Electrical energy control systems manufacturer Powell (NYSE: POWL) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 8.3% year on year to $298 million. Its GAAP profit of $4.22 per share was 12.2% above analysts’ consensus estimates.

Is now the time to buy Powell? Find out by accessing our full research report, it’s free for active Edge members.

Powell (POWL) Q3 CY2025 Highlights:

- Revenue: $298 million vs analyst estimates of $292.8 million (8.3% year-on-year growth, 1.8% beat)

- EPS (GAAP): $4.22 vs analyst estimates of $3.76 (12.2% beat)

- Adjusted EBITDA: $65.3 million vs analyst estimates of $59.32 million (21.9% margin, 10.1% beat)

- Operating Margin: 21.2%, in line with the same quarter last year

- Free Cash Flow was -$1.77 million compared to -$14.45 million in the same quarter last year

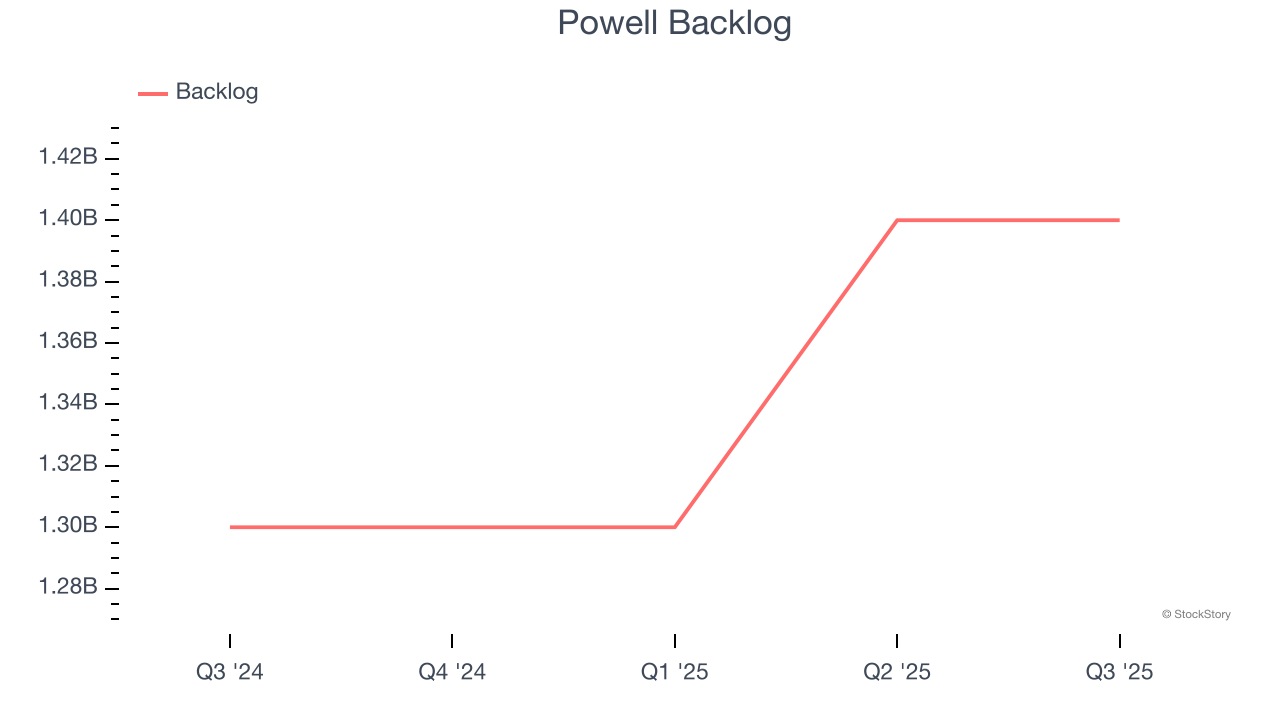

- Backlog: $1.4 billion at quarter end, up 7.7% year on year

- Market Capitalization: $3.84 billion

Brett A. Cope, Powell’s Chairman and Chief Executive Officer, stated, “Our fourth quarter marked a solid finish to another record year for Powell. We delivered gross profit dollar growth of 16% on revenue growth of 8%, which is a testament to the ongoing high levels of execution across our manufacturing footprint. This culminated in record quarterly earnings per share of $4.22. Our order intake of $271 million was well-balanced across markets and the commercial momentum continues as we enter Fiscal 2026. We also closed our acquisition of Remsdaq, which will allow us to scale a highly competitive and margin-accretive electrical automation solution to meet a growing and underserved demand in the markets where we compete. I’d like to thank the entire Powell team for their commitment to our customers and for another incredible year, helping to further our unique position as a supplier of critical electrical distribution solutions to a growing array of applications.”

Company Overview

Originally a metal-working shop supporting local petrochemical facilities, Powell (NYSE: POWL) has grown from a small Houston manufacturer to a global provider of electrical systems.

Revenue Growth

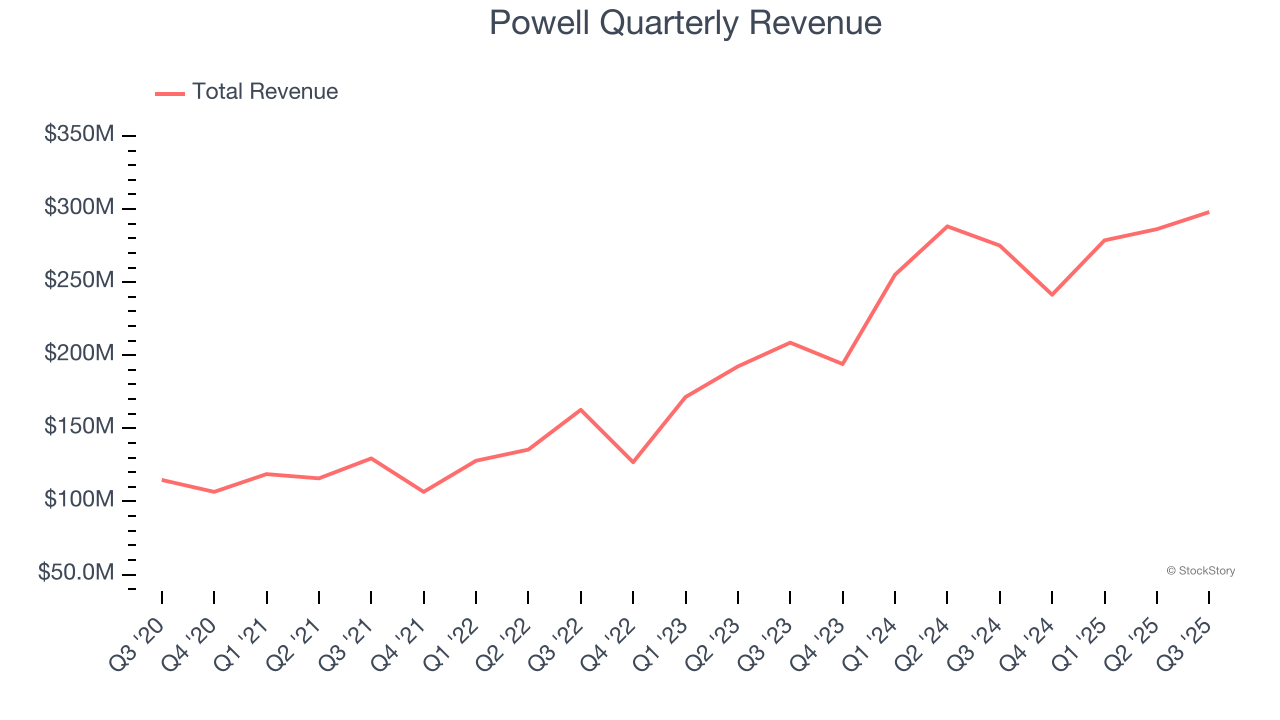

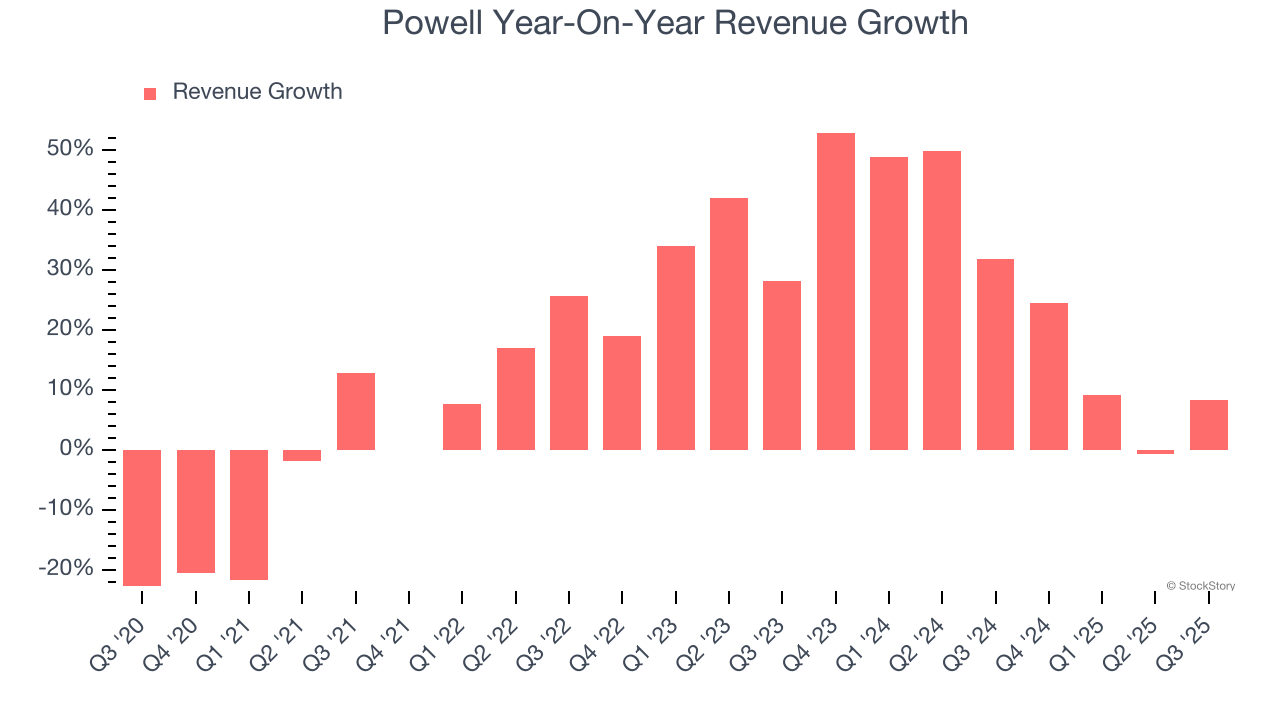

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Powell’s 16.3% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Powell’s annualized revenue growth of 25.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Powell’s backlog reached $1.4 billion in the latest quarter and averaged 7.7% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Powell was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Powell reported year-on-year revenue growth of 8.3%, and its $298 million of revenue exceeded Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 6.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

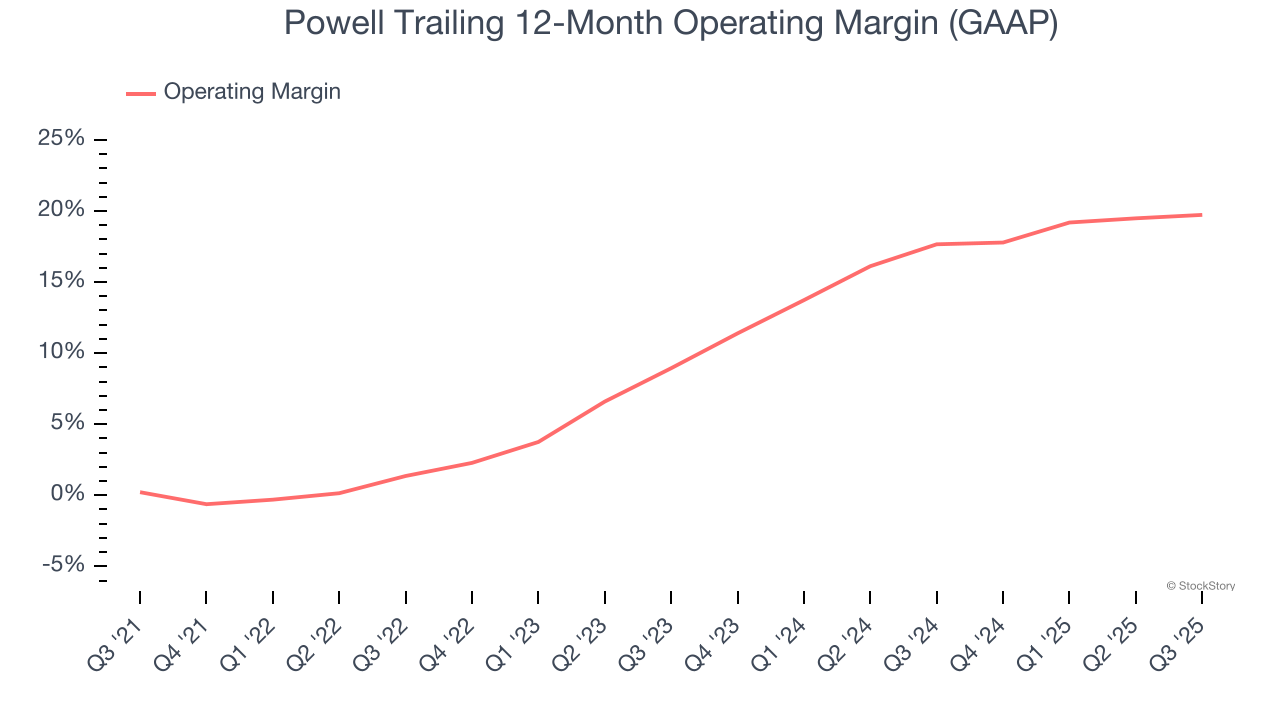

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Powell has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Powell’s operating margin rose by 19.5 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Powell generated an operating margin profit margin of 21.2%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

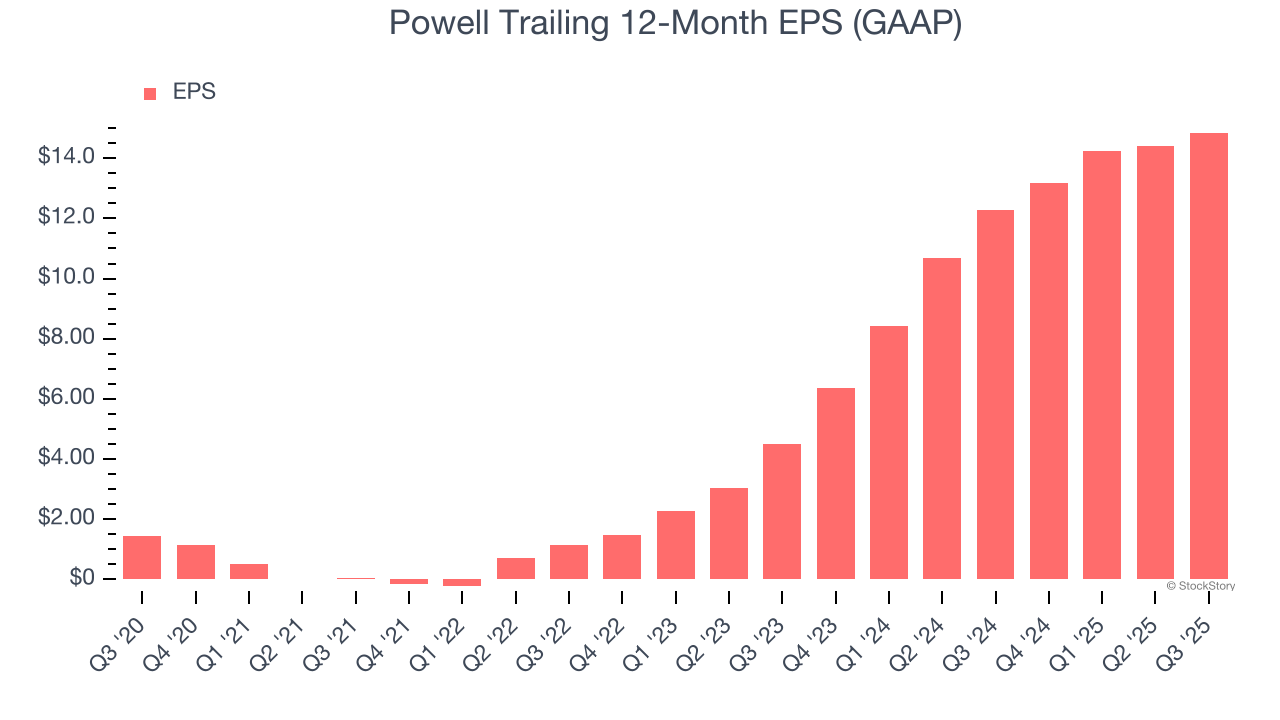

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Powell’s EPS grew at an astounding 59.7% compounded annual growth rate over the last five years, higher than its 16.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Powell’s earnings to better understand the drivers of its performance. As we mentioned earlier, Powell’s operating margin was flat this quarter but expanded by 19.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Powell, its two-year annual EPS growth of 81.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Powell reported EPS of $4.22, up from $3.77 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Powell’s full-year EPS of $14.85 to stay about the same.

Key Takeaways from Powell’s Q3 Results

We were impressed by how significantly Powell blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 4.1% to $335.04 immediately following the results.

Indeed, Powell had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.