What Is Quick Ratio?

By:

GlobePRwire

October 29, 2025 at 06:15 AM EDT

Understanding the Quick RatioThe Quick Ratio, also known as the Acid-Test Ratio, is a key financial metric used to evaluate a company’s short-term liquidity and ability to meet its current liabilities with its most liquid assets. Unlike the current ratio, which includes all current assets, the quick ratio focuses only on assets that can be quickly converted into cash — typically within 90 days or less. This metric provides investors, creditors, and analysts with insight into whether a company can pay off its short-term debts without relying on the sale of inventory or securing additional financing. The Formula for Quick RatioThe quick ratio is calculated using the following formula: Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) ÷ Current Liabilities Each component plays a specific role:

For example, if a company has $50,000 in cash, $20,000 in marketable securities, $30,000 in receivables, and $70,000 in current liabilities, its quick ratio would be: (50,000 + 20,000 + 30,000) ÷ 70,000 = 1.43 A quick ratio of 1.43 means the company has $1.43 in liquid assets for every $1 of short-term liability. Why the Quick Ratio MattersThe quick ratio is one of the most effective indicators of a company’s financial health. It shows how well a firm can withstand sudden financial stress without needing to liquidate long-term assets or raise external funds. Key reasons why it matters:

Interpreting the Quick RatioThe interpretation of the quick ratio depends on the industry and the company’s operational structure. Generally:

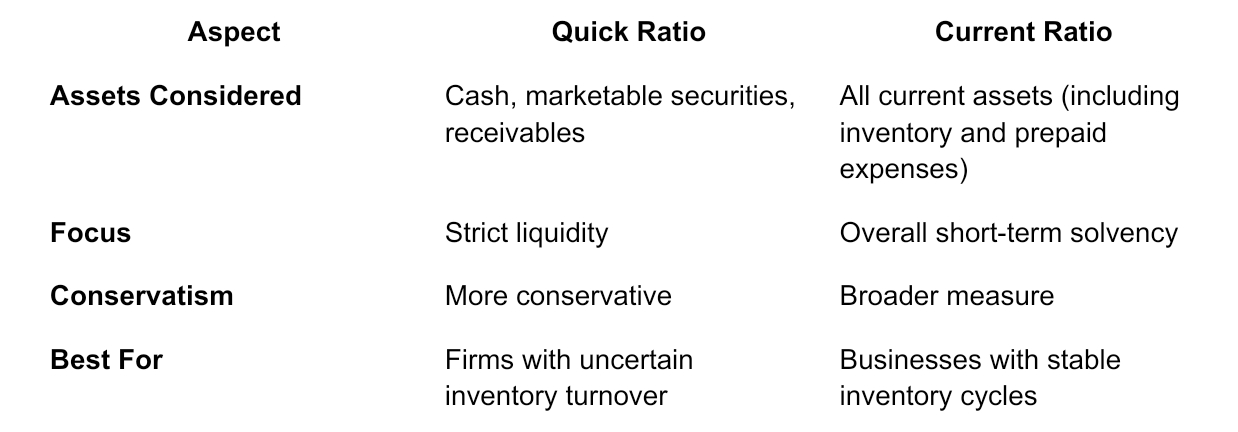

However, a very high quick ratio may also signal inefficiency. For instance, if a company is holding excessive cash instead of reinvesting or expanding, it may indicate underutilized resources. Quick Ratio vs. Current RatioWhile both ratios assess liquidity, they differ in scope:

Firms with uncertain inventory turnover Businesses with stable inventory cycles The quick ratio provides a stricter test of liquidity by excluding inventory, which might not be easily sold in emergencies. In contrast, the current ratio gives a broader perspective but may overestimate liquidity in certain sectors, such as retail or manufacturing. Industry BenchmarksThere is no universal “ideal” quick ratio. Acceptable values vary widely by industry:

Therefore, comparing a company’s quick ratio only makes sense within its industry context and over time, rather than against companies in unrelated sectors. Limitations of the Quick RatioAlthough useful, the quick ratio has its limitations:

To get a more accurate picture, analysts should use the quick ratio alongside other metrics like cash flow analysis, debt ratios, and current ratio. How to Improve the Quick RatioCompanies can take several measures to strengthen their quick ratio:

Effective liquidity management ensures financial flexibility and better creditworthiness. Final ThoughtsThe Quick Ratio is an essential indicator of a company’s ability to meet short-term obligations using its most liquid assets. While a ratio above 1 generally signals financial stability, the ideal benchmark depends on the company’s size, industry, and operational model. Investors and managers should not view the quick ratio in isolation but as part of a broader liquidity and profitability assessment framework. When interpreted correctly, it provides valuable insights into a business’s efficiency, stability, and financial resilience — key components for long-term success. More NewsView More

Via MarketBeat

Tickers

LLY

D-Wave: Time to Buy the Dip? Or is the Fall Just Starting? ↗

November 24, 2025

Via MarketBeat

Tickers

QBTS

Hims, Block, and NRG Just Launched Huge Stock Buybacks ↗

November 24, 2025

Via MarketBeat

Retail Earnings Roundup: Walmart Scores, Target Slumps in Q3 ↗

November 24, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|