Palantir Breaks 100-Day Moving Average Amid AI Stock Selloff. Should You Buy the Dip in PLTR?

By:

Barchart.com

November 24, 2025 at 11:28 AM EST

Palantir (PLTR) shares tanked below their 100-day moving average (MA) on Friday, Nov. 21 and remove below that threshold Monday as bubble concerns and macroeconomic uncertainty continue to make investors bail on high-flying tech stocks. The breach of that technical indicator signals the bearish momentum may not be over for PLTR yet since the 100-day MA has historically served as dynamic support for trending stocks. More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

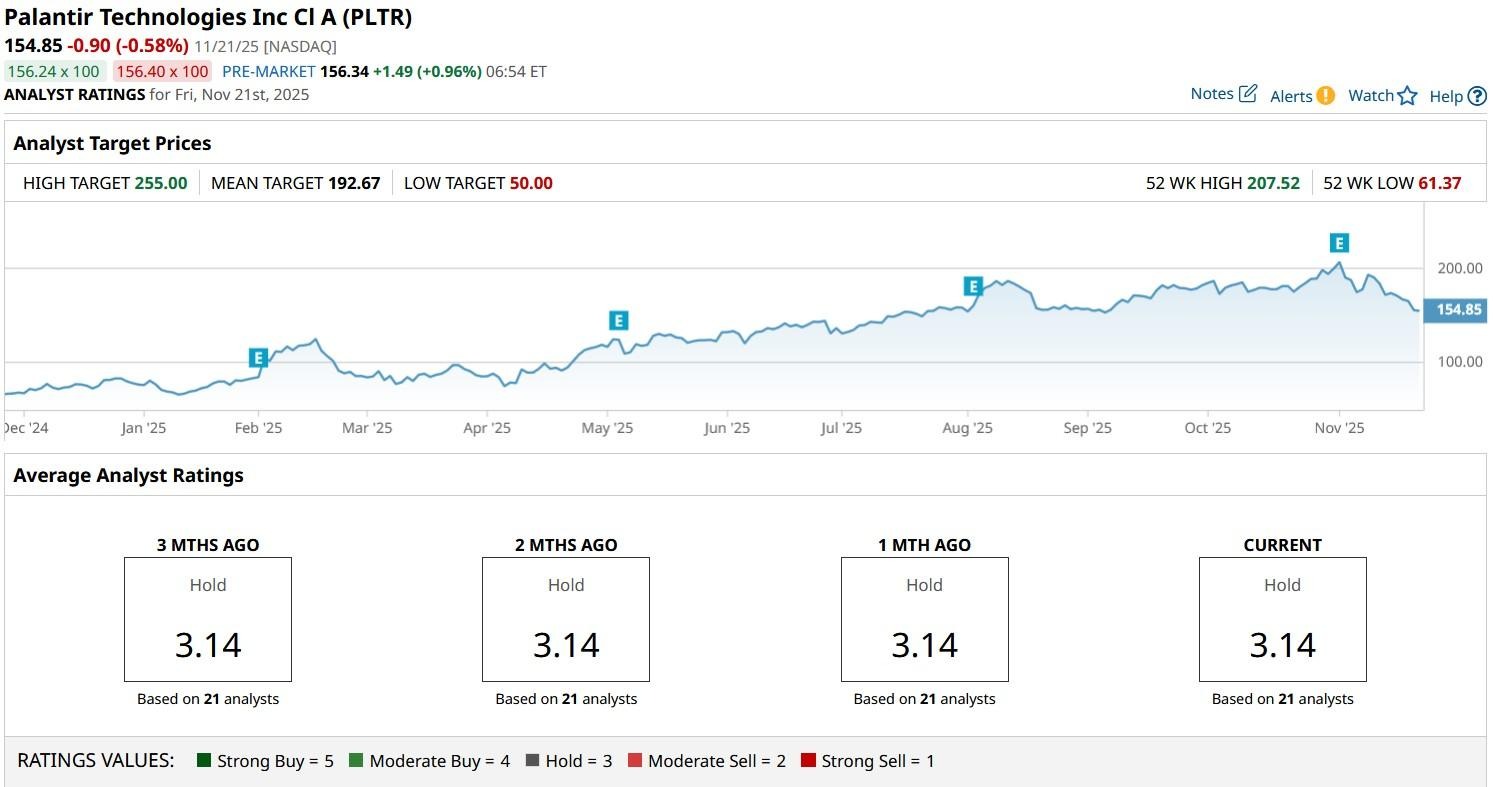

Palantir stock has lost over 20% from its November highs but it still remains one of the most expensive S&P 500 Index ($SPX) names at the time of writing.  Palantir Stock’s Valuation Warrants ScrutinyValuation remains the most compelling argument against buying the dip in PLTR shares as they’re trading at a price-sales (P/S) ratio of nearly 130x currently. For comparison, the next most expensive S&P 500 name is going for 32x sales only. What it means is that Palantir could crash by well over 65% and still maintain the index’s highest sales multiple. The Denver-headquartered firm’s nearly $400 billion market cap rests on under $4 billion revenue, creating a fundamental disconnection that historically has rarely ended well. That’s perhaps why insiders have trimmed their exposure to Palantir stock over the past six months. Why Else PLTR Shares Are UnattractiveIn its latest reported quarter, Palantir Technologies witnessed meaningful growth across both government and commercial segments. But the speed and accelerations metrics have collapsed while price remains elevated, creating what analysts describe as a structurally fragile condition where the stock stands on hollow ground without underlying support. Among globally renowned names that have recently flagged valuation concerns on Palantir shares are billionaire Stanley Druckenmiller and “Big Short” investor Michael Burry. Additionally, historical returns do not currently favor owning PLTR stock either. Over the past four years, the artificial intelligence (AI)-enabled data analytics firm has lost over 8% on average in December. How Wall Street Recommends Playing PalantirDespite the aforementioned concerns, Wall Street firms believe the selloff in Palantir stock has gone a bit too far. While the consensus rating on PLTR shares sits at “Hold” only, the mean target of $192 indicates potential upside of nearly 20% from here.  On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

D-Wave: Time to Buy the Dip? Or is the Fall Just Starting? ↗

November 24, 2025

Via MarketBeat

Tickers

QBTS

Hims, Block, and NRG Just Launched Huge Stock Buybacks ↗

November 24, 2025

Via MarketBeat

Retail Earnings Roundup: Walmart Scores, Target Slumps in Q3 ↗

November 24, 2025

Via MarketBeat

Via MarketBeat

Why Circle Stock Is Falling—and Why Some Analysts See Big Upside ↗

November 24, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|