3 Reasons to Avoid CARG and 1 Stock to Buy Instead

CarGurus trades at $36.90 and has moved in lockstep with the market. Its shares have returned 17.8% over the last six months while the S&P 500 has gained 15.7%.

Is now the time to buy CarGurus, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is CarGurus Not Exciting?

We're sitting this one out for now. Here are three reasons there are better opportunities than CARG and a stock we'd rather own.

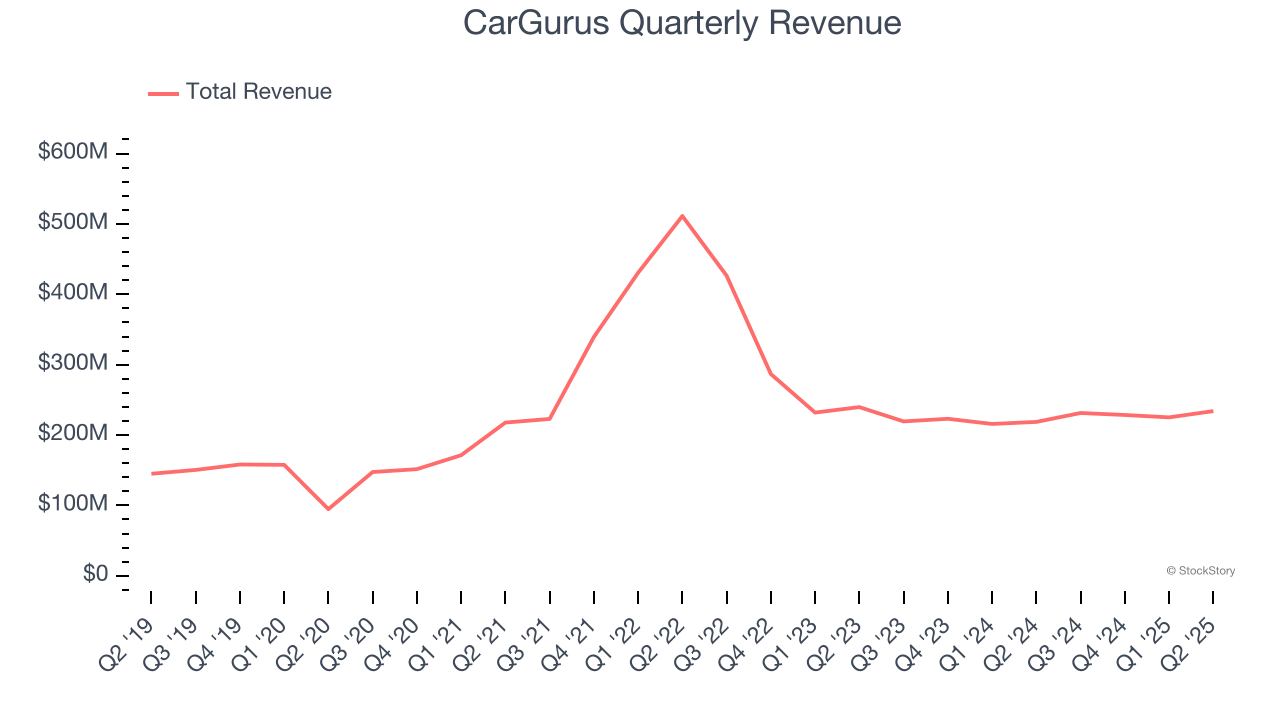

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, CarGurus’s demand was weak and its revenue declined by 15.1% per year. This wasn’t a great result and is a sign of lacking business quality.

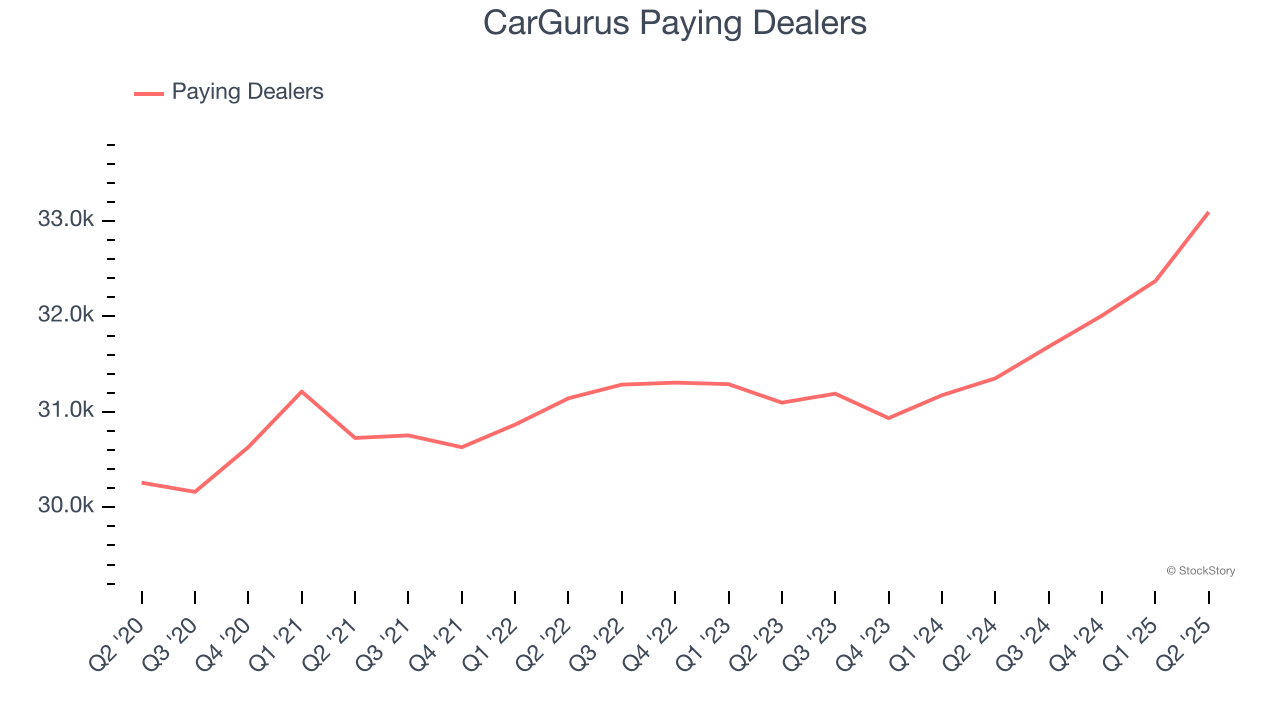

2. Change in Paying Dealers Points to Soft Demand

As an online marketplace, CarGurus generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, CarGurus’s paying dealers, a key performance metric for the company, increased by 1.7% annually to 33,095 in the latest quarter. This growth rate is one of the lowest in the consumer internet sector. If CarGurus wants to accelerate growth, it likely needs to engage users more effectively with its existing offerings or innovate with new products.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect CarGurus’s revenue to rise by 3.4%. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Final Judgment

CarGurus isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 11.8× forward EV/EBITDA (or $36.90 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward an all-weather company that owns household favorite Taco Bell.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.