Q2 Casino Operator Earnings Review: First Prize Goes to Red Rock Resorts (NASDAQ:RRR)

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Red Rock Resorts (NASDAQ: RRR) and its peers.

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

The 9 casino operator stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 2.8%.

In light of this news, share prices of the companies have held steady as they are up 2.5% on average since the latest earnings results.

Best Q2: Red Rock Resorts (NASDAQ: RRR)

Founded in 1976, Red Rock Resorts (NASDAQ: RRR) operates a range of casino resorts and entertainment properties, primarily in the Las Vegas metropolitan area.

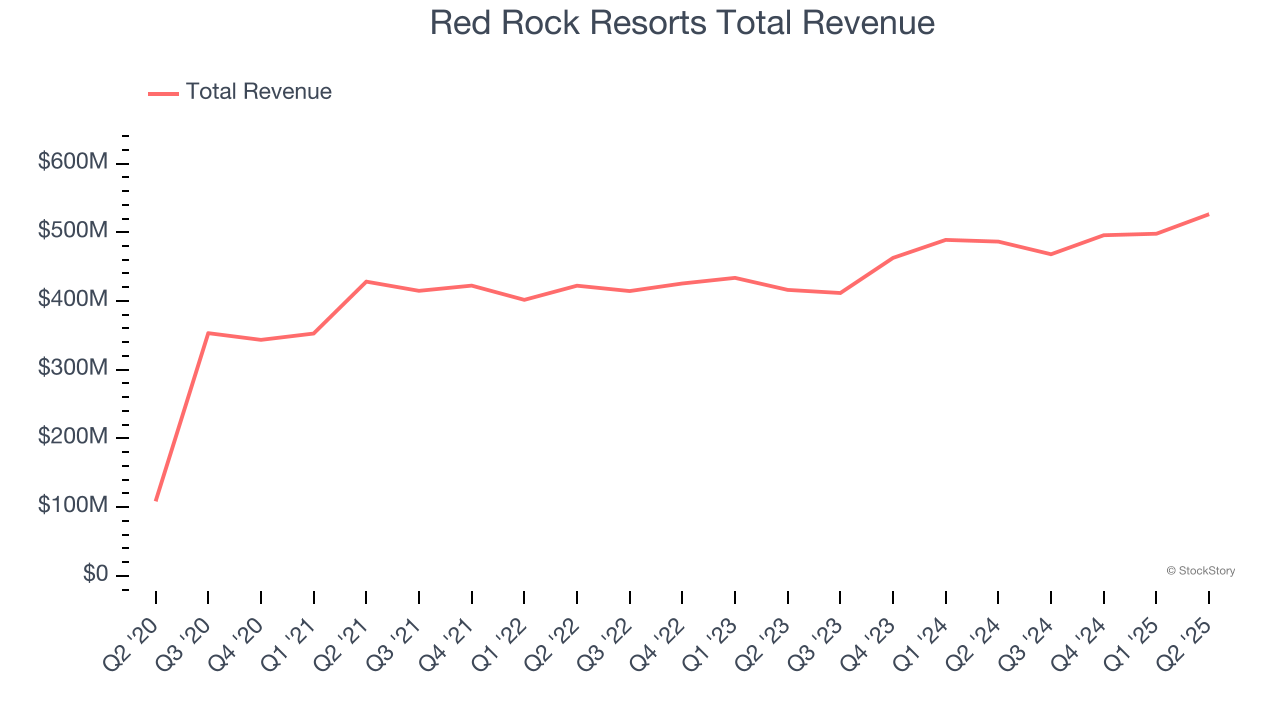

Red Rock Resorts reported revenues of $526.3 million, up 8.2% year on year. This print exceeded analysts’ expectations by 8.4%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ EBITDA estimates.

Red Rock Resorts achieved the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 11.8% since reporting and currently trades at $61.43.

Is now the time to buy Red Rock Resorts? Access our full analysis of the earnings results here, it’s free.

Monarch (NASDAQ: MCRI)

Established in 1993, Monarch (NASDAQ: MCRI) operates luxury casinos and resorts, offering high-end gaming, dining, and hospitality experiences.

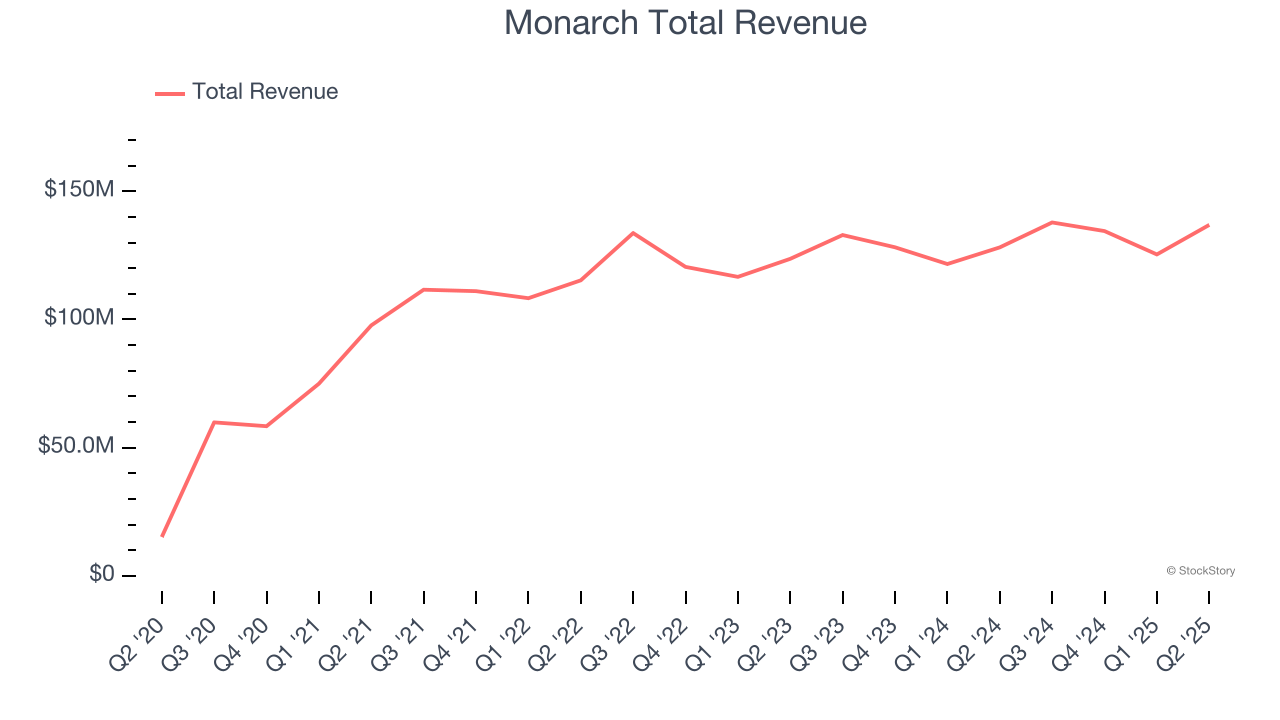

Monarch reported revenues of $136.9 million, up 6.8% year on year, outperforming analysts’ expectations by 5.4%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 18% since reporting. It currently trades at $102.94.

Is now the time to buy Monarch? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Wynn Resorts (NASDAQ: WYNN)

Founded by the former Mirage Resorts CEO, Wynn Resorts (NASDAQ: WYNN) is a global developer and operator of high-end hotels and casinos, known for its luxurious properties and premium guest services.

Wynn Resorts reported revenues of $1.74 billion, flat year on year, falling short of analysts’ expectations by 0.6%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates and a miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 3.6% since the results and currently trades at $111.01.

Read our full analysis of Wynn Resorts’s results here.

Bally's (NYSE: BALY)

Headquartered in Providence, Rhode Island, Bally's Corporation (NYSE: BALY) is a diversified global casino-entertainment company that owns and manages casinos, resorts, and online gaming platforms.

Bally's reported revenues of $679.1 million, up 9.2% year on year. This number beat analysts’ expectations by 4.3%. Zooming out, it was a softer quarter as it recorded a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EPS estimates.

Bally's delivered the fastest revenue growth among its peers. The stock is down 1.2% since reporting and currently trades at $9.85.

Read our full, actionable report on Bally's here, it’s free.

Caesars Entertainment (NASDAQ: CZR)

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ: CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

Caesars Entertainment reported revenues of $2.91 billion, up 2.7% year on year. This print topped analysts’ expectations by 1.2%. More broadly, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates and a miss of analysts’ adjusted operating income estimates.

The stock is down 9% since reporting and currently trades at $25.88.

Read our full, actionable report on Caesars Entertainment here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.