Licensed Money Lender vs. Bank Loans: Key Differences You Should Know

By:

GlobePRwire

November 18, 2025 at 10:15 AM EST

Singapore's lending landscape offers two primary regulated channels for personal financing: traditional banks and licensed microfinance institutions. Each operates under distinct regulatory frameworks—banks through the Monetary Authority of Singapore (MAS), while a licensed money lender functions under Ministry of Law oversight. Understanding these differences directly impacts your borrowing costs, approval timeline, and access to funds. In this comparison, we will examine practical distinctions that influence which option aligns with your financial profile, credit history, and timeline requirements.

What Makes Banks and Licensed Money Lenders Fundamentally Different?The structural divide runs deeper than interest rates alone. Regulatory OversightAs we already mentioned, banks operate as comprehensive financial institutions regulated by MAS, offering everything from savings accounts to investment products alongside credit services. A legal money lender, conversely, functions under the Ministry of Law's Registry of Moneylenders with a specialized focus on consumer credit products. Operational PhilosophyTraditional banks employ multi-layered verification systems designed for institutional risk management across diverse financial products. Licensed microfinance providers streamline operations specifically for personal credit, enabling faster decision-making without sacrificing regulatory compliance. Digital TransformationModern licensed money lender platforms have digitized the entire lending lifecycle—from application through credit scoring to payment processing. This technological investment maintains speed while meeting regulatory requirements, including mandatory face-to-face verification before loan granting. The Ministry of Law caps licensed money lender interest at 4% monthly, with administrative fees limited to 10% of principal and late fees at S$60 per month. These regulations protect borrowers while separating legitimate operators from unlicensed entities. How Do Approval Speed and Processing Times Compare?Timeline differences can determine which option serves your needs. Bank processing reality:

Licensed microfinance speed:

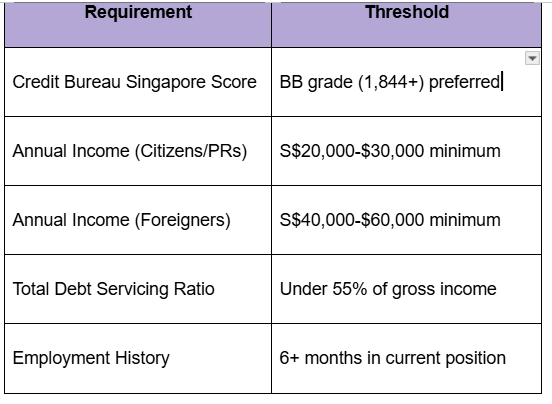

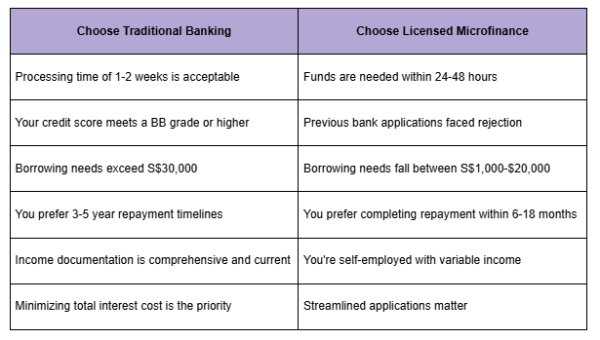

Choose based on urgency: emergency medical expenses favor faster processing, while planned purchases allow time for comprehensive bank loan applications. What Credit Score and Eligibility Requirements Should You Expect?Your credit profile determines which doors open. Bank Standards

Banks demand comprehensive documentation: tax assessments, CPF contribution statements, recent payslips, and proof of stable employment Licensed Provider FlexibilityA licensed money lender operates with more accommodating parameters:

Rejected by banks due to credit history? Licensed microfinance becomes a viable alternative. Self-employed with irregular documented income? The assessment methodology may be more accommodating than traditional banking underwriting. Licensed Money Lender vs Bank: How Do Interest Rates and Costs Differ?Cost structures reflect different risk profiles and operational models.

Bank PricingTraditional institutions typically charge 3.5%-7% per annum, with rates varying based on credit profile. Lower rates attach to strong credit scores and stable income. Longer repayment tenures (up to 5-7 years) spread costs across more installments. Additional fees include processing charges and potential early repayment penalties. Licensed Provider FrameworkThe Ministry of Law mandates a maximum 4% monthly interest rate. This translates to a higher effective rate but includes built-in consumer protections:

Cost-Benefit AnalysisA bank loan offers lower total interest for longer-term needs. The higher monthly rate from a licensed money lender becomes justified by accessibility and speed for urgent, short-term requirements. Example: A S$10,000 loan over 24 months at 6% p.a. from a bank costs approximately S$876 in interest. The same amount from a licensed provider at 1% monthly over 12 months results in higher total interest but serves borrowers unable to access traditional banking. What Loan Amounts and Repayment Terms Can You Access?Borrowing capacity varies significantly between channels. Bank CapacityBanks typically lend 4-6x your monthly income, though regulatory caps allow up to 10-12x. Larger sums (S$50,000-$200,000+) become available to qualified borrowers. Repayment timelines extend from 1-7 years, depending on the amount, with monthly installment structures. Licensed Provider ParametersA licensed money lender operates within income-based regulatory frameworks: Income-based borrowing limits:

Major financial commitments like debt consolidation favor bank lending limits. Smaller cash flow gaps or bridge financing needs align with licensed microfinance accessibility. How Do You Determine Which Option Fits Your Situation?Your circumstances dictate the optimal path.

When evaluating the best money lending options, prioritize platforms that demonstrate digital efficiency alongside regulatory transparency. Verify any provider through the Ministry of Law's official Registry of Moneylenders before proceeding. Critical Red FlagsAvoid any lender who:

Singapore's regulated environment protects borrowers, but verification remains your responsibility. Making an Informed Borrowing Decision

The choice between traditional banking and licensed microfinance isn't about superiority—it's about alignment. Banks excel in cost efficiency for larger, longer-term borrowing when your credit profile meets their standards. Licensed providers offer speed and accessibility when conventional pathways present barriers. Before applying:

Singapore's regulated lending environment protects consumers through both channels. Whether you select traditional banking or explore licensed microfinance alternatives, prioritize lenders demonstrating transparency, technological innovation, and strict regulatory adherence. The right borrowing choice aligns your specific financial profile, timeline constraints, and repayment capacity with the lending channel designed to serve those exact parameters.

More NewsView More

D-Wave: Time to Buy the Dip? Or is the Fall Just Starting? ↗

November 24, 2025

Via MarketBeat

Tickers

QBTS

Hims, Block, and NRG Just Launched Huge Stock Buybacks ↗

November 24, 2025

Via MarketBeat

Retail Earnings Roundup: Walmart Scores, Target Slumps in Q3 ↗

November 24, 2025

Via MarketBeat

Via MarketBeat

Why Circle Stock Is Falling—and Why Some Analysts See Big Upside ↗

November 24, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|