Amazon, Inc.'s (AMZN) Q3 revenue surprised analysts after the market closed on Oct. 30, coming in about 1.3% above expectations. Analysts had been expecting around $177.76 billion in quarterly sales, according to Seeking Alpha, but it came in at $180.17 billion, up 13% YoY.

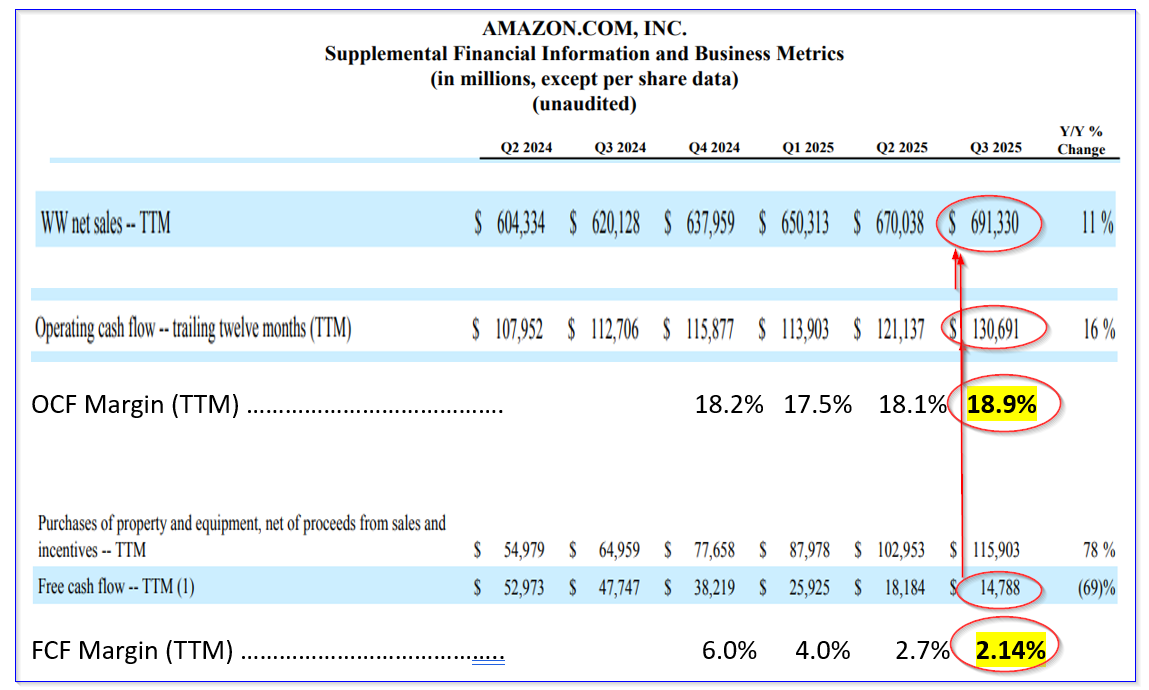

Moreover, its trailing 12-month (TTM) operating cash flow (OCF) remained strong, with 16% Y/Y growth, and its TTM OCF margin on revenue was 19%. That implies its future value could be higher. This article will show why it could be up to 26% too cheap.

As a result, AMZN stock is up over 10% in morning trading on Friday, Oct. 31, at $246.24 per share. That gives it a market capitalization of $2.631 trillion, based on 10.687 billion shares outstanding as of Oct. 30.

Free Cash Flow Impacted By Heavy Capex Spending

However, the company's FCF growth was 69% lower than last year at $14.788 billion, albeit still positive on a TTM basis. That means that, based on the TTM revenue of $691.33 billion, from Stock Analysis data, its FCF margin was 2.139%.

This is because Amazon is continuing to spend heavily on capex related to AI-driven projects, such as data centers.

For example, in the capex has risen from $102.953 billion last quarter (over the trailing 12-month period) to $115.9 billion in Q3 (again on a TTM basis). That's a huge +12.6% gain in spending in one quarter (over the last 12 months).

Amazon believes this spending of its operating cash flow will eventually pay off. Moreover, CNBC reported that some analysts are bullish on Amazon's AWS (data centers) segment.

This is driven by Amazon's higher revenue and operating margins. For example, its Q3 TTM OCF of $130.691 billion, representing 18.9% of TTM sales, was higher than Q2's 18.1% TTM margin. This higher margin growth can be seen in the table from page 10 of Amazon's Q3 release below (and my analysis of the OCF and FCF margins):

It shows that even though the operating cash flow margins have been rising each quarter, the FCF margins are lower consecutively as a result of accelerating capex spending. In fact, the company said it expects 2025 capex will rise even further to $125 billion, up from $116 billion on a TTM basis in Q3.

The reason is Amazon told investors, according to the WSJ, that demand for its cloud and AI products has “outpaced its ability to bring new data centers online.” Until that demand cools off, it's likely to continue to amp up its capital spending. That will depress its FCF margins in the near term.

But as long as its OCF margins stay strong - and they should as the capex spending pays off over time - the stock could continue to improve.

Forecasting Operating Cash Flow and a Price Target

For example, let's use analysts' forecasts of $785.38 billion in revenue next year, and assume Amazon's OCF margin rises from 18.9% to 20.79% FCF margin (i.e., up 10%):

$785.38 x 0.2079 = $163.28 billion operating cash flow

That would be $47.4 billion higher than its Q3 TTM cash flow of $115.9 billion, or an increase of +40.9%.

Moreover, assuming that Amazon spends $130 billion on capex next year, its FCF could rise to over $33 billion:

$163.28 - $130 b capex = $33.28 billion FCF

Assuming that the market gives AMZN stock a 1.0% FCF yield, even though its TTM FCF yield is about half that at 0.56% (i.e., $14.788b/$2,631 billion):

$33.28 billion / 0.01 = $3,328 billion market value

That is 26.5% higher than today's market value of $2,631 billion.

In other words, AMZN stock could be worth 26.5% higher than today's price of $246.24, or $311.50 per share.

Analysts See Higher Price Targets for AMZN

Some analysts have begun raising their price targets for AMZN stock. For example, the average of 67 analysts' price targets surveyed by Yahoo! Finance is now $280.77 per share.

Moreover, Barchart's survey shows a mean price of $268.84, and AnaChart's survey of 41 analysts is $260.94.

The bottom line is that even after today's jump in AMZN stock, its value could be higher over the coming year. This could be due to higher demand for its cloud and AI products.

One way to play this for value investors is to set a lower buy-in price by selling short out-of-the-money (OTM) put options.

Shorting OTM Puts for a Lower Potential Buy-In

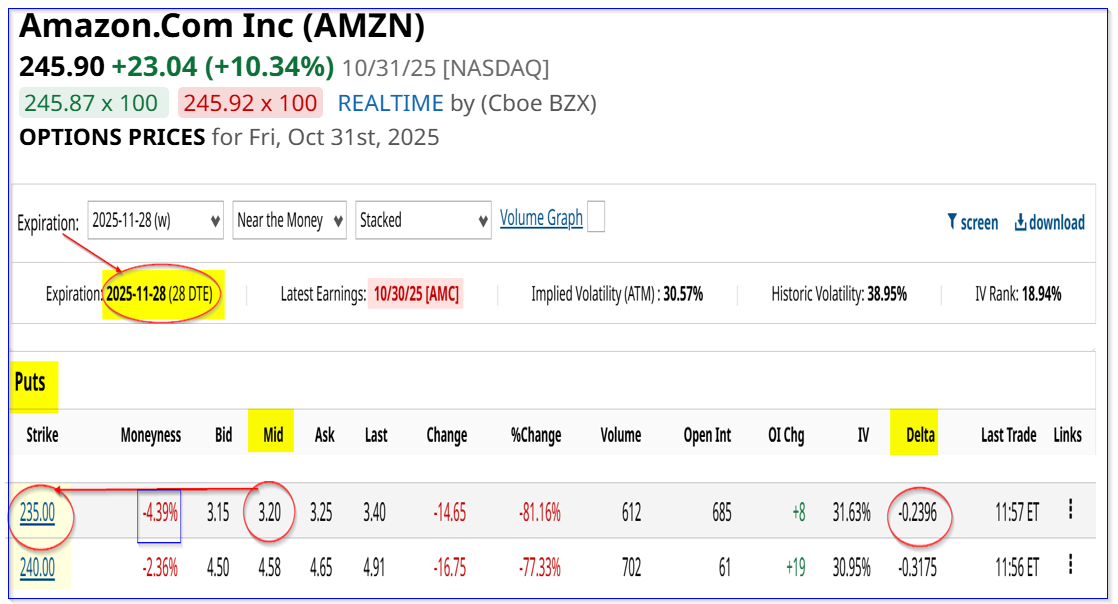

For example, the Nov. 28 expiry period shows that the $235.00 put option contract has a midpoint premium of $3.20.

That works out to an immediate short-selling put yield of 1.36% (i.e., $3.20/$135.00). This is for an exercise price that is $10 lower, or -4.43% below the trading price.

Moreover, it provides a potentially lower all-in buying point, after including the income received:

$235.00 - $3.20 = $231.80 breakeven point

That is 5.73% below today's price. The point is that a patient investor can collect the 1.36% yield while waiting for AMZN to fall 4.4% to set a 5.73% lower buy-in point.

That also could potentially provide better upside:

$311.50 / $231.80 breakeven -1 = 0.3438 = +34.38% upside

The bottom line is that AMZN stock still looks cheap, and shorting OTM puts is an attractive way to play it.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $135 Billion Reason to Buy Microsoft Stock Now

- 3 Options Strategies. 3 Unusually Active Options. 3 Long-Term Stocks to Buy.

- Amazon Stock Popped on Earnings. Options Data Tells Us AMZN Could Be Headed Here Next.

- Tesla’s New Focus Isn’t on Cars, But on ‘Sustainable Abundance.’ What Does That Mean for TSLA Stock and Buy-and-Hold Investors?