Vertical Software Stocks Q2 In Review: Alarm.com (NASDAQ:ALRM) Vs Peers

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Alarm.com (NASDAQ: ALRM) and the best and worst performers in the vertical software industry.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 4 vertical software stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.4% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 7.6% on average since the latest earnings results.

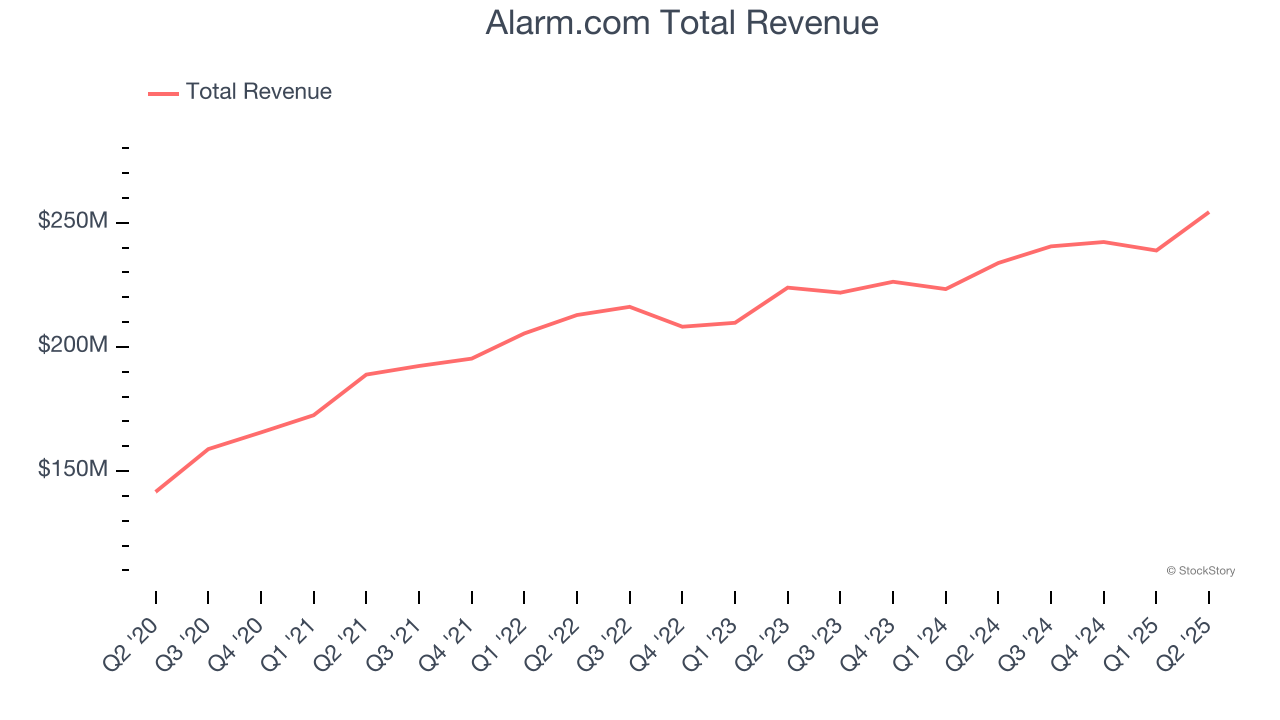

Alarm.com (NASDAQ: ALRM)

Processing over 325 billion data points annually from more than 150 million connected devices, Alarm.com (NASDAQ: ALRM) provides cloud-based platforms that enable residential and commercial property owners to remotely monitor and control their security, video, energy, and other connected devices.

Alarm.com reported revenues of $254.3 million, up 8.8% year on year. This print exceeded analysts’ expectations by 4.3%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

Alarm.com delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 4.8% since reporting and currently trades at $56.98.

Is now the time to buy Alarm.com? Access our full analysis of the earnings results here, it’s free.

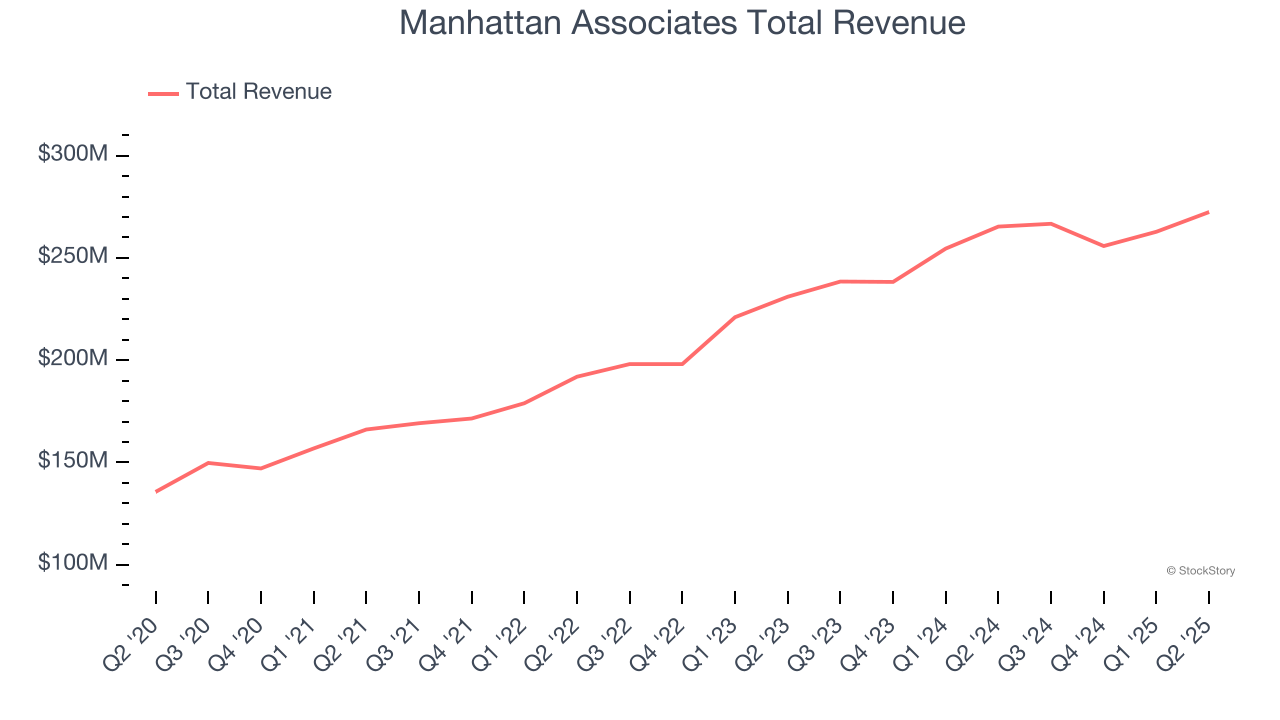

Best Q2: Manhattan Associates (NASDAQ: MANH)

Built on a "versionless" cloud architecture that delivers quarterly updates to all customers, Manhattan Associates (NASDAQ: MANH) develops cloud-based software that helps retailers, wholesalers, and manufacturers manage their supply chains, inventory, and omnichannel operations.

Manhattan Associates reported revenues of $272.4 million, up 2.7% year on year, outperforming analysts’ expectations by 3.3%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 8% since reporting. It currently trades at $219.81.

Is now the time to buy Manhattan Associates? Access our full analysis of the earnings results here, it’s free.

Guidewire Software (NYSE: GWRE)

With its systems powering the operations of hundreds of insurance brands across 42 countries, Guidewire Software (NYSE: GWRE) provides a technology platform that helps property and casualty insurance companies manage their core operations, digital engagement, and analytics.

Guidewire Software reported revenues of $356.6 million, up 22.3% year on year, exceeding analysts’ expectations by 5.8%. It was a satisfactory quarter as it also posted an impressive beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

Interestingly, the stock is up 21.6% since the results and currently trades at $263.95.

Read our full analysis of Guidewire Software’s results here.

Bentley Systems (NASDAQ: BSY)

Pioneering the concept of "digital twins" for infrastructure projects long before it became an industry buzzword, Bentley Systems (NASDAQ: BSY) provides software solutions that help engineers design, build, and operate infrastructure projects across sectors including roads, bridges, utilities, mining, and industrial facilities.

Bentley Systems reported revenues of $364.1 million, up 10.2% year on year. This result met analysts’ expectations. Overall, it was a strong quarter as it also put up an impressive beat of analysts’ annual recurring revenue estimates and a decent beat of analysts’ billings estimates.

Bentley Systems had the weakest performance against analyst estimates among its peers. The stock is down 4.1% since reporting and currently trades at $54.69.

Read our full, actionable report on Bentley Systems here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.