Marine infrastructure company Orion (NYSE: ORN) met Wall Street’s revenue expectations in Q3 CY2025, but sales were flat year on year at $225.1 million. The company’s full-year revenue guidance of $842.5 million at the midpoint came in 1.6% above analysts’ estimates. Its non-GAAP profit of $0.09 per share was 50% above analysts’ consensus estimates.

Is now the time to buy Orion? Find out by accessing our full research report, it’s free for active Edge members.

Orion (ORN) Q3 CY2025 Highlights:

- Revenue: $225.1 million vs analyst estimates of $225.3 million (flat year on year, in line)

- Adjusted EPS: $0.09 vs analyst estimates of $0.06 (3c beat)

- Adjusted EBITDA: $13.13 million vs analyst estimates of $13.19 million (5.8% margin, in line)

- The company lifted its revenue guidance for the full year to $842.5 million at the midpoint from $825 million, a 2.1% increase

- Management raised its full-year Adjusted EPS guidance to $0.20 at the midpoint, a 42.9% increase

- EBITDA guidance for the full year is $45 million at the midpoint, above analyst estimates of $44.37 million

- Operating Margin: 2.4%, in line with the same quarter last year

- Free Cash Flow was -$2.08 million, down from $33.31 million in the same quarter last year

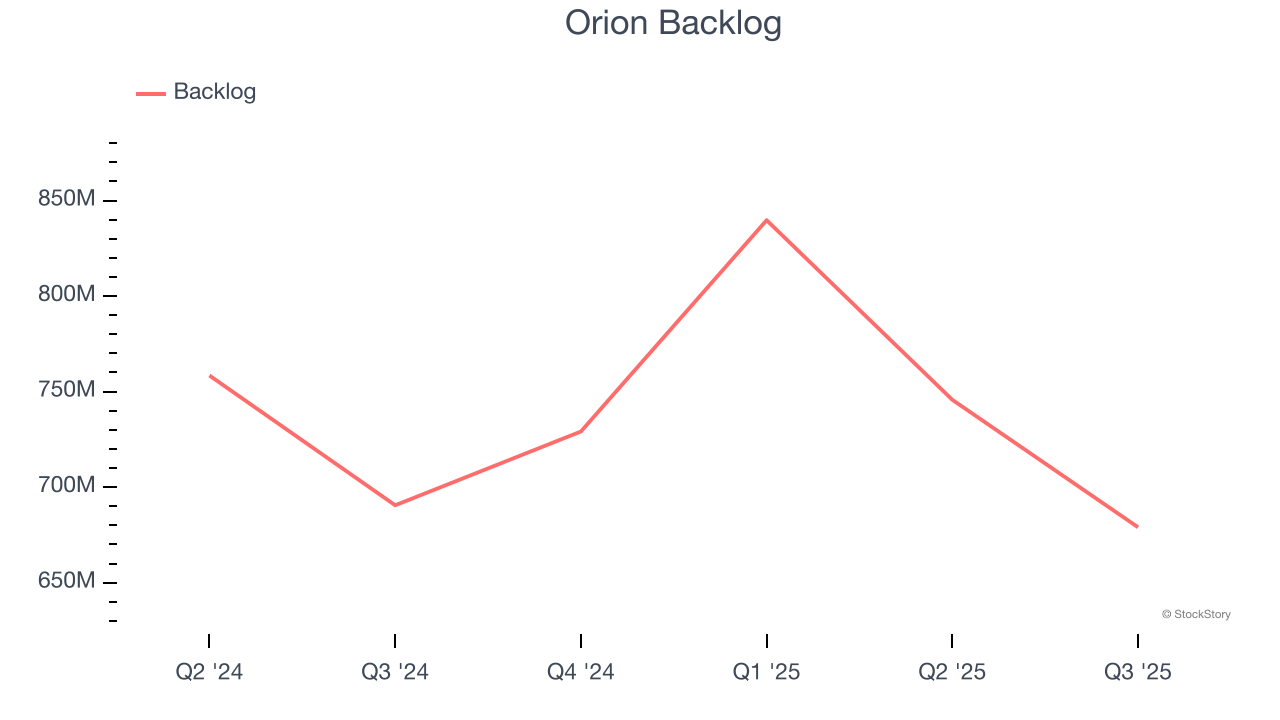

- Backlog: $679 million at quarter end, down 1.7% year on year

- Market Capitalization: $346.1 million

“We delivered another strong third quarter marked by top- and bottom-line results, robust cash generation, good bookings, and market-leading safety. We have also continued to advance strategic priorities, including expanding our bonding capacity by $400 million, continuing to strengthen our board with the appointment of Robert Ledford, and closing the sale of the East and West Jones property in October. With a strong balance sheet, disciplined capital deployment strategy, and focus on long-term strategic execution, our team is laying the foundation for Orion’s next phase of growth,” said Travis Boone, President and Chief Executive Officer of Orion Group Holdings.

Company Overview

Established in 1994, Orion (NYSE: ORN) provides construction services for marine infrastructure and industrial projects.

Revenue Growth

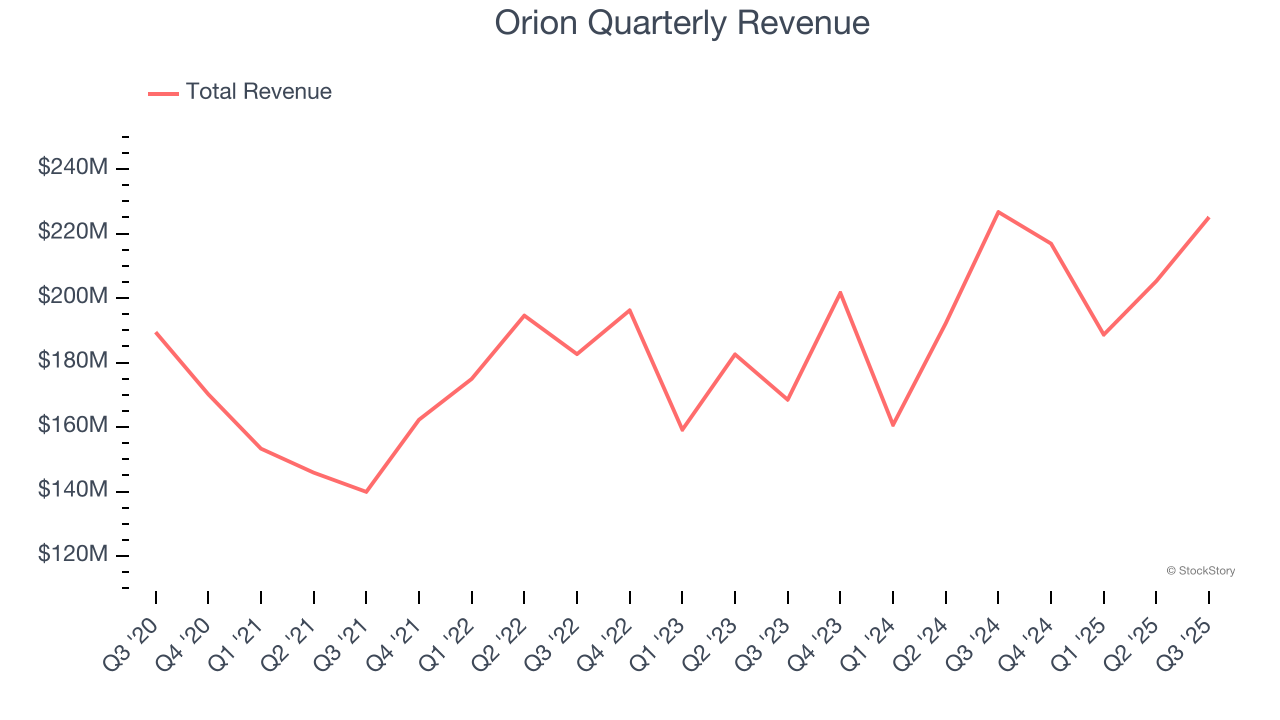

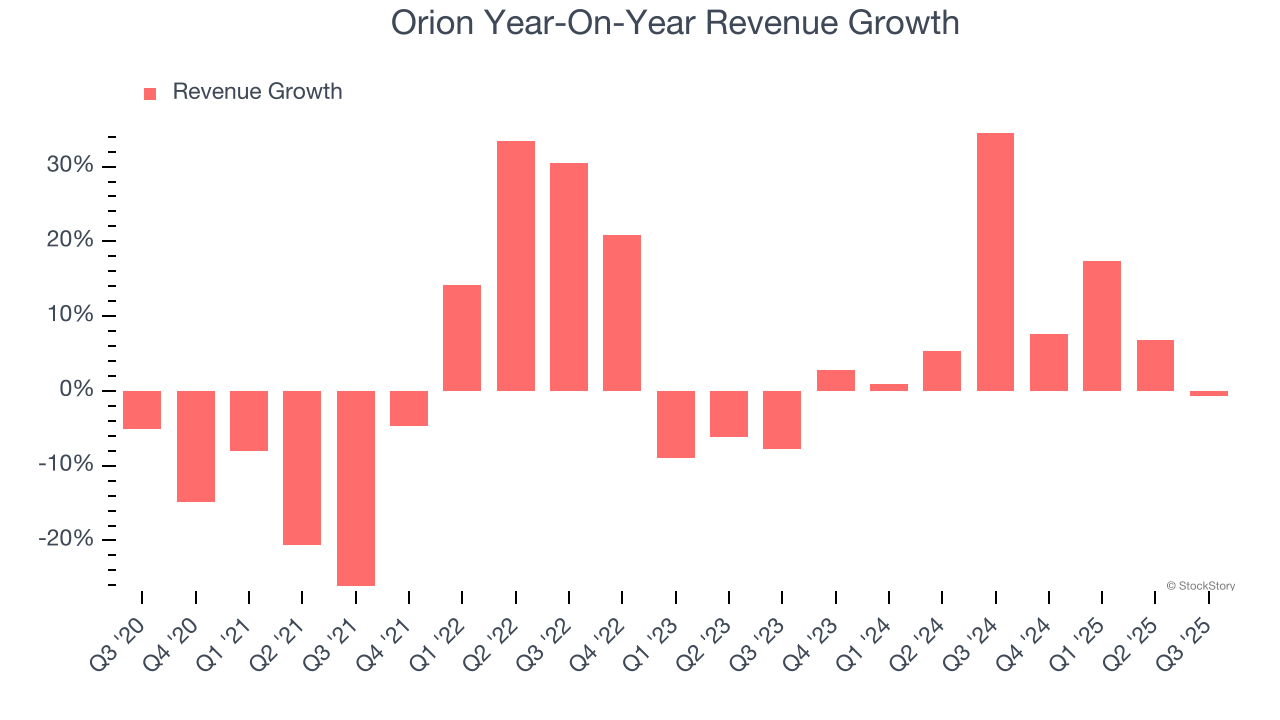

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Orion’s 2.5% annualized revenue growth over the last five years was sluggish. This was below our standards and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Orion’s annualized revenue growth of 8.8% over the last two years is above its five-year trend, suggesting some bright spots.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Orion’s backlog reached $679 million in the latest quarter and averaged 1.7% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Orion was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Orion’s $225.1 million of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

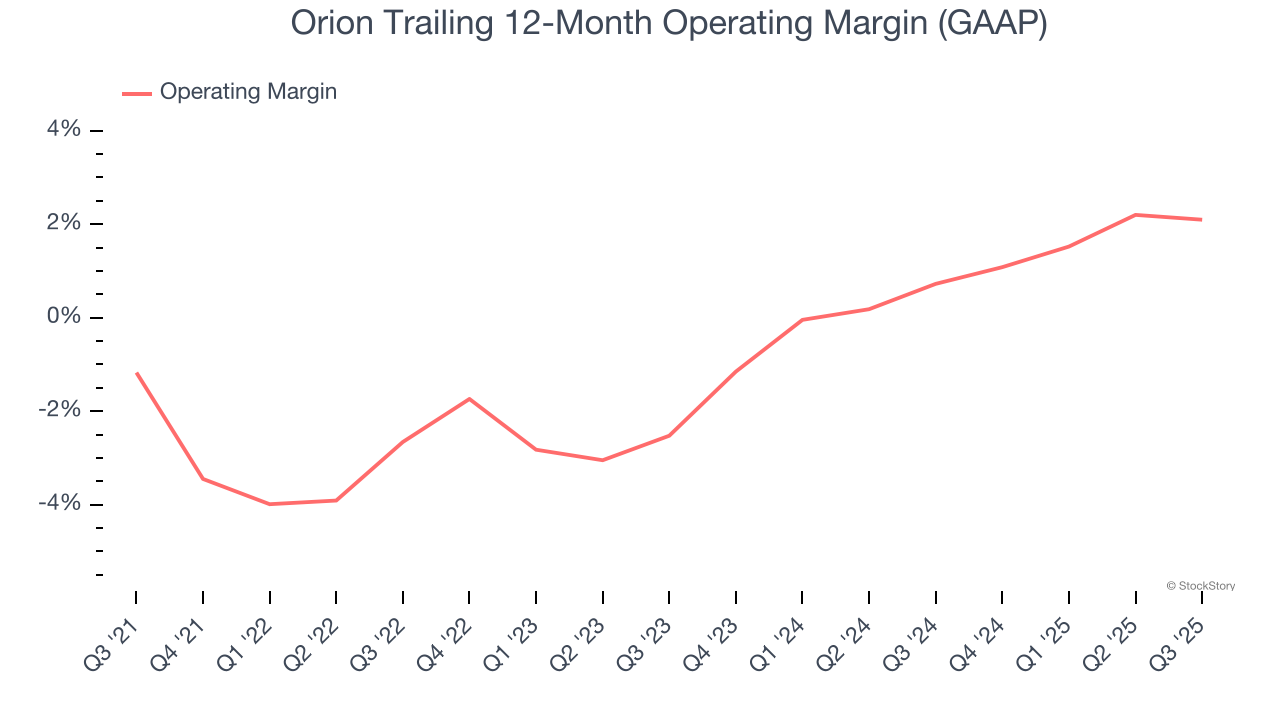

Orion was roughly breakeven when averaging the last five years of quarterly operating profits, one of the worst outcomes in the industrials sector. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Orion’s operating margin rose by 3.3 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Orion generated an operating margin profit margin of 2.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

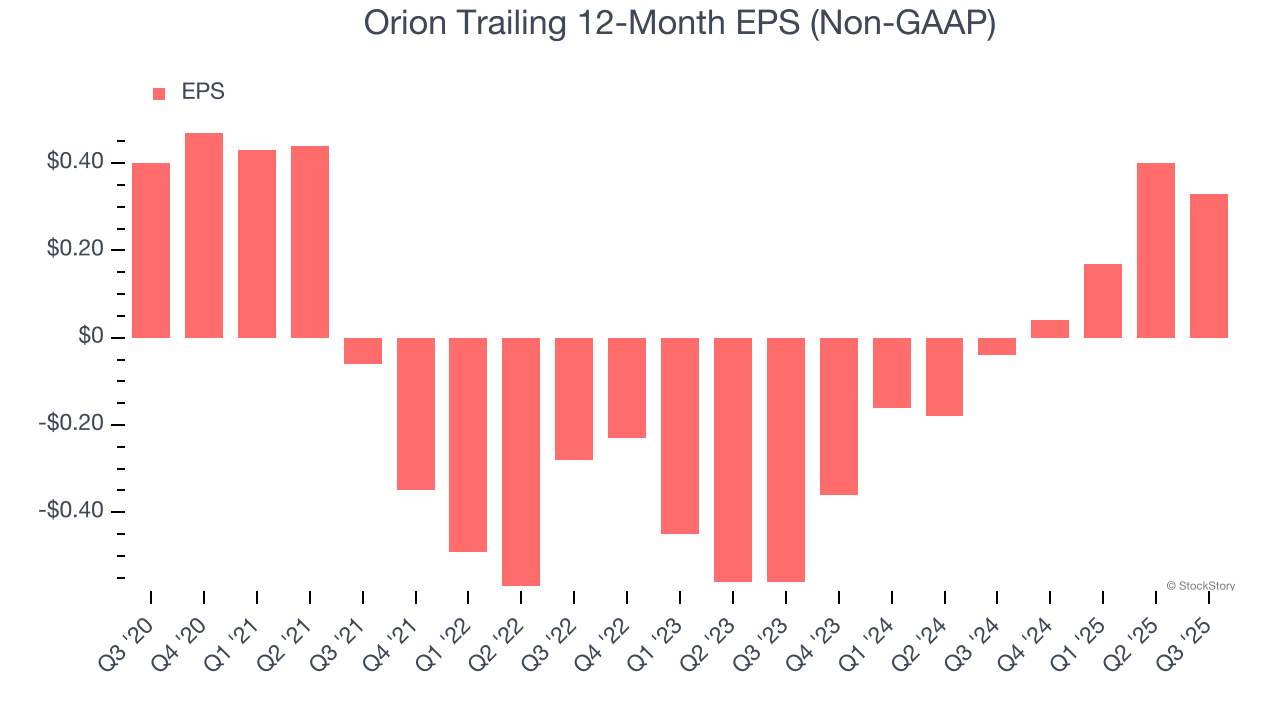

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

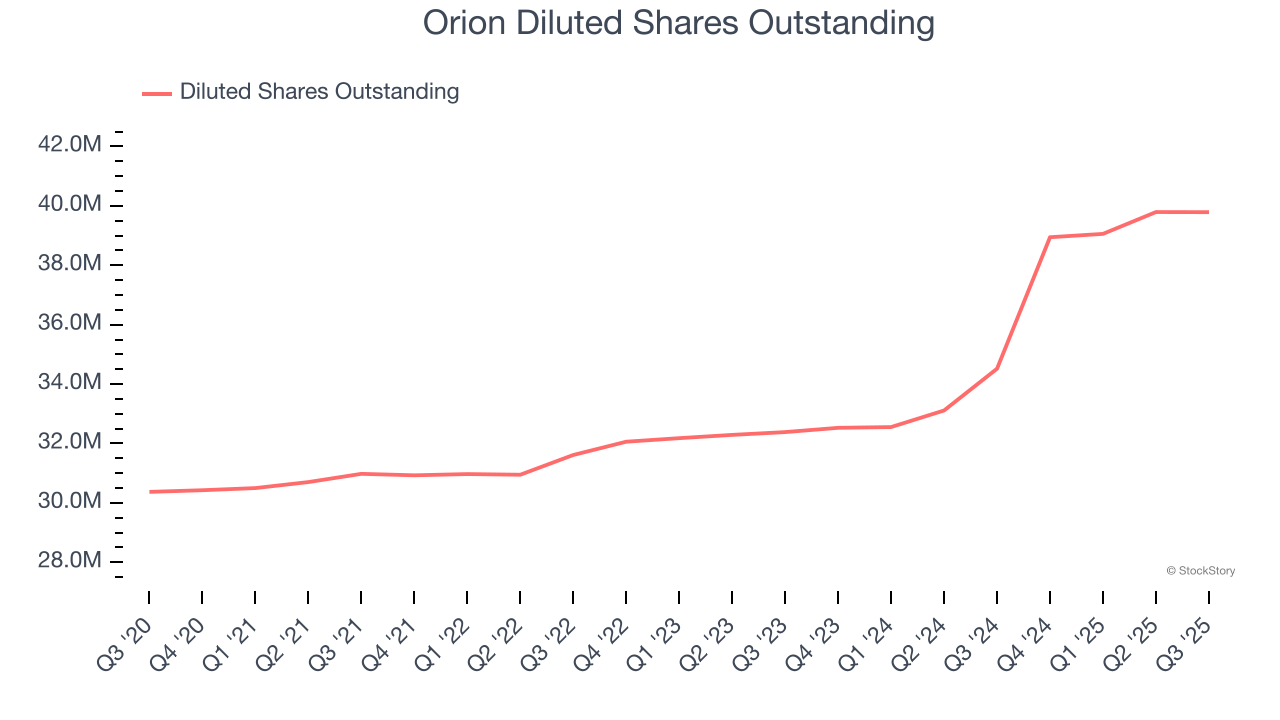

Sadly for Orion, its EPS declined by 3.8% annually over the last five years while its revenue grew by 2.5%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

We can take a deeper look into Orion’s earnings to better understand the drivers of its performance. A five-year view shows Orion has diluted its shareholders, growing its share count by 31%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Orion, its two-year annual EPS growth of 60.9% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q3, Orion reported adjusted EPS of $0.09, down from $0.16 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Orion’s full-year EPS of $0.33 to shrink by 31.3%.

Key Takeaways from Orion’s Q3 Results

It was good to see Orion beat analysts’ EPS expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 2.8% to $8.89 immediately following the results.

Orion had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.