Airbnb’s (NASDAQ:ABNB) Q1: Beats On Revenue But Quarterly Revenue Guidance Slightly Misses Expectations

Online accommodations platform Airbnb (NASDAQ: ABNB) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 6.1% year on year to $2.27 billion. On the other hand, next quarter’s revenue guidance of $3.02 billion was less impressive, coming in 0.6% below analysts’ estimates. Its GAAP profit of $0.24 per share was in line with analysts’ consensus estimates.

Is now the time to buy Airbnb? Find out by accessing our full research report, it’s free.

Airbnb (ABNB) Q1 CY2025 Highlights:

- Revenue: $2.27 billion vs analyst estimates of $2.26 billion (6.1% year-on-year growth, 0.6% beat)

- EPS (GAAP): $0.24 vs analyst estimates of $0.24 (in line)

- Adjusted EBITDA: $417 million vs analyst estimates of $363.2 million (18.4% margin, 14.8% beat)

- Revenue Guidance for Q2 CY2025 is $3.02 billion at the midpoint, below analyst estimates of $3.04 billion

- Operating Margin: 1.7%, down from 4.7% in the same quarter last year

- Free Cash Flow Margin: 78.4%, up from 18.5% in the previous quarter

- Nights and Experiences Booked: 143.1 million, up 10.5 million year on year

- Market Capitalization: $75.43 billion

Company Overview

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

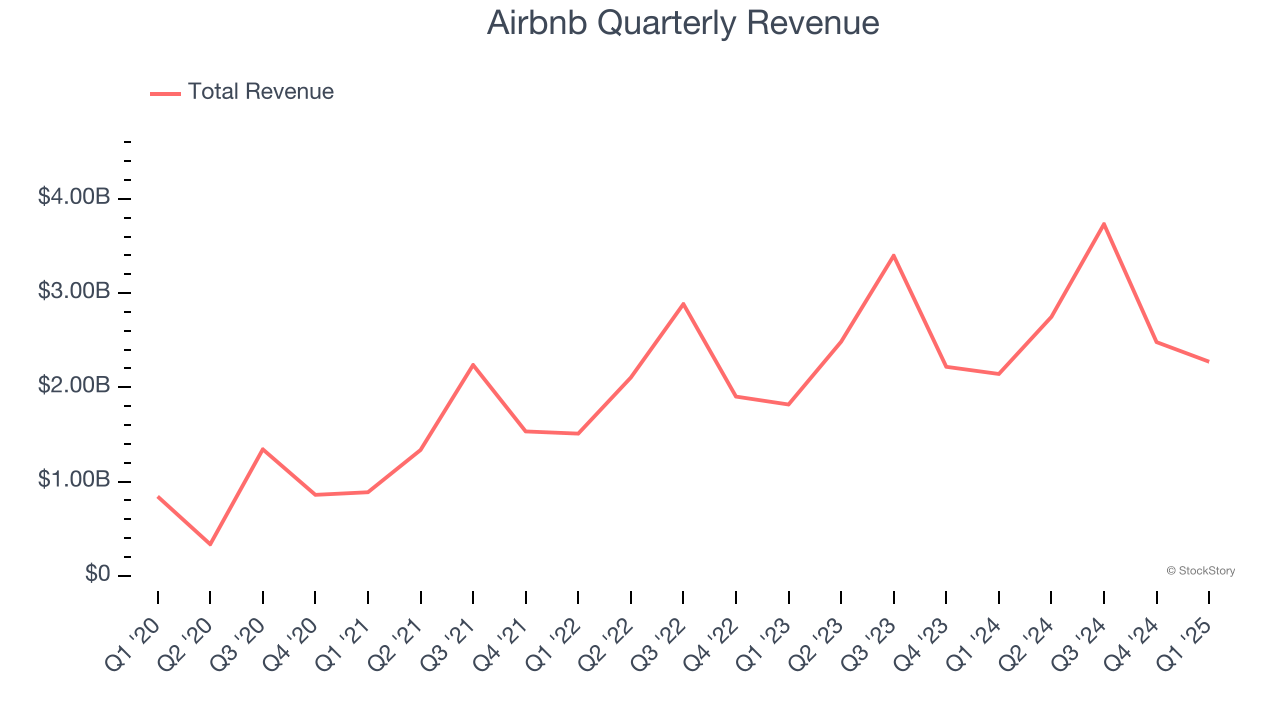

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Airbnb’s 19.3% annualized revenue growth over the last three years was impressive. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Airbnb reported year-on-year revenue growth of 6.1%, and its $2.27 billion of revenue exceeded Wall Street’s estimates by 0.6%. Company management is currently guiding for a 9.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.9% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Nights And Experiences Booked

Booking Growth

As an online travel company, Airbnb generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Airbnb’s nights and experiences booked, a key performance metric for the company, increased by 10.4% annually to 143.1 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

In Q1, Airbnb added 10.5 million nights and experiences booked, leading to 7.9% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating booking growth just yet.

Revenue Per Booking

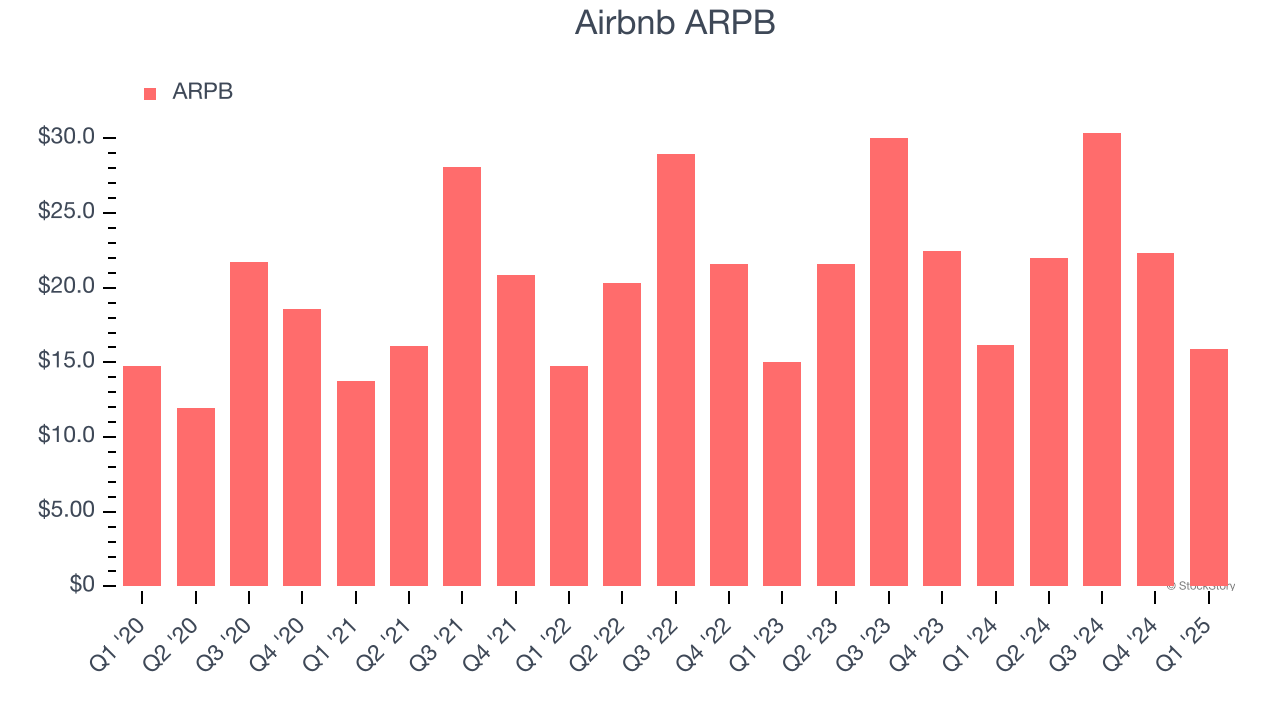

Average revenue per booking (ARPB) is a critical metric to track because it not only measures how much users book on its platform but also the commission that Airbnb can charge.

Airbnb’s ARPB growth has been subpar over the last two years, averaging 2.8%. This isn’t great, but the increase in nights and experiences booked is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Airbnb tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether bookings can continue growing at the current pace.

This quarter, Airbnb’s ARPB clocked in at $15.88. It declined 1.7% year on year, worse than the change in its nights and experiences booked.

Key Takeaways from Airbnb’s Q1 Results

We were impressed by how significantly Airbnb blew past analysts’ EBITDA expectations this quarter. On the other hand, its number of nights and experiences booked slightly missed Wall Street’s estimates and its revenue guidance for next quarter slightly missed as well despite a tailwind from the timing of Easter this year. Zooming out, we think this was a mixed quarter featuring some areas of strength but also some blemishes. The areas below expectations seem to be driving the move, and the stock traded down 3.3% to $120.03 immediately following the results.

Big picture, is Airbnb a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.