Do Wall Street Analysts Like Generac Holdings Stock?

By:

Barchart.com

November 24, 2025 at 08:48 AM EST

Generac Holdings Inc. (GNRC) is a leading player in backup power, designing and manufacturing equipment and solutions for homes, businesses, and industries. Its wide range includes generators, energy storage systems, and digital energy management tools. Generac operates a vertically integrated structure that covers R&D, manufacturing, and global distribution. The company’s main office is situated in Waukesha, Wisconsin. Generac currently has a market capitalization of $8.57 billion. Generac’s stock has been turbulent on Wall Street. A relatively milder weather season, without significant events that drive demand for backup generators, has weighed on the stock’s performance. Over the past 52 weeks, the stock has declined by 20.4%, while it is down 23.4% over the past three months. Generac’s shares had reached a 52-week high of $203.25 in August, but are down 28.2% from that level. More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

On the other hand, the broader S&P 500 Index ($SPX) has gained 11% and 3.7% over the same periods, respectively, indicating that the stock has underperformed the broader market. The same trend can be observed when comparing the stock's performance with that of the industrial sector. The Industrial Select Sector SPDR Fund (XLI) has gained 6.4% over the past 52 weeks but declined marginally over the past three months.

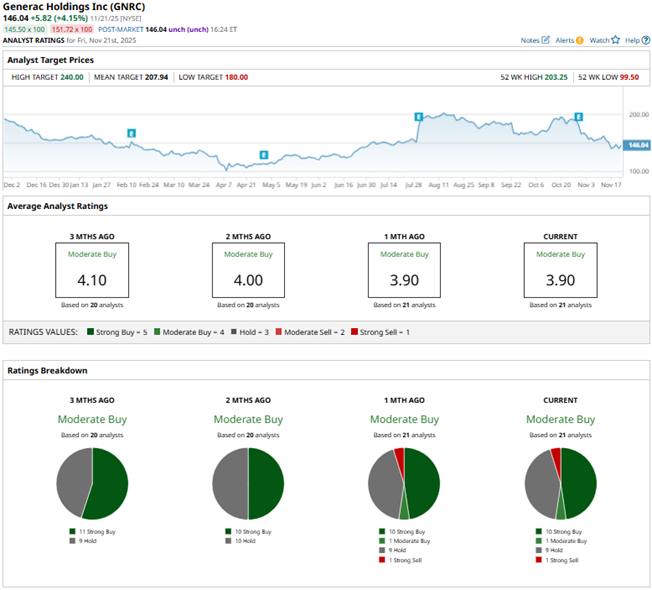

On Oct. 29, Generac reported its third-quarter results for fiscal 2025 that missed analyst estimates. The company’s net sales decreased 5% year-over-year (YOY) to $1.11 billion, below the $1.20 billion that Wall Street analysts had expected. The weaker-than-expected result was likely due to a power outage environment below the baseline average. The bottom line also declined, with adjusted EPS declining by 18.7% from the prior year’s period to $1.83, missing the $2.25 figure that Wall Street analysts had expected. For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect Generac’s EPS to decline 10.9% YOY to $6.48 on a diluted basis. However, EPS is expected to increase 25.6% annually to $8.14 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in three of the four trailing quarters. Among the 21 Wall Street analysts covering Generac’s stock, the consensus is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” nine “Holds,” and one “Strong Sell.” The ratings configuration is less bullish than it was two months ago, with the addition of one “Strong Sell” rating.

This month, analysts at Citigroup maintained a “Neutral” rating on Generac’s stock. Last month, UBS analyst Jon Windham maintained a “Buy” rating on the stock. However, he also lowered the price target from $220 to $215. Generac’s mean price target of $207.94 indicates a 42.4% upside over current market prices. The Street-high price target of $240 implies a potential upside of 64.3%. On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

D-Wave: Time to Buy the Dip? Or is the Fall Just Starting? ↗

November 24, 2025

Via MarketBeat

Tickers

QBTS

Hims, Block, and NRG Just Launched Huge Stock Buybacks ↗

November 24, 2025

Via MarketBeat

Retail Earnings Roundup: Walmart Scores, Target Slumps in Q3 ↗

November 24, 2025

Via MarketBeat

Via MarketBeat

Why Circle Stock Is Falling—and Why Some Analysts See Big Upside ↗

November 24, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|