systems to improve the efficiency of solar panels.

SolarEdge reported revenues of $196.2 million, down 37.9% year on year. This result topped analysts’ expectations by 4%. Aside from that, it was a mixed quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 18.8% since reporting and currently trades at $13.75.

Read our full, actionable report on SolarEdge here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.