These 3 Stocks Gained When Seemingly Everything Else Sold Off Last Week. Are They Worth a Buy Here?

By:

Barchart.com

November 24, 2025 at 14:14 PM EST

How bad were things for the S&P 500 Index ($SPX) on Thursday, Nov. 20? Not quite as bad as you might think. I’ve been writing here on Barchart for months, lamenting the fact that a small number of huge stocks are carrying the market. On Thursday, those stocks, mostly in the tech sector, reminded traders that markets often drop faster than they rise. It’s only a day, but all trends begin that way. More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

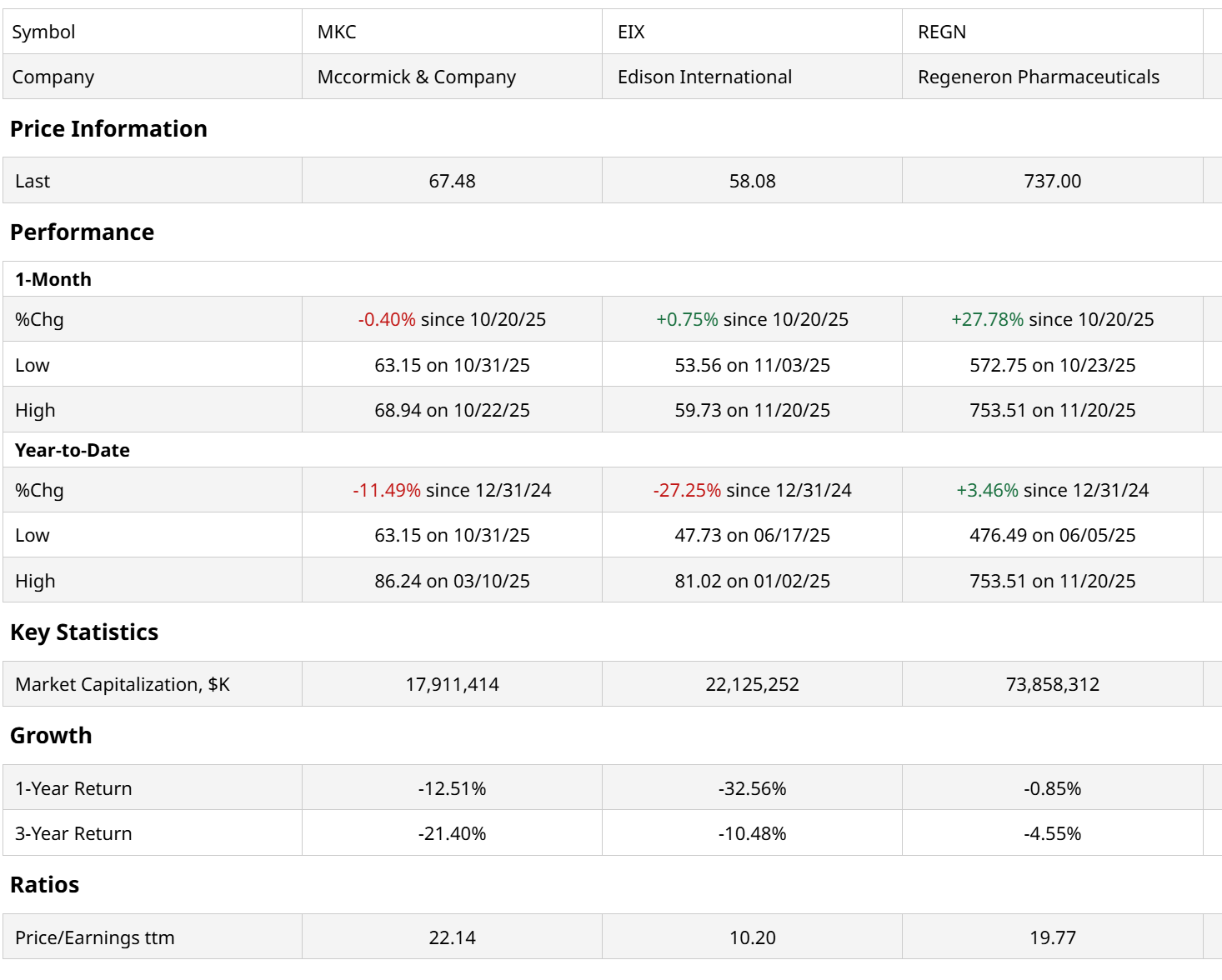

Still, there were quite a few stocks up more than 1% on the day. That means nothing for the future. But it does indicate their charts are worth a look, so see if any could have some legs to their unlikely rallies on such a sour day in the stock market. In all, about one-fourth of the S&P 500 Index stocks were positive, but 32 of them were up at least 1%. That’s always something that hits my radar. Here they are.  I drilled through the charts in hopes of finding at least three stocks from that list to present here, as those with what I think are the best shot at moving up at least 10% from here within a few months. Traders and investors have gotten used to much faster success than that. However, recent market action indicates that might be a tougher slog for a while. As it is, many S&P 500 stocks have spent this year attempting rallies, only to see them peter out after maybe a 5%-7% rise. So let’s see if there are some “green shoots” for future gains, based on this snapshot of one day’s countertrend winners. I’m presenting weekly charts, which are more reliable when looking beyond a swing-trader’s time frame. Here are the three I chose: McCormick (MKC) is known for living on your kitchen table and in your pantry. It is the leading maker of spices, and even at 22x trailing earnings, the stock looks spicier than most. It has lost money for shareholders the past three years, but these are the types of markets where stability sells. MKC has that going for it. Edison International (EIX) is a California-based electric utility. That was not newsworthy until its area was hit with some of the worst fire damage in history. That dented the company severely. But at 10x earnings, and in gradual recovery mode, it represents a speculative comeback candidate. Regeneron (REGN) is one of the largest biotech companies in the world, and made its reputation by targeting serious and often overlooked medical conditions. The stock is not overlooked anymore, up nearly 28% in a month. But it is still below its price level from three years ago.  These 3 Stock Charts Show Profit PotentialMKC is a slow-going stock most of the time. But it is attempting to create a rounded bottom here, and has rallied from this level before. It is not there yet, as its 20-week moving average is still moving lower. But if the market continues to flock to defensive names, this stock can be in the sweet spot once again.  EIX appears to be on the move higher. There’s plenty of risk here, as the firm is not yet off the hook for past issues affecting its area. But for true contrarians, it may have appeal.  And, REGN has made the turn, as they say. The risk here is that it went too far too fast, in a market that might get very unfriendly quickly. But it just broke through its 150-week moving average, a good sign for a long-term breakout.  The caveat here is that we might be trending toward a stock market that is driven by liquidity-based selling, not fundamentals, quality, turnaround stories, or anything else. So while these stocks stand out to me among a weak set of 500 in the S&P index, caution is the word. Still, for those who like to take on the challenge of buying into a market headwind, these three and perhaps others on the list above, might be the start of a potential shopping list. On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

D-Wave: Time to Buy the Dip? Or is the Fall Just Starting? ↗

November 24, 2025

Via MarketBeat

Tickers

QBTS

Hims, Block, and NRG Just Launched Huge Stock Buybacks ↗

November 24, 2025

Via MarketBeat

Retail Earnings Roundup: Walmart Scores, Target Slumps in Q3 ↗

November 24, 2025

Via MarketBeat

Via MarketBeat

Why Circle Stock Is Falling—and Why Some Analysts See Big Upside ↗

November 24, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|