Q1 Earnings Outperformers: FuelCell Energy (NASDAQ:FCEL) And The Rest Of The Renewable Energy Stocks

Let’s dig into the relative performance of FuelCell Energy (NASDAQ: FCEL) and its peers as we unravel the now-completed Q1 renewable energy earnings season.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 18 renewable energy stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 5.2% while next quarter’s revenue guidance was 1.1% above.

Luckily, renewable energy stocks have performed well with share prices up 21.8% on average since the latest earnings results.

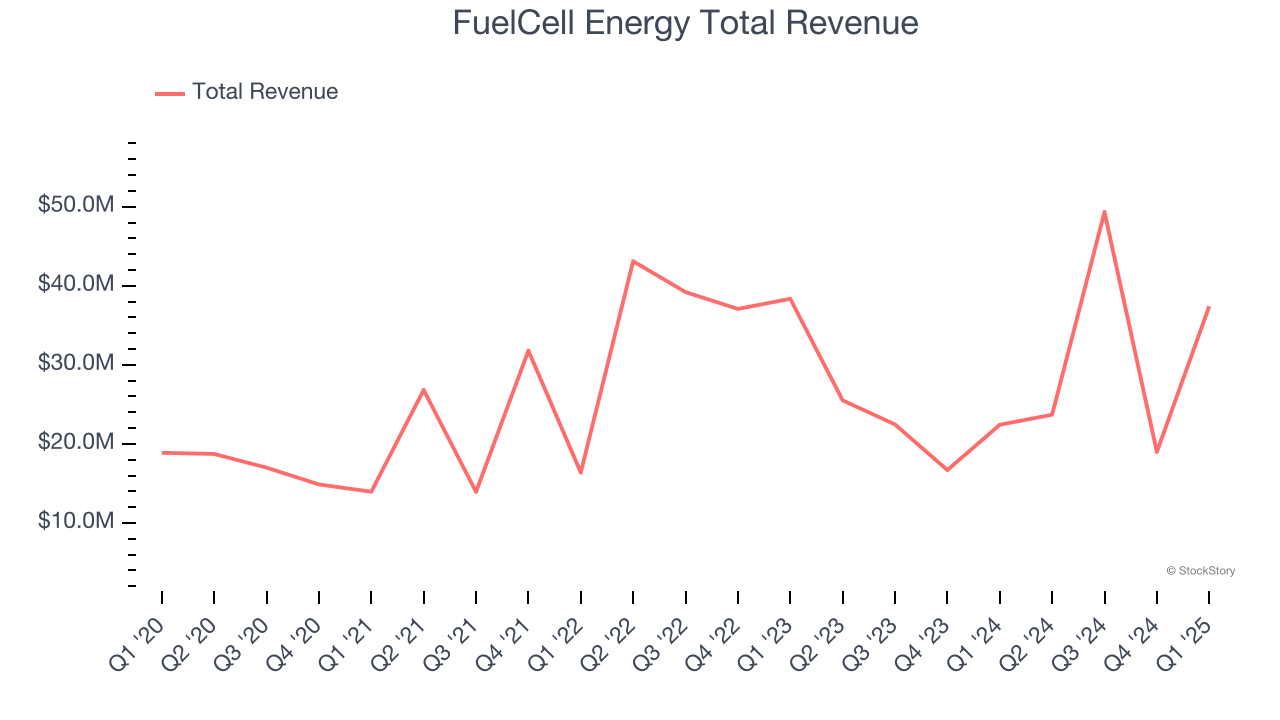

FuelCell Energy (NASDAQ: FCEL)

Founded in 1969, FuelCell Energy (NASDAQ: FCEL) is a leading manufacturer and developer of carbonate fuel cell technology for stationary power generation.

FuelCell Energy reported revenues of $37.41 million, up 66.8% year on year. This print exceeded analysts’ expectations by 14.4%. Despite the top-line beat, it was still a softer quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

“In our second fiscal quarter, we delivered sequential revenue growth and continued executing on the disciplined cost management strategy we initiated in late 2024, in recognition of the changing energy landscape,” said Jason Few, President and Chief Executive Officer.

Interestingly, the stock is up 2.3% since reporting and currently trades at $5.32.

Read our full report on FuelCell Energy here, it’s free.

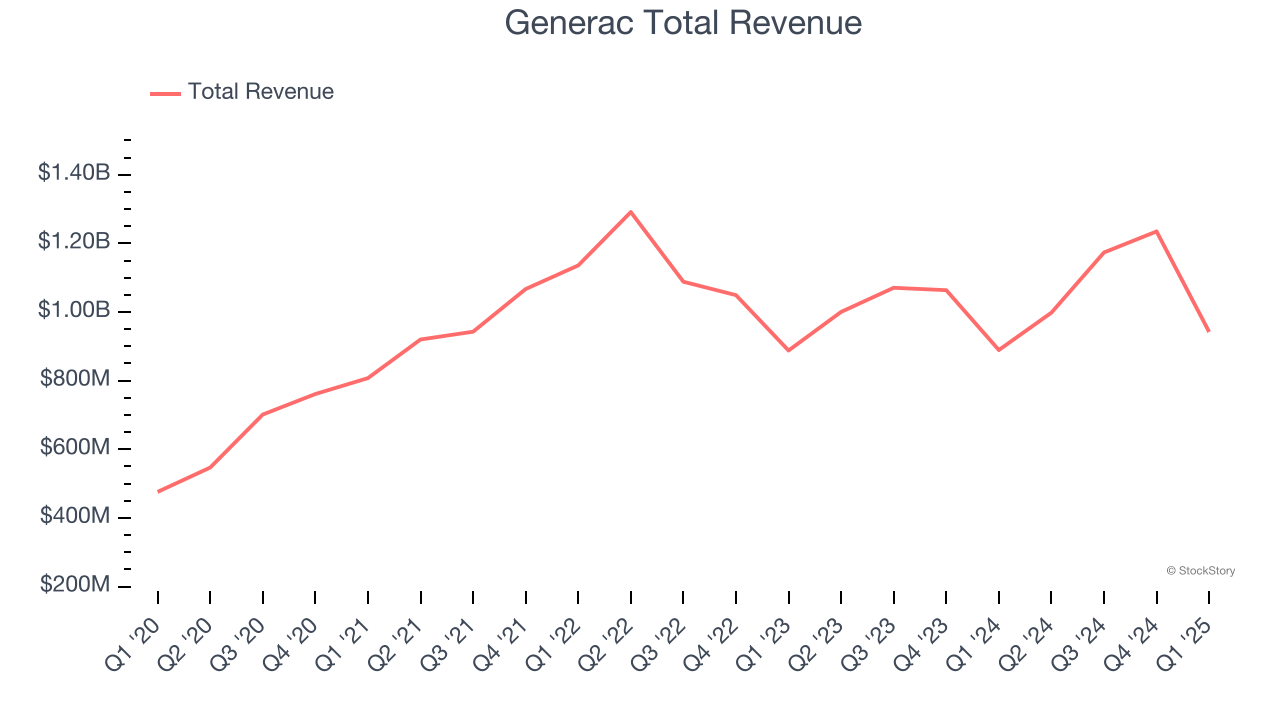

Best Q1: Generac (NYSE: GNRC)

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE: GNRC) offers generators and other power products for residential, industrial, and commercial use.

Generac reported revenues of $942.1 million, up 5.9% year on year, outperforming analysts’ expectations by 2.3%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 30.5% since reporting. It currently trades at $147.70.

Is now the time to buy Generac? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Blink Charging (NASDAQ: BLNK)

One of the first EV charging companies to go public, Blink Charging (NASDAQ: BLNK) is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Blink Charging reported revenues of $20.75 million, down 44.8% year on year, falling short of analysts’ expectations by 24.3%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Blink Charging delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 4.9% since the results and currently trades at $0.91.

Read our full analysis of Blink Charging’s results here.

American Superconductor (NASDAQ: AMSC)

Founded in 1987, American Superconductor (NASDAQ: AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

American Superconductor reported revenues of $66.66 million, up 58.6% year on year. This print beat analysts’ expectations by 10.6%. Overall, it was a stunning quarter as it also logged a solid beat of analysts’ EBITDA estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The stock is up 48.1% since reporting and currently trades at $35.89.

Read our full, actionable report on American Superconductor here, it’s free.

SolarEdge (NASDAQ: SEDG)

Established in 2006, SolarEdge (NASDAQ: SEDG) creates advanced systems to improve the efficiency of solar panels.

SolarEdge reported revenues of $219.5 million, up 7.4% year on year. This result topped analysts’ expectations by 7.3%. It was a strong quarter as it also put up a solid beat of analysts’ adjusted operating income estimates and a decent beat of analysts’ EPS estimates.

The stock is up 69.8% since reporting and currently trades at $21.94.

Read our full, actionable report on SolarEdge here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.