2 Reasons to Like SRCE and 1 to Stay Skeptical

1st Source has been treading water for the past six months, recording a small return of 1.4% while holding steady at $60.48.

Is now the time to buy SRCE? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free.

Why Does 1st Source Spark Debate?

Tracing its roots back to 1863 during the Civil War era, 1st Source Corporation (NASDAQ: SRCE) is a regional bank holding company that provides commercial, consumer, specialty finance, and wealth management services across Indiana, Michigan, and Florida.

Two Things to Like:

1. Outstanding Long-Term EPS Growth

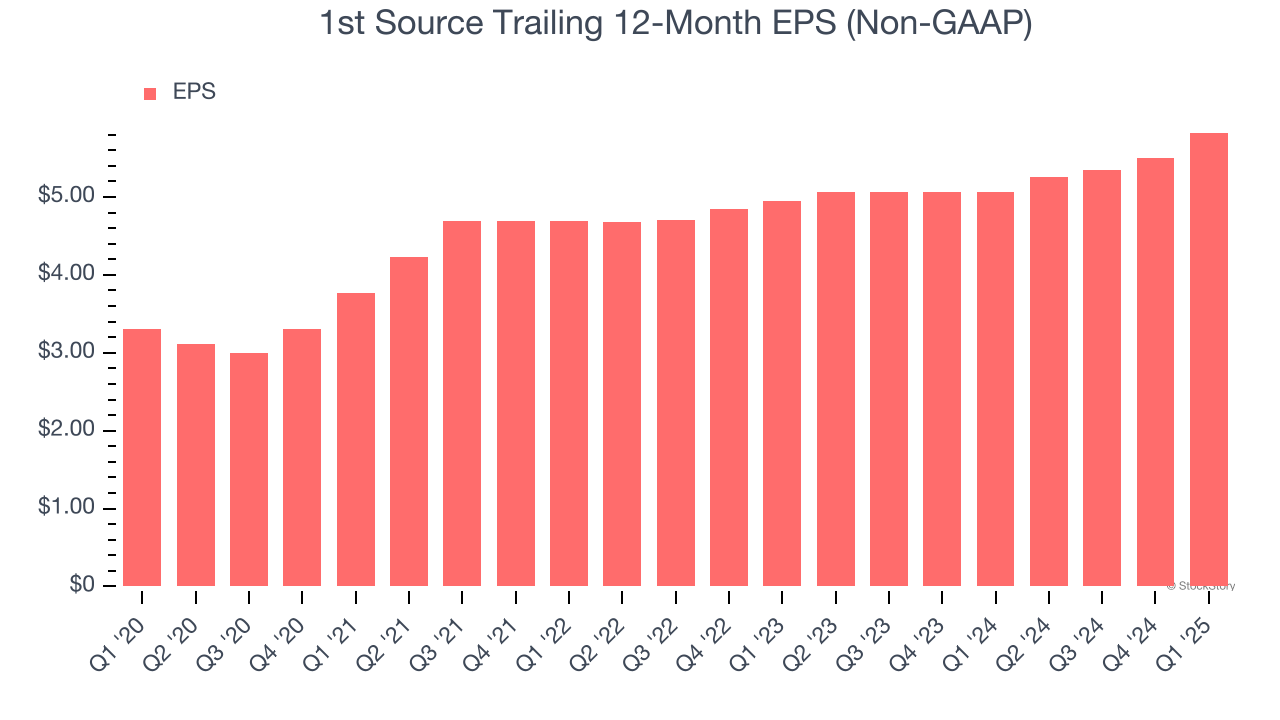

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

1st Source’s EPS grew at an astounding 12% compounded annual growth rate over the last five years, higher than its 4.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

2. Stellar ROE Showcases Lucrative Growth Opportunities

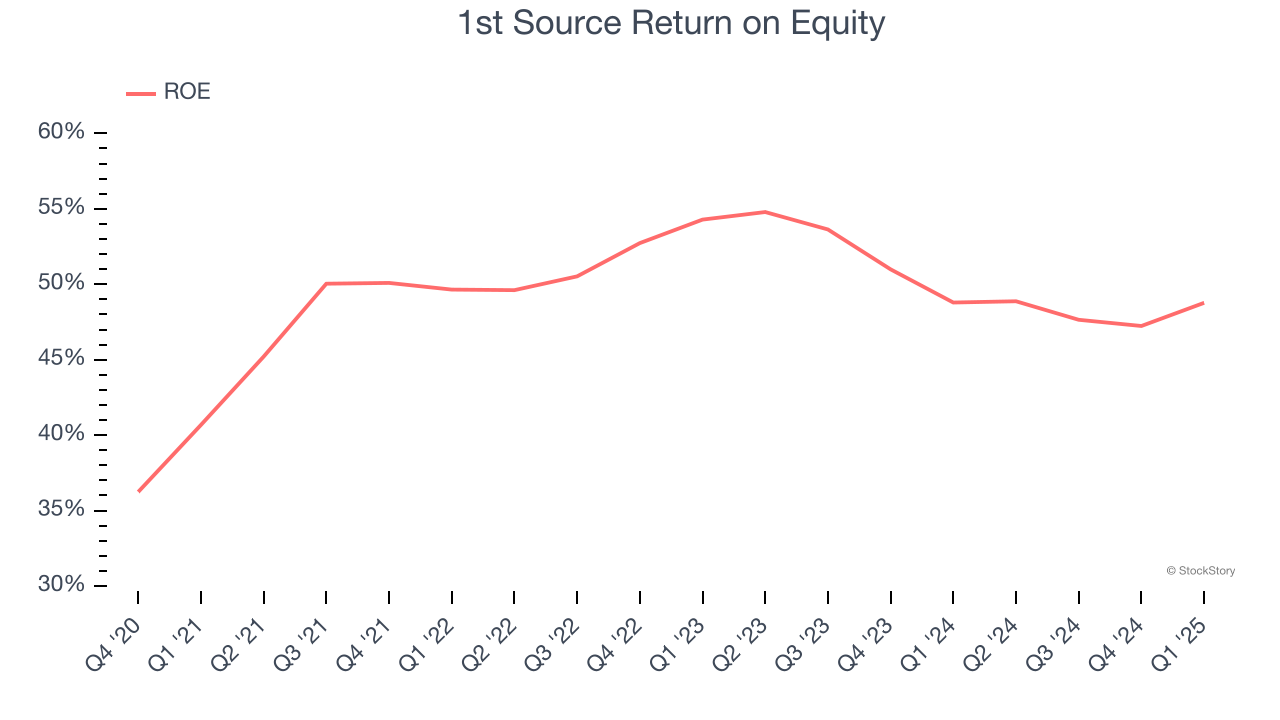

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, 1st Source has averaged an ROE of 12.1%, excellent for a company operating in a sector where the average shakes out around 7.5% and those putting up 15%+ are greatly admired. This shows 1st Source has a strong competitive moat.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

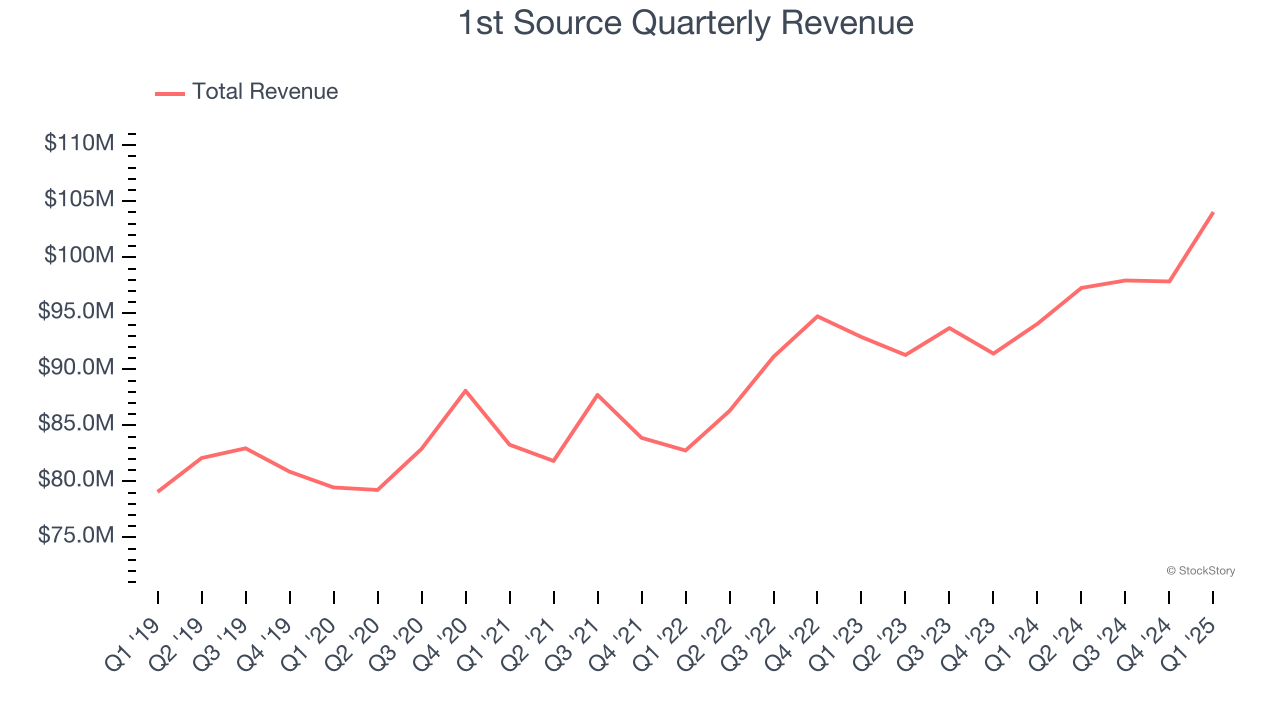

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income.

Unfortunately, 1st Source’s 4.1% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the bank sector, but there are still things to like about 1st Source.

Final Judgment

1st Source’s merits more than compensate for its flaws, but at $60.48 per share (or 1.2× forward P/B), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than 1st Source

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.