Electronic measurement provider Keysight (NYSE: KEYS) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 10.3% year on year to $1.42 billion. On top of that, next quarter’s revenue guidance ($1.54 billion at the midpoint) was surprisingly good and 7.9% above what analysts were expecting. Its non-GAAP profit of $1.91 per share was 4.2% above analysts’ consensus estimates.

Is now the time to buy Keysight? Find out by accessing our full research report, it’s free for active Edge members.

Keysight (KEYS) Q3 CY2025 Highlights:

- Revenue: $1.42 billion vs analyst estimates of $1.38 billion (10.3% year-on-year growth, 2.5% beat)

- Adjusted EPS: $1.91 vs analyst estimates of $1.83 (4.2% beat)

- Revenue Guidance for Q4 CY2025 is $1.54 billion at the midpoint, above analyst estimates of $1.43 billion

- Adjusted EPS guidance for Q4 CY2025 is $1.98 at the midpoint, above analyst estimates of $1.84

- Operating Margin: 15.3%, down from 17.9% in the same quarter last year

- Free Cash Flow Margin: 13.2%, down from 24.9% in the same quarter last year

- Market Capitalization: $29.68 billion

Company Overview

Spun off from Hewlett-Packard in 2014, Keysight (NYSE: KEYS) offers electronic measurement products for use in various sectors.

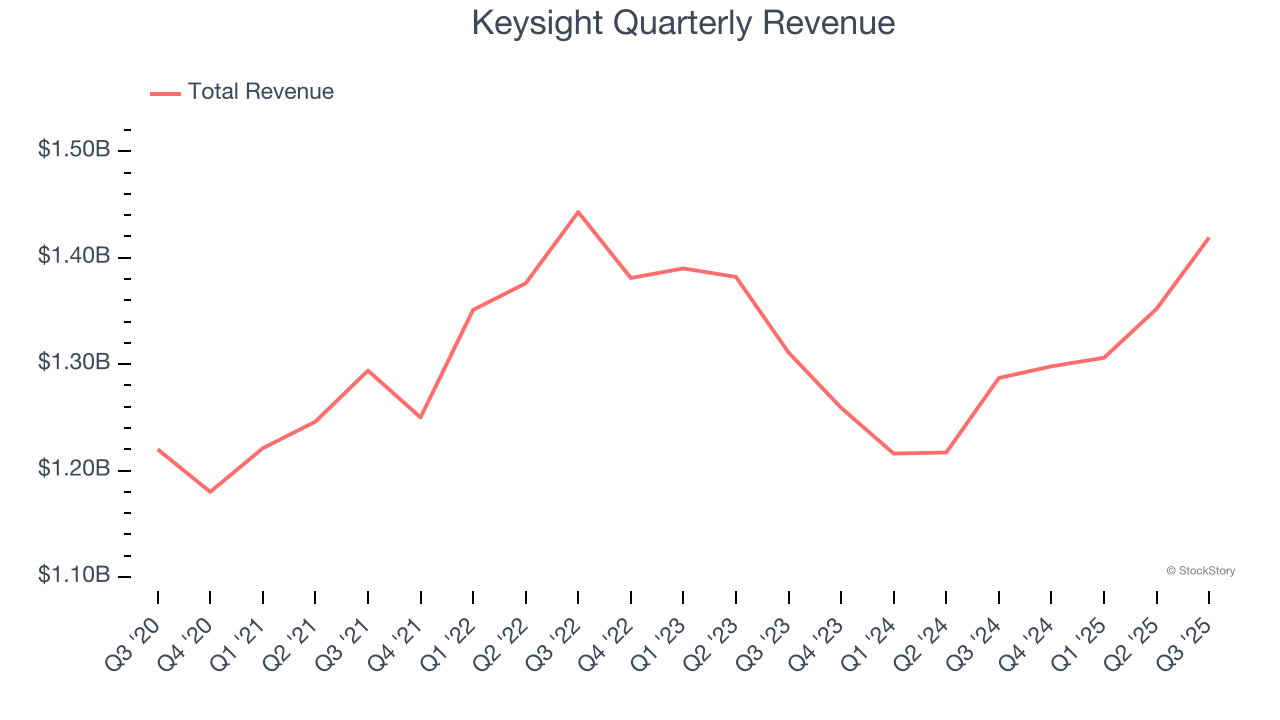

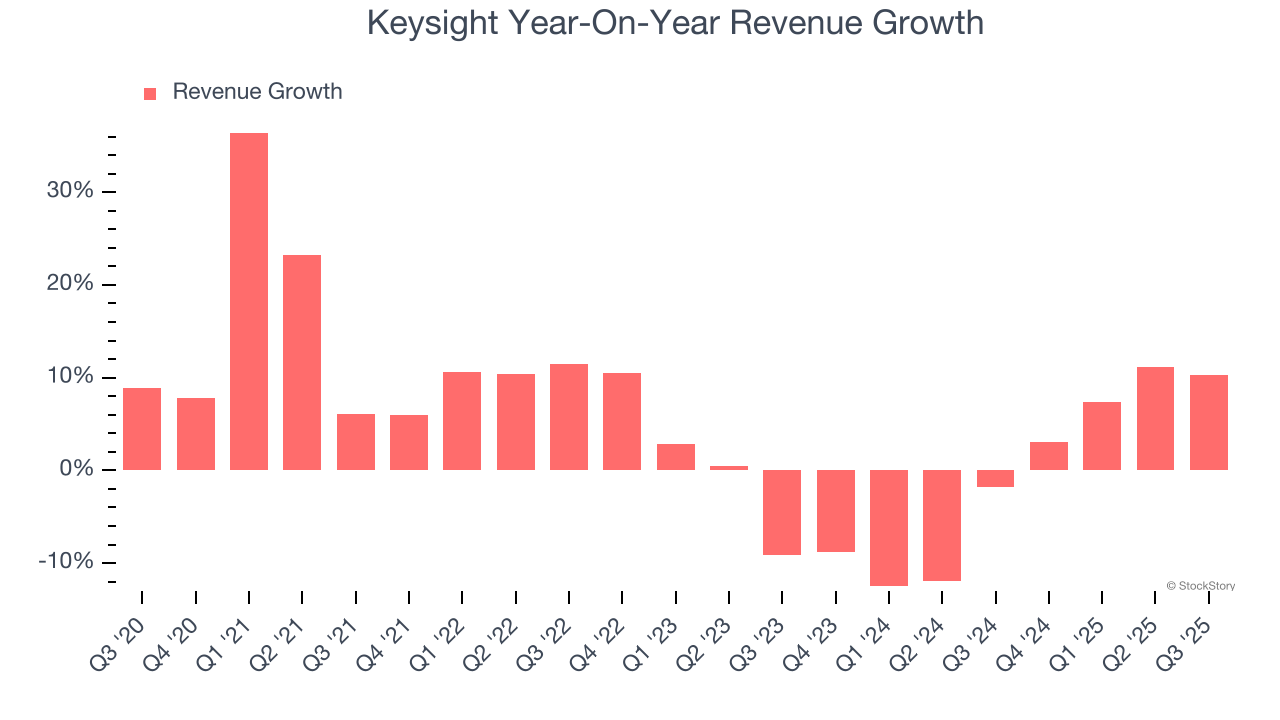

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Keysight’s 5% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Keysight’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Keysight reported year-on-year revenue growth of 10.3%, and its $1.42 billion of revenue exceeded Wall Street’s estimates by 2.5%. Company management is currently guiding for a 18.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will spur better top-line performance.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

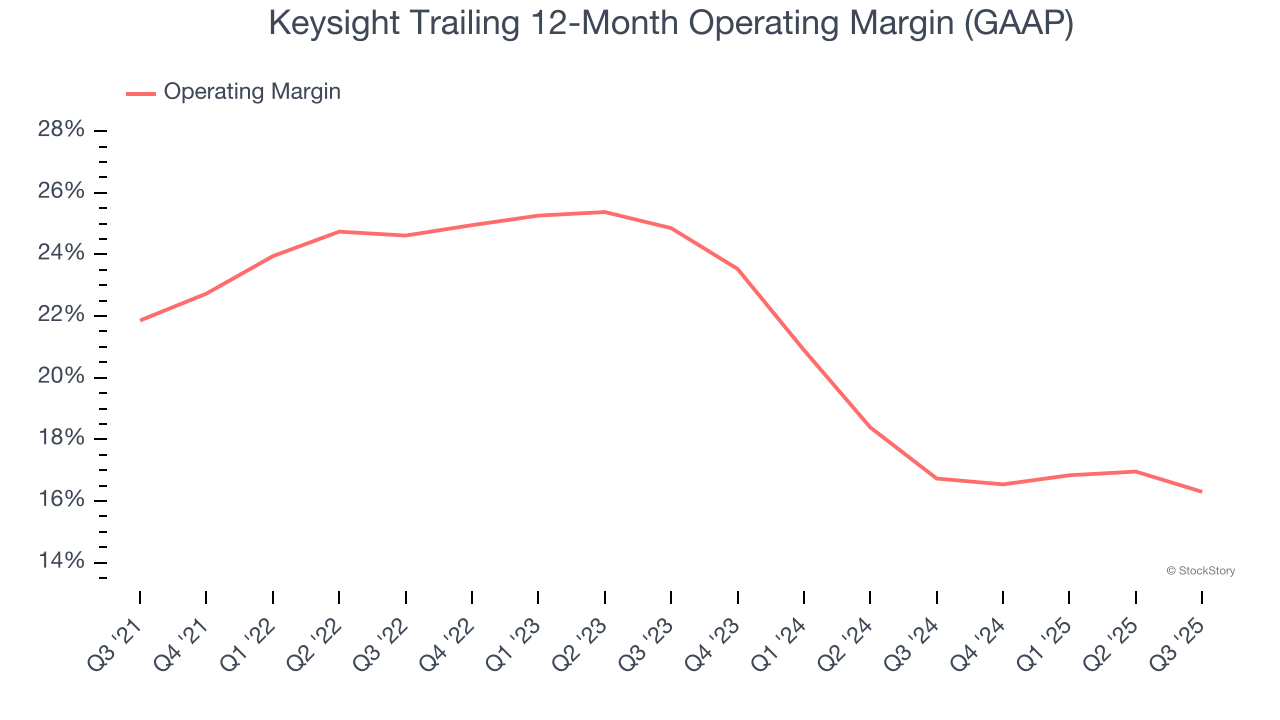

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Keysight has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 20.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Keysight’s operating margin decreased by 5.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Keysight generated an operating margin profit margin of 15.3%, down 2.6 percentage points year on year. Since Keysight’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

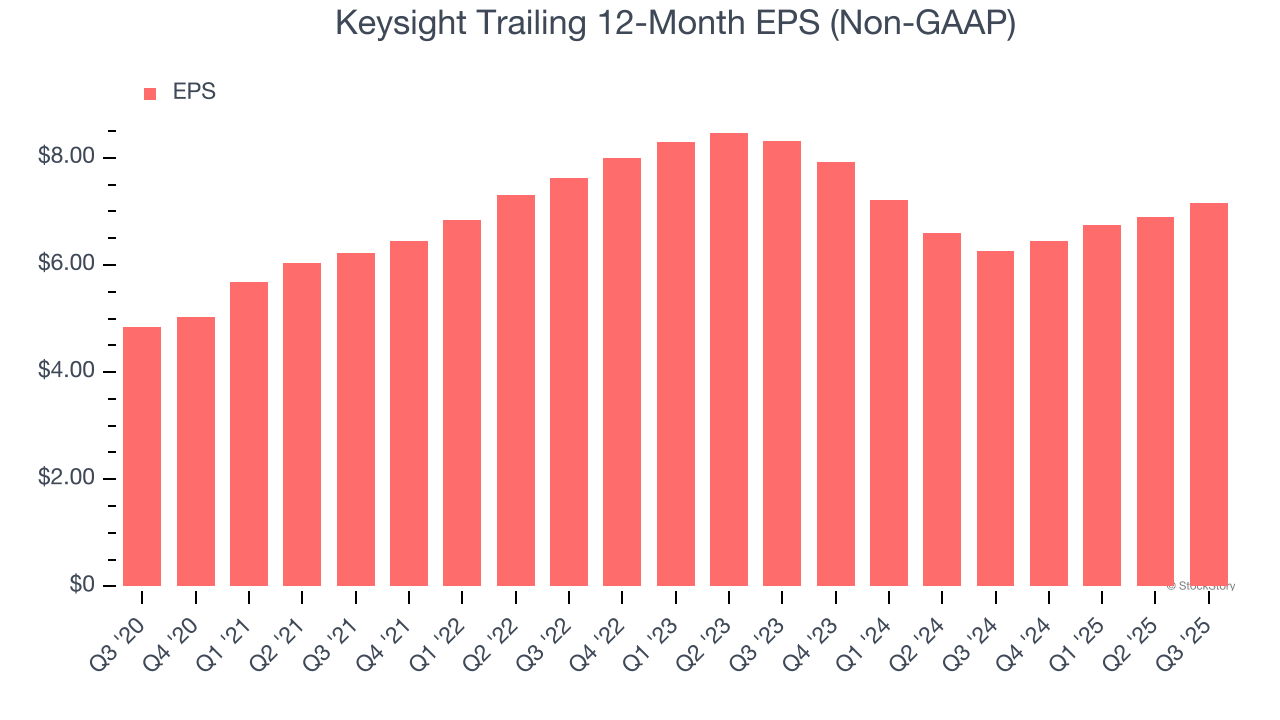

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Keysight’s EPS grew at a decent 8.1% compounded annual growth rate over the last five years, higher than its 5% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

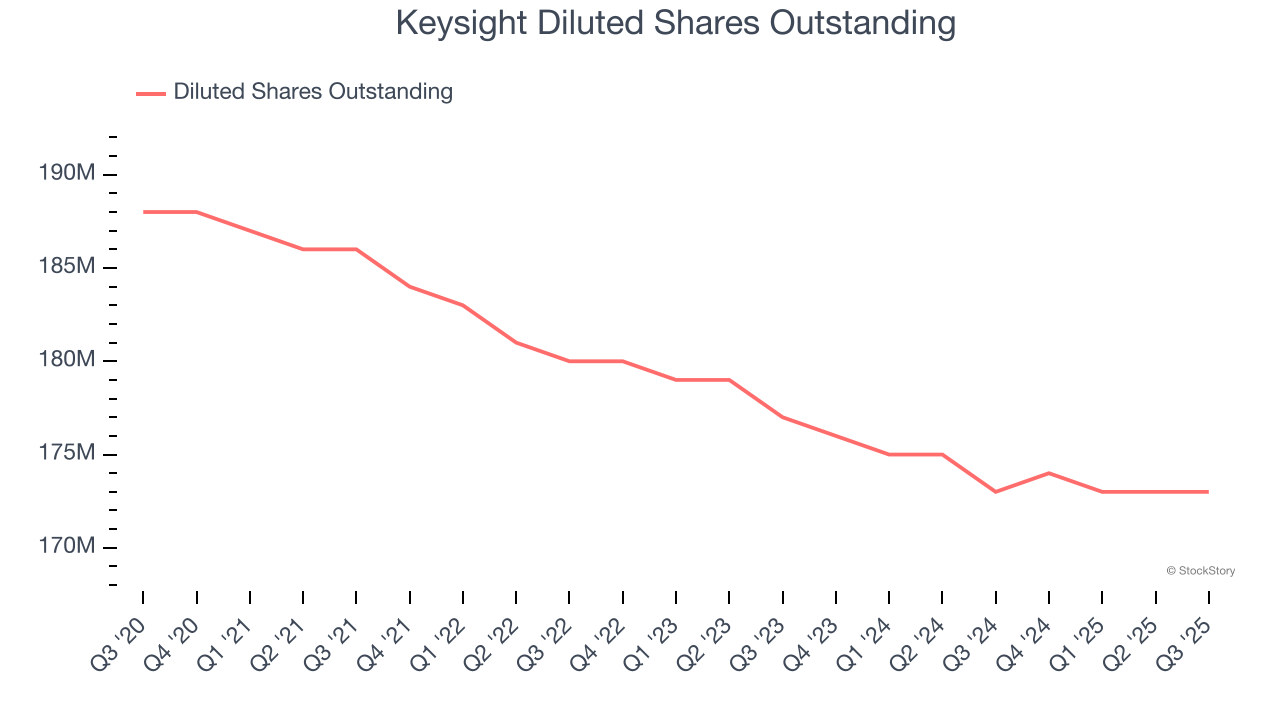

Diving into Keysight’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Keysight has repurchased its stock, shrinking its share count by 8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Keysight, its two-year annual EPS declines of 7.3% mark a reversal from its five-year trend. We hope Keysight can return to earnings growth in the future.

In Q3, Keysight reported adjusted EPS of $1.91, up from $1.65 in the same quarter last year. This print beat analysts’ estimates by 4.2%. Over the next 12 months, Wall Street expects Keysight’s full-year EPS of $7.15 to grow 9.1%.

Key Takeaways from Keysight’s Q3 Results

We were impressed by Keysight’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS guidance for next quarter exceeded Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 10.7% to $197.26 immediately after reporting.

Keysight had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.