If you believe that a stock is going to fall lower in price, then there are three kinds of options trades you can make to capitalize on the move potentially. You don't necessarily have to be a bear or a short seller to believe a stock has room to fall.

You may feel the market is too toppy at the moment and is ready for a pullback, or perhaps you may want to hedge a stock position in your portfolio. There are many reasons why you would want or expect a stock price to fall.

Using put options contracts

A put option can be bought or taken long if you think a stock will fall lower. By owning a put option, you have the right, but not the obligation, to sell a stock at a selected strike price by the expiration date. For example, if you have a $50 put option on XYZ, the value of the option rises as XYZ falls below $50. It can act as insurance if you are long XYZ or a directional trade if you are looking to sell the option at a higher price for a profit.

Put option contacts enable you to potentially capitalize on the sell-off for a fraction of the cost of short-selling the stock. Put options also limit your maximum losses, whereas a short position can experience a short squeeze for unlimited losses if the stock rallies. In this article, we’ll review three ways to trade options for a stock you think will fall lower in price.

While the methods described use one contract as an example, you can implement many contracts depending on how many shares of the underlying stock you are targeting in increments of 1 contract per 100 shares in any stock sector. .

Identify support and resistance levels.

Before making any trade, it pays to do your technical analysis preparation ahead of time on the underlying stock. This means being aware of the trend, support and resistance levels as well as any chart pattern set-ups that may be forming.

We’re going to use Intel Co. (NASDAQ: INTC) for examples for each type of options trade. The daily candlestick chart on INTC illustrates a golden cross breakout uptrend pattern with a rising 50-period moving average support at $42.27 and 200-period moving average support at $35.31. INTC peaked at $51.28 on Dec. 27, 2023, following nine higher candle body highs. The lower high candle formed a market structure high (MSH) sell trigger before $49.77 on Dec. 29, 2023.

The daily relative strength index (RSI) fell back below the overbought 70-band, stretching down through the 60-band. The range of pullback support levels is at $45.92, $43.26, $42.26, $41.17, $39.19, and $35.31 daily 200-period moving average. The momentum is to the downside while the golden cross uptrend is still intact. INTC is trading around $47.62 on Jan. 3, 2024. We will use the Feb. 2, 2024, expiration, which is 30 days away. With this information, we can consider three types of put option trades based on risk.

1) Buy an out-of-the-money (OTM) put contract.

This is the simplest but the highest-risk option trade. This is a trade where the probability is the lowest, and the chance of losing all your investment is higher. It's speculation bordering on gambling akin to a scratch-off lottery ticket in the short term. An out-of-the-money (OTM) contract means it has no intrinsic value.

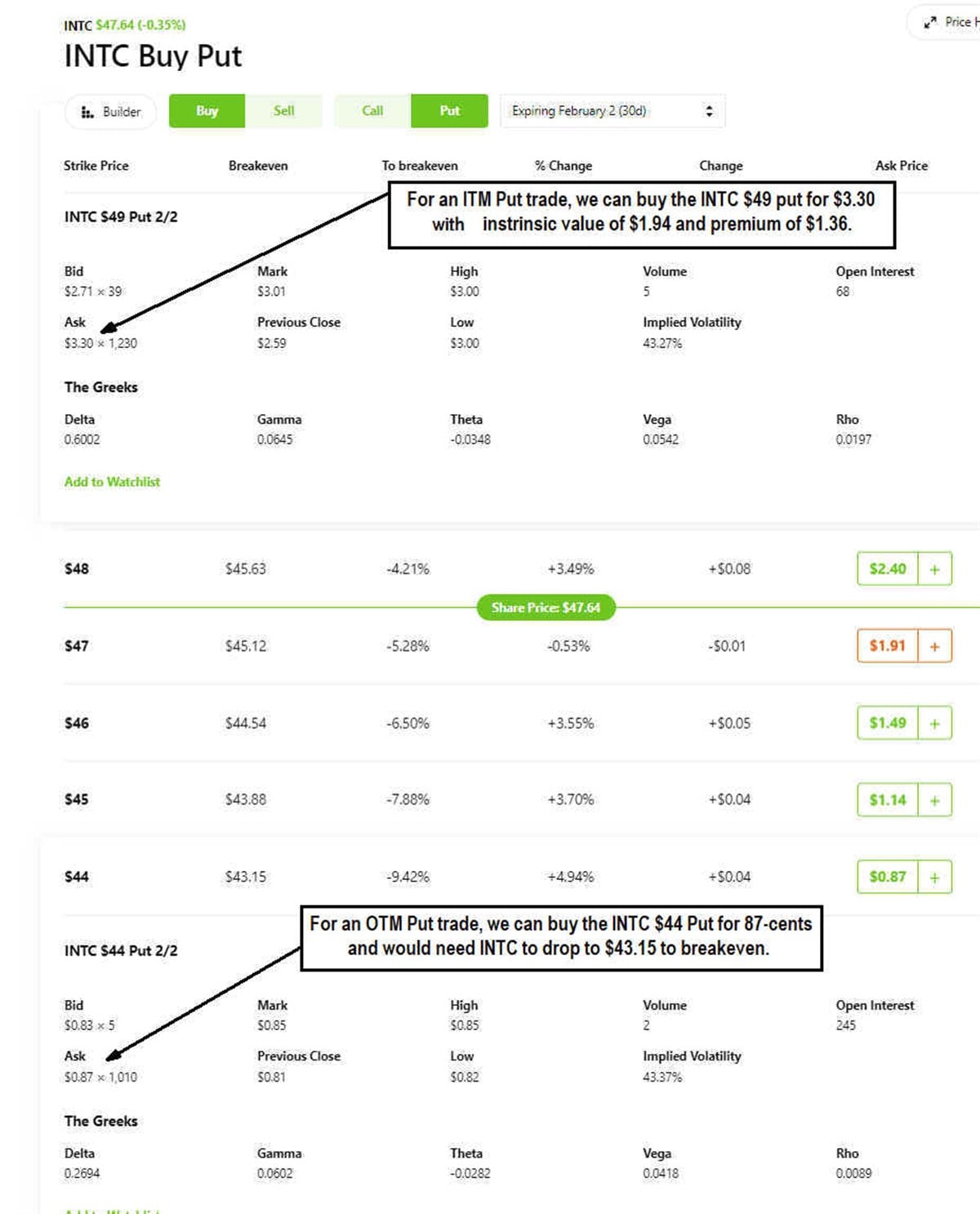

Since INTC is trading at $47.65, any contract priced above $47.65 is an OTM put. The put prices get cheaper as the strike price gets lower below where INTC is currently trading. The probabilities also drop. Assuming we expect INTC to fall towards the $43.92 to the $39.19 support level, we can select to buy the $44 put contract that expires on Feb. 2, 2024, for 87 cents. INTC would need to fall to $43.13 to break even on the trade. It’s possible to lose 100% of the trade if INTC closes above $43.13 on expiration.

2) Buy an in-the-money (ITM) put contract.

This trade costs the most, but that’s because it has intrinsic value since you will be buying a put that’s higher than the current price of INTC. If we bought the $49 put contract at $3.30 when INTC was trading at $47.65, the put is already $1.35 in the money (ITM) which is the intrinsic value. The other $1.95 is premium.

The break even stock price would be $45.70 on the $49 put contract. If it drops any further, then it becomes profitable. This trade is less risky because you are starting ITM, but that doesn't guarantee it will still be in ITM by the expiration.

3) Buy a bear put debit spread.

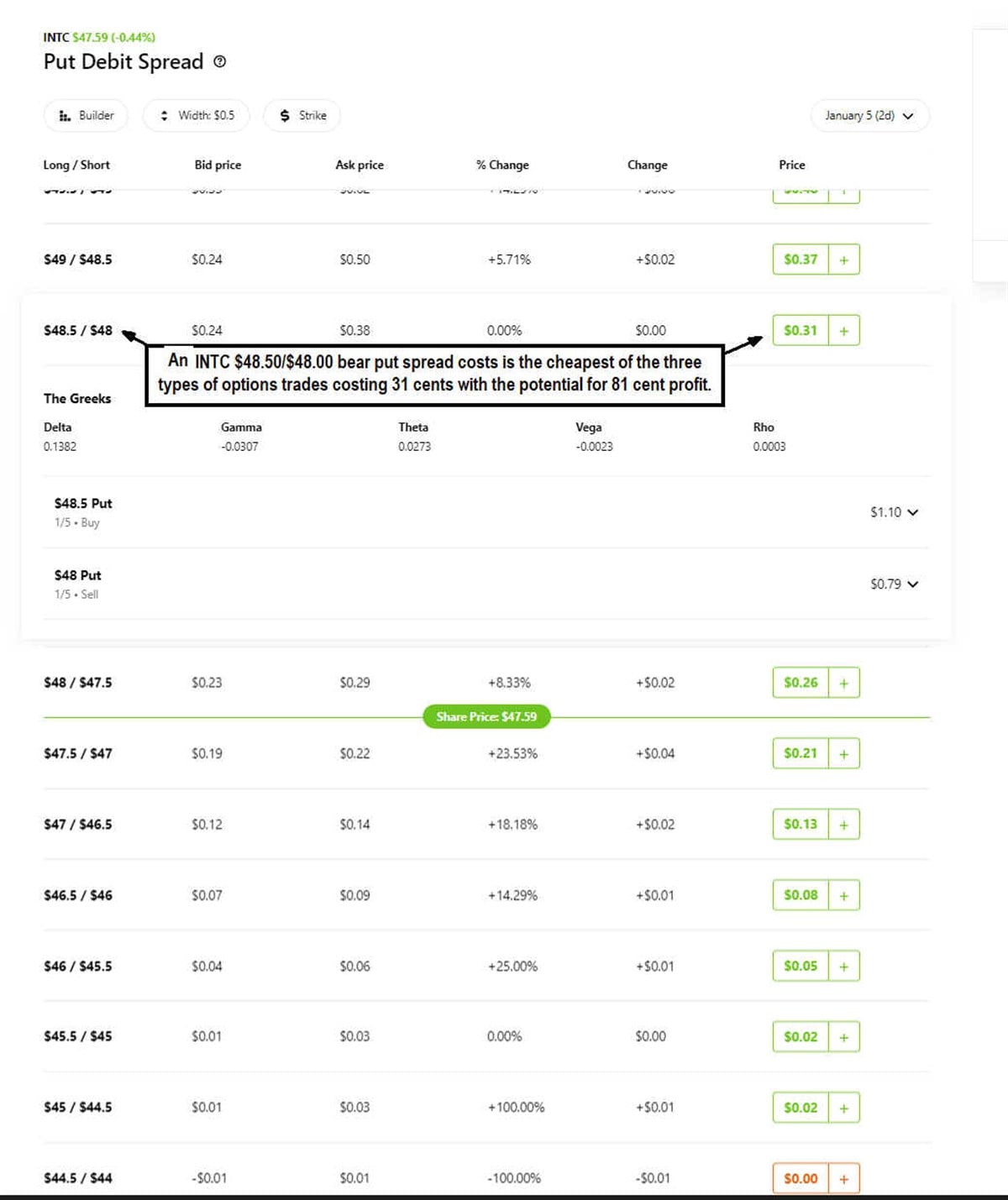

You are also referred to as a bear put spread. This is the more complicated trade, but it costs less and is the least risky if you are willing to cap your upside. It's just like buying an ITM put at a premium but selling a lower strike price put to cut down the price of the trade but limit your max profit.

Buying the $48.50 put at $1.10, while INTC is trading at $47.59, and selling the $48 put at 79 cents results in a cost of 31 cents for the trade. Rather than doing this manually, check your broker for the ability to execute debit spreads in a single trade. A bear put debit spread is the opposite of a bull call debit spread.

If INTC stock falls under $48 by options expiration, then the max gain is 81 cents, comprised of the 31-cent cost of the trade and the 50-cent spread. If INTC closes above $48.50 upon expiration, then the max loss is the 31-cent cost of the trade. There are variations of this where you can use a wider spread and sell the OTM put for the potential for a larger max profit, which is comprised of the premium and spread.

Conclusion

While the examples assume you hold the put contracts through expiration, you can always look to take profits or cut losses before expiration. The breakeven prices only apply to the closing price upon options expiration. Remember that time value (theta) and volatility are the key components of extrinsic value and premium.

Directional options players will want a fast (and large) move in the shortest period to keep time decay and volatility slippage to a minimum.