Valued at a market cap of $87.6 billion, Automatic Data Processing, Inc. (ADP) is a Roseland, New Jersey-based company that provides cloud-based human capital management (HCM) solutions.

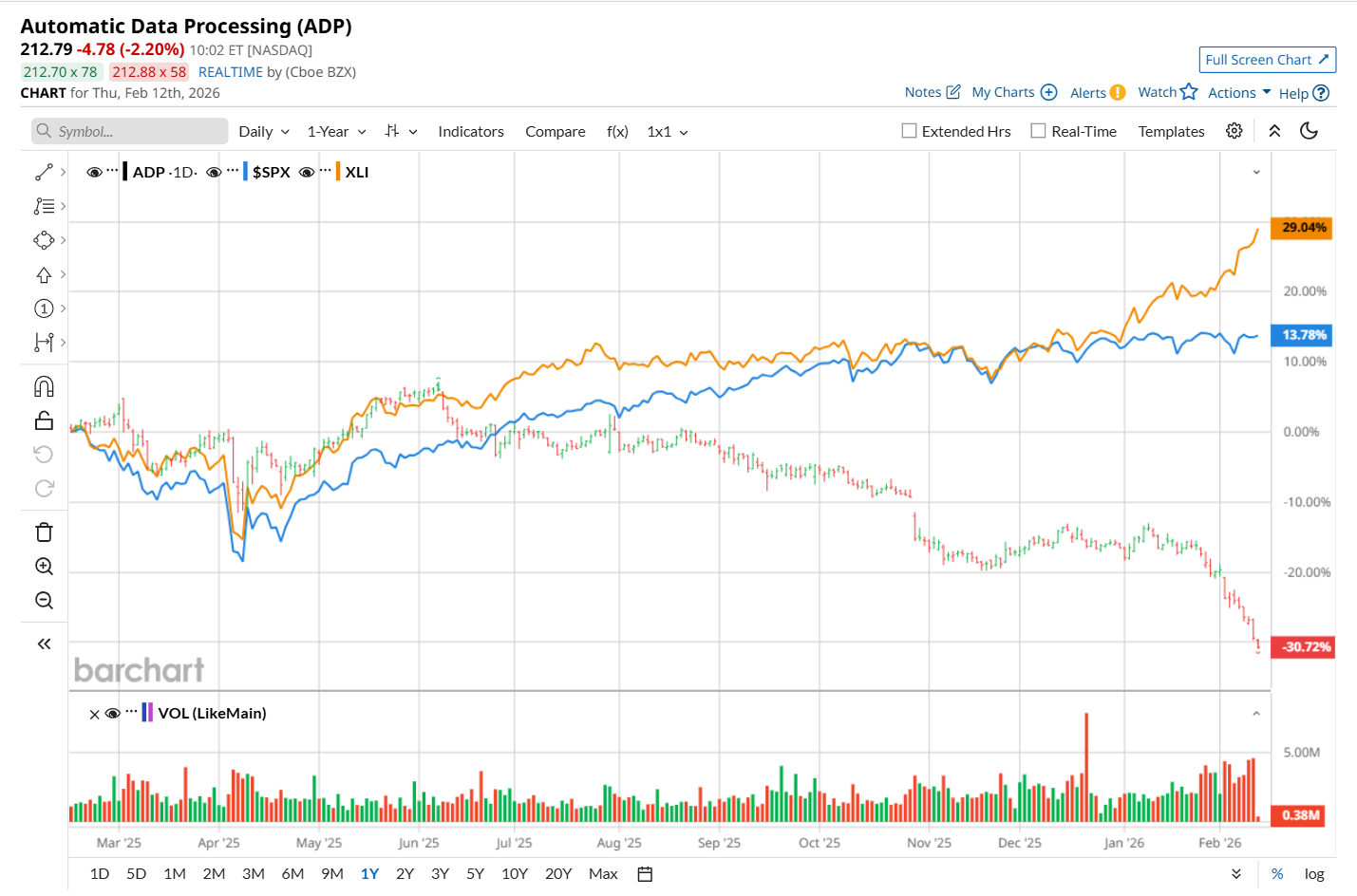

This HCM solutions provider has considerably underperformed the broader market over the past 52 weeks. Shares of ADP have declined 29.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.4%. Moreover, on a YTD basis, the stock is down 16%, compared to SPX’s 1.4% return.

Narrowing the focus, ADP has also notably lagged behind the State Street Industrial Select Sector SPDR ETF (XLI), which surged 28.9% over the past 52 weeks and 14.5% on a YTD basis.

Shares of ADP dipped 1.5% on Jan. 28, after its mixed Q2 earnings release. The company’s total revenue increased 6.2% year-over-year to $5.4 billion, but missed Wall Street expectations by a slight margin, which might have made investors jittery. However, on the upside, its adjusted EPS advanced 11.5% from the year-ago quarter to $2.62, surpassing consensus estimates of $2.58. Moreover, ADP raised its fiscal 2026 revenue and adjusted EPS growth guidance.

For fiscal 2026, ending in June, analysts expect ADP’s EPS to grow 9.5% year-over-year to $10.96. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

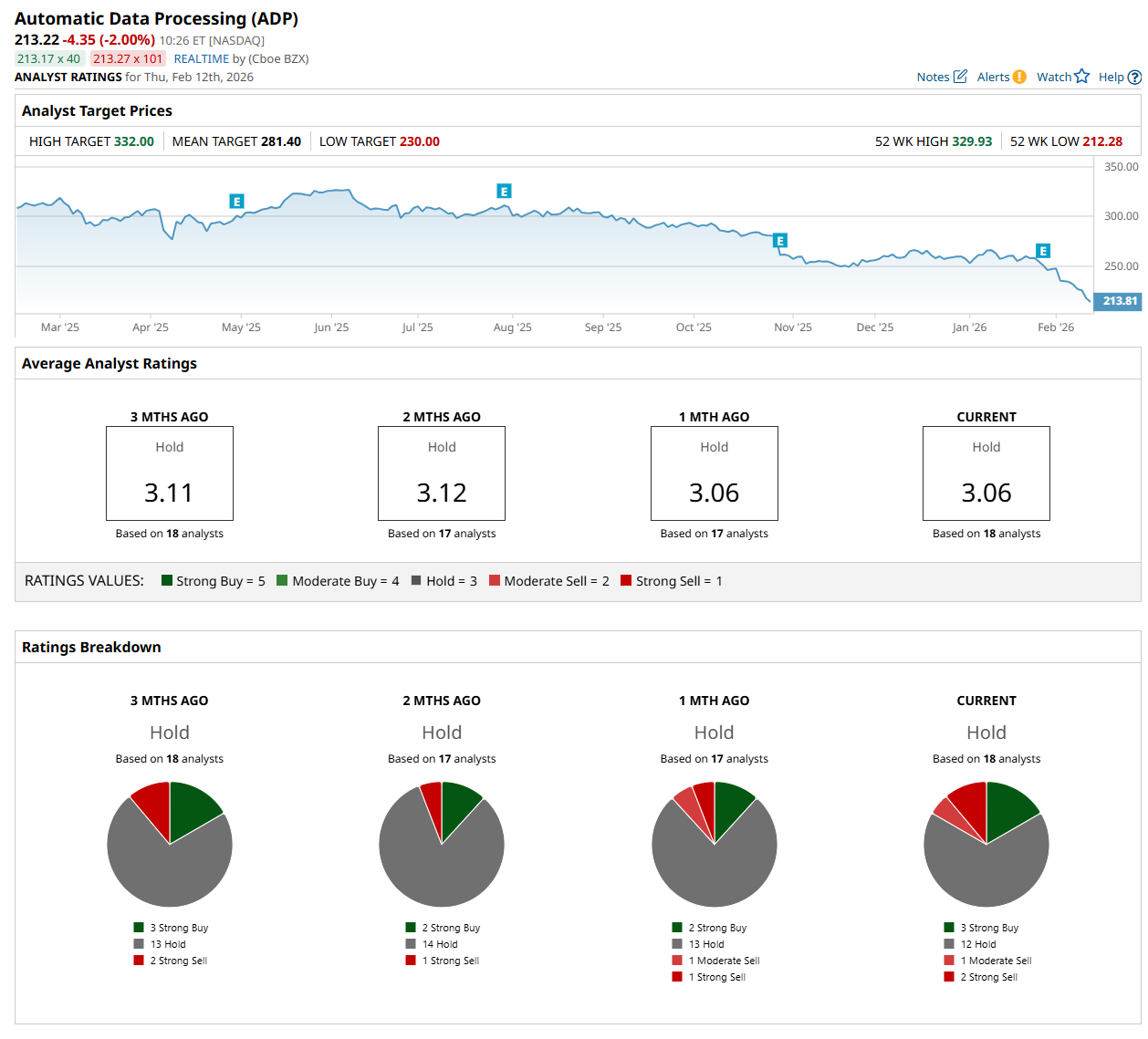

Among the 18 analysts covering the stock, the consensus rating is a "Hold,” which is based on three “Strong Buy,” 12 “Hold,” one "Moderate Sell,” and two “Strong Sell” ratings.

The configuration has changed since a month ago, with two analysts suggesting a “Strong Buy” rating and one recommending a “Strong Sell.”

On Feb. 9, Stifel Financial Corp. (SF) analyst David Grossman maintained a “Hold" rating on ADP and lowered its price target to $270, indicating a 26.6% potential upside from the current levels.

The mean price target of $281.40 represents a 32% premium to its current price, while its Street-high price target of $332 suggests an ambitious 55.7% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What Does Alphabet’s $31.5 Billion Bond Sale Really Mean for GOOGL Stock Investors?

- As Salesforce Acquires AI Startup Cimulate, Should You Buy, Sell, or Hold CRM Stock?

- Investors in Search of Alpha Are Fleeing Tech Stocks for These 3 High-Yield Sectors Instead

- 200 Years Later, This Stock Is Still Setting New All-Time Highs