First Watch (NASDAQ:FWRG) Posts Q2 Sales In Line With Estimates, Stock Soars

Breakfast restaurant chain First Watch Restaurant Group (NASDAQ: FWRG) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 19.1% year on year to $307.9 million. Its GAAP profit of $0.03 per share was $0.02 below analysts’ consensus estimates.

Is now the time to buy First Watch? Find out by accessing our full research report, it’s free.

First Watch (FWRG) Q2 CY2025 Highlights:

- Revenue: $307.9 million vs analyst estimates of $306.6 million (19.1% year-on-year growth, in line)

- EPS (GAAP): $0.03 vs analyst estimates of $0.05 ($0.02 miss)

- Adjusted EBITDA: $30.38 million vs analyst estimates of $30.33 million (9.9% margin, in line)

- EBITDA guidance for the full year is $121 million at the midpoint, above analyst estimates of $114.6 million

- Operating Margin: 2.4%, down from 6.4% in the same quarter last year

- Locations: 600 at quarter end, up from 538 in the same quarter last year

- Same-Store Sales rose 3.5% year on year (-0.3% in the same quarter last year)

- Market Capitalization: $1.05 billion

"We delivered both positive same restaurant traffic growth and same restaurant sales growth in the second quarter, representing three consecutive quarters of sequential improvement,” stated Chris Tomasso, CEO and President of First Watch.

Company Overview

Based on a nautical reference to the first work shift aboard a ship, First Watch (NASDAQ: FWRG) is a chain of breakfast and brunch restaurants whose menu is heavily-focused on eggs and griddle items such as pancakes.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.11 billion in revenue over the past 12 months, First Watch is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

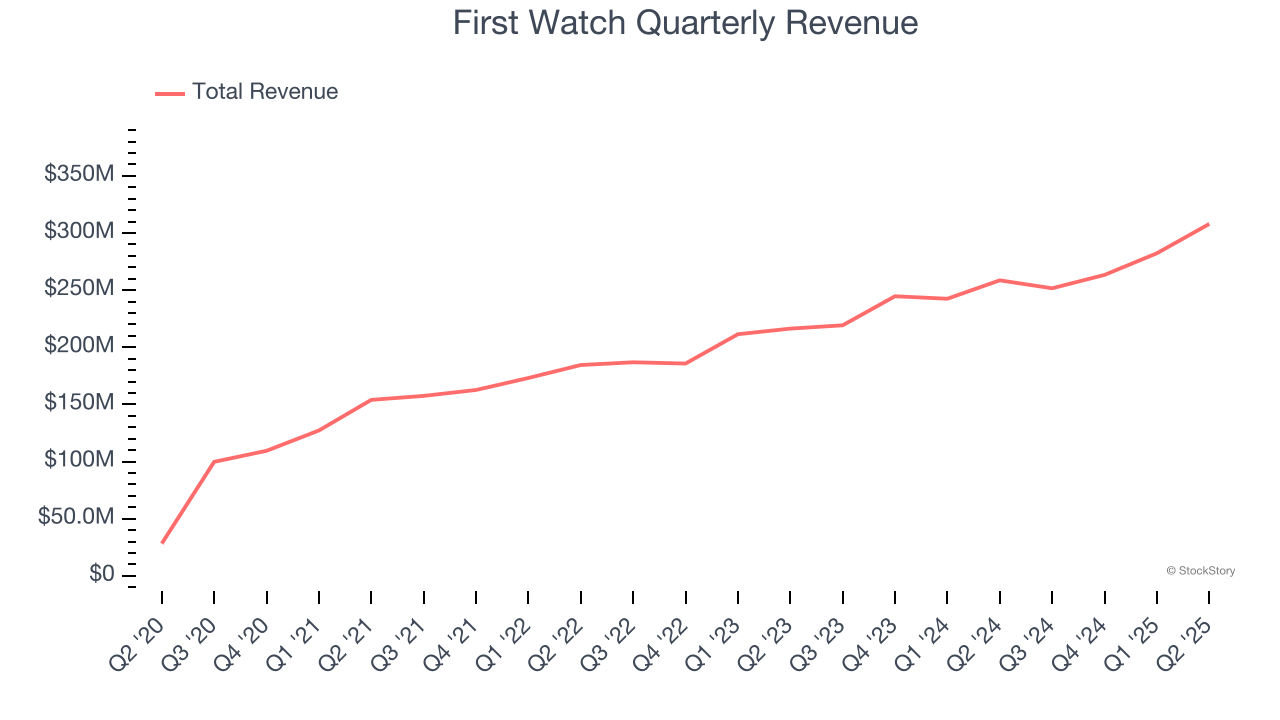

As you can see below, First Watch’s sales grew at an excellent 18.6% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, First Watch’s year-on-year revenue growth was 19.1%, and its $307.9 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 18.9% over the next 12 months, similar to its six-year rate. This projection is commendable and indicates the market is baking in success for its menu offerings.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

Number of Restaurants

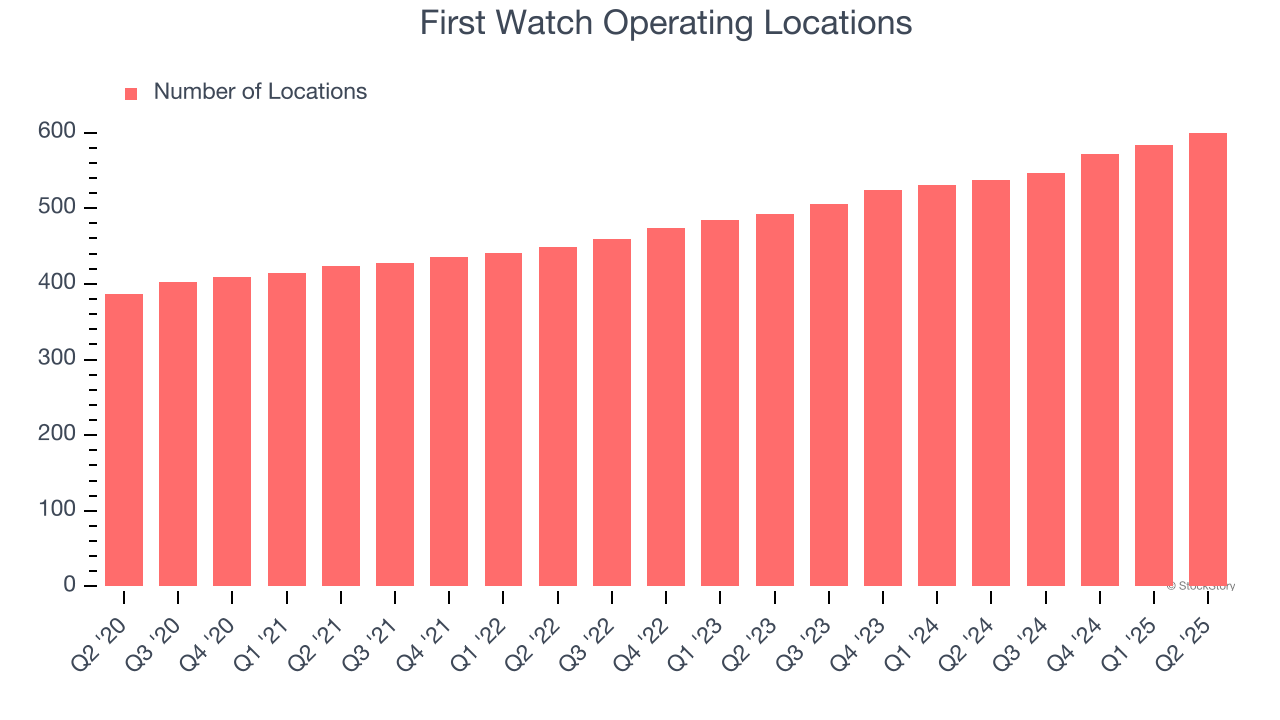

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

First Watch sported 600 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 9.8% annual growth, among the fastest in the restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

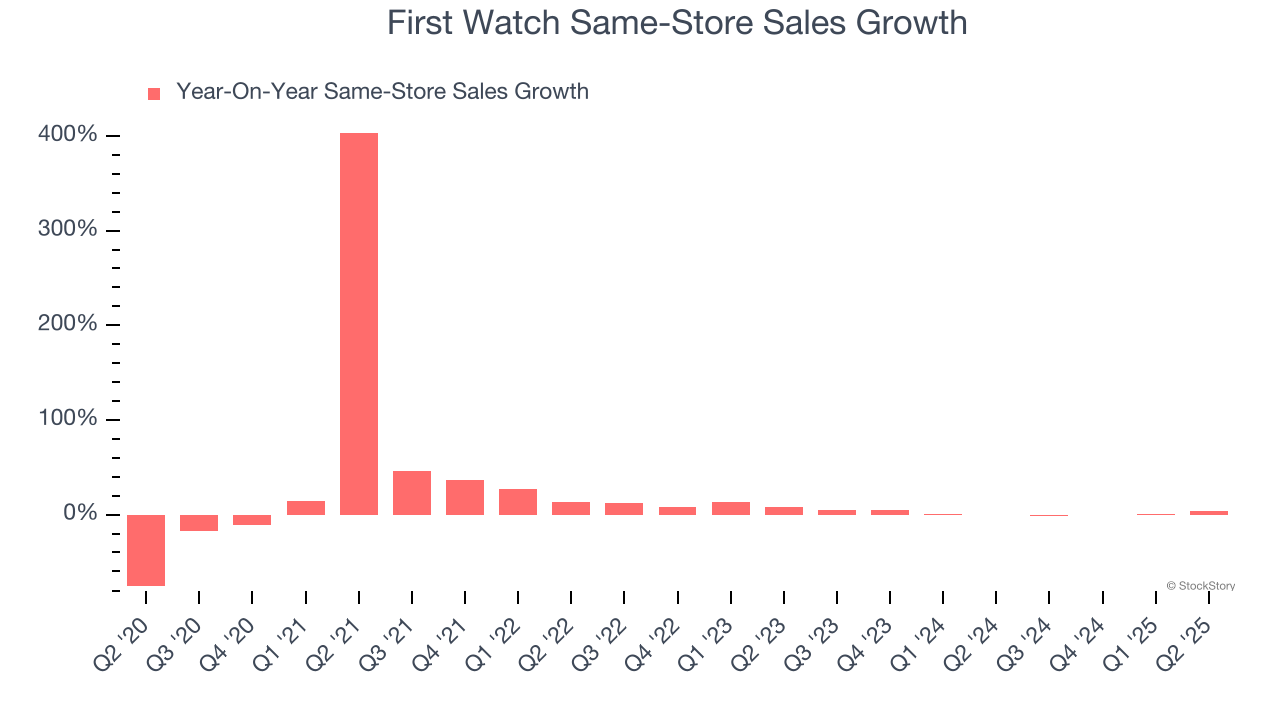

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

First Watch’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.5% per year. This performance suggests it should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, First Watch’s same-store sales rose 3.5% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from First Watch’s Q2 Results

We were impressed by First Watch’s optimistic full-year EBITDA guidance, which blew past analysts’ expectations. We were also glad its same-store sales outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 6.6% to $18.36 immediately after reporting.

So do we think First Watch is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.