Align Technology Stock: Analyst Estimates & Ratings

By:

Barchart.com

November 24, 2025 at 07:33 AM EST

With a market cap of $10.2 billion, Align Technology, Inc. (ALGN) is a global medical device company best known for its Invisalign clear aligners, Vivera retainers, and iTero intraoral scanners. The company provides advanced orthodontic and restorative digital solutions across the United States, Switzerland, and international markets. Shares of the Tempe, Arizona-based company have delivered weaker returns than the broader market over the past 52 weeks. ALGN stock has decreased 37.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11%. Moreover, shares of the company have dropped 31.6% on a YTD basis, compared to SPX's 12.3% rise. More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

Looking closer, shares of the Invisalign tooth-straightening system maker have also lagged behind the Health Care Select Sector SPDR Fund's (XLV) 7.4% return over the past 52 weeks.

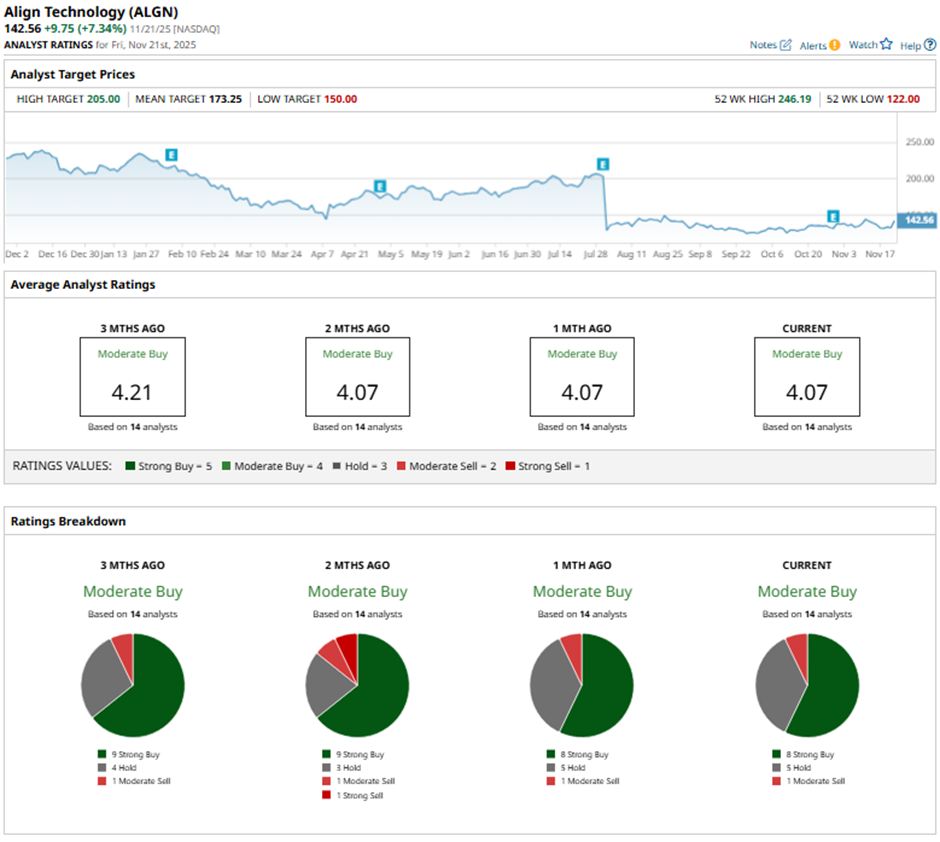

Shares of ALGN surged 4.9% following its Q3 2025 results on Oct. 29. Adjusted EPS came in at $2.61 and revenue reached $995.7 million, exceeding the consensus estimates. Investor sentiment was further lifted as Align raised its Q4 revenue forecast to $1.03 billion - $1.05 billion and projected mid-single-digit growth in Clear Aligner volumes. For the fiscal year ending in December 2025, analysts expect Align Technology’s EPS to increase 16.7% year-over-year to $8.18. The company's earnings surprise history is mixed. It topped the consensus estimates in two of the last four quarters while missing on two other occasions. Among the 14 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, five “Holds,” and one “Moderate Sell.”

This configuration is slightly less bullish than three months ago, with nine “Strong Buy” ratings on the stock. On Oct. 30, Evercore ISI raised its price target on Align Technology to $170 and reiterated an “Outperform” rating. The mean price target of $173.25 represents a premium of 21.5% to ALGN's current price. The Street-high price target of $205 suggests a 43.8% potential upside. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

D-Wave: Time to Buy the Dip? Or is the Fall Just Starting? ↗

November 24, 2025

Via MarketBeat

Tickers

QBTS

Hims, Block, and NRG Just Launched Huge Stock Buybacks ↗

November 24, 2025

Via MarketBeat

Retail Earnings Roundup: Walmart Scores, Target Slumps in Q3 ↗

November 24, 2025

Via MarketBeat

Via MarketBeat

Why Circle Stock Is Falling—and Why Some Analysts See Big Upside ↗

November 24, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|