Silver Stalled- Was the Recent Record High the Top?

By:

Barchart.com

November 20, 2025 at 15:00 PM EST

In an October 2, 2025, Barchart article, I asked how high silver prices could rise. Silver was still below the highs from 2011 and 1980 in early October, trading at $47.375 per ounce when I concluded:

Silver had already set new nominal record highs in October and November, and the corrections bounced back above the $560 level, which could be a healthy sign that silver will continue to rally over the coming weeks, months, and into 2026. New highs, pullbacks, and recoveriesSilver is a highly volatile precious metal, so it is no surprise that silver futures corrected after reaching a new record high in October 2025.

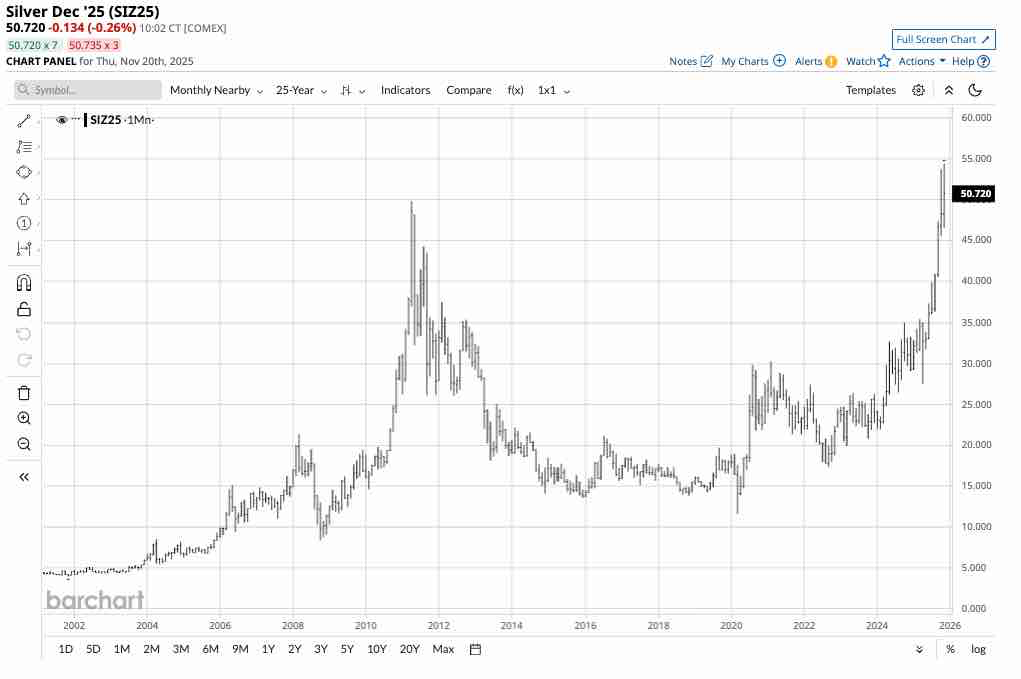

The monthly continuous COMEX silver futures chart highlights silver’s rise to $53.765 per ounce in October 2025, surpassing the 2011 $49.92 and the 1980 $50.36 peaks. While silver futures corrected 15.4% to a low of $45.51 on October 28, the price moved to a new high of $54.415 on November 13 before correcting below $50 and rising above $50.70 on November 20. Silver remains in a long-term bullish trend. The reasons supporting a parabolic silver rallyThe following factors support higher highs in silver over the coming months:

The bottom line is that all the pieces are in place for a parabolic rise in silver over the coming months. Silver remains inexpensive compared to goldThe silver-gold ratio, or value proposition, dates back to ancient Egypt, when Pharaoh Menes declared that two and one-half parts silver equal one part gold. At Menes’ level, with gold at $4,120 per ounce, silver would be trading $1,648 per ounce. In modern times, the silver-gold ratio has been far higher, but the value proposition’s trend suggests more gains for gold’s sibling.

The long-term chart of the silver/gold ratio ({GCZ25}/{SIZ25}) shows that for nearly six decades, the ratio has been as high as 1:142 and was low as 1:14.24. In the 2000s, the range has been from 1:31.66 to 1:124.65. The midpoint of the range is around 78 ounces of silver value for each ounce of gold value. At $4,075 per ounce, a return to that average would put silver’s price at $52.24. However, silver’s volatility, gold’s bullish trajectory, and the pattern of lower highs in the silver/gold ratio suggest higher silver prices. A return to the ratio’s low in 2011 at 1.36.22 would put silver’s price at $112.50 with gold at $4,075 per ounce. Silver remains inexpensive compared to gold, and a continuation of gold’s bull market could only fuel further, perhaps parabolic, gains in silver prices. Buying on weakness is optimalEven the most aggressive bull markets rarely move in straight lines, and silver’s recent over 15% correction from the October 2025 record high to $45.51 per ounce during the same month illustrates the potential for sudden and significant pullbacks.

The monthly continuous COMEX silver futures chart highlights the 367.5% rally from the pandemic-inspired March 2020 low of $11.64 to the October 2025 high of $54.415 per ounce. While silver prices have moved more than four and a half times higher, there were plenty of pullbacks over the past five and a half years. Buying silver on price corrections has been an optimal strategy. A recent example was the over 22% decline from $35.495 in March 2025 to $27.545 in April 2025 following the Trump administration’s roll out its tariff policies. A scale-down approach to accumulating silver during downside corrections has been optimal since 2020, and I expect that trend to continue. Physical silver is the most direct route- There are many silver-related ETFsThe most direct route for an investment or speculative position in silver is through the physical market for bars and coins. However, silver is a bulky commodity that becomes expensive to store and transport. COMEX silver futures are the next most direct route, as they provide a delivery mechanism. Each COMEX silver futures contract contains 5,000 ounces. At $50.70, the value is $253,500. The exchange’s original margin requirement is currently $22,000. A market participant can control a quarter of a million worth of silver for around an 8.68% down payment. If the equity on a risk position falls below the $20,000 level, the exchange requires maintenance margin. The exchange also offers mini and micro silver futures contracts. The iShares Silver Trust (SLV) is the most liquid silver ETF product. At $46.14 per share, SLV had over $25 billion in assets under management. SLV trades an average of over 25.565 million shares daily and charges a 0.50% management fee. There are other silver-related ETF and ETN products that move higher and lower with the precious metal’s price. Silver mining shares also offer exposure, and diversified products like SIL and SILJ provide diversified exposure to portfolios of senior and junior silver mining shares. While I remain bullish on silver prices, buying and accumulating silver or silver-related products during corrections, leaving room to add on further declines has been optimal, and I expect that trend to continue. The bottom line is that I expect the price to rise far above the October 2025 record high, but the road to higher prices could be extremely volatile. On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

D-Wave: Time to Buy the Dip? Or is the Fall Just Starting? ↗

November 24, 2025

Via MarketBeat

Tickers

QBTS

Hims, Block, and NRG Just Launched Huge Stock Buybacks ↗

November 24, 2025

Via MarketBeat

Retail Earnings Roundup: Walmart Scores, Target Slumps in Q3 ↗

November 24, 2025

Via MarketBeat

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|