Residential solar energy company Sunrun (NASDAQ: RUN) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 34.9% year on year to $724.6 million. Its GAAP profit of $0.06 per share was 58.2% below analysts’ consensus estimates.

Is now the time to buy Sunrun? Find out by accessing our full research report, it’s free for active Edge members.

Sunrun (RUN) Q3 CY2025 Highlights:

- Revenue: $724.6 million vs analyst estimates of $592 million (34.9% year-on-year growth, 22.4% beat)

- EPS (GAAP): $0.06 vs analyst expectations of $0.14 (58.2% miss)

- Adjusted EBITDA: $214.8 million vs analyst estimates of $74.77 million (29.6% margin, significant beat)

- Cash Generation guidance for 2025: $350 million midpoint reiterated

- Operating Margin: 0.5%, up from -23.8% in the same quarter last year

- Free Cash Flow was -$865.2 million compared to -$156.4 million in the same quarter last year

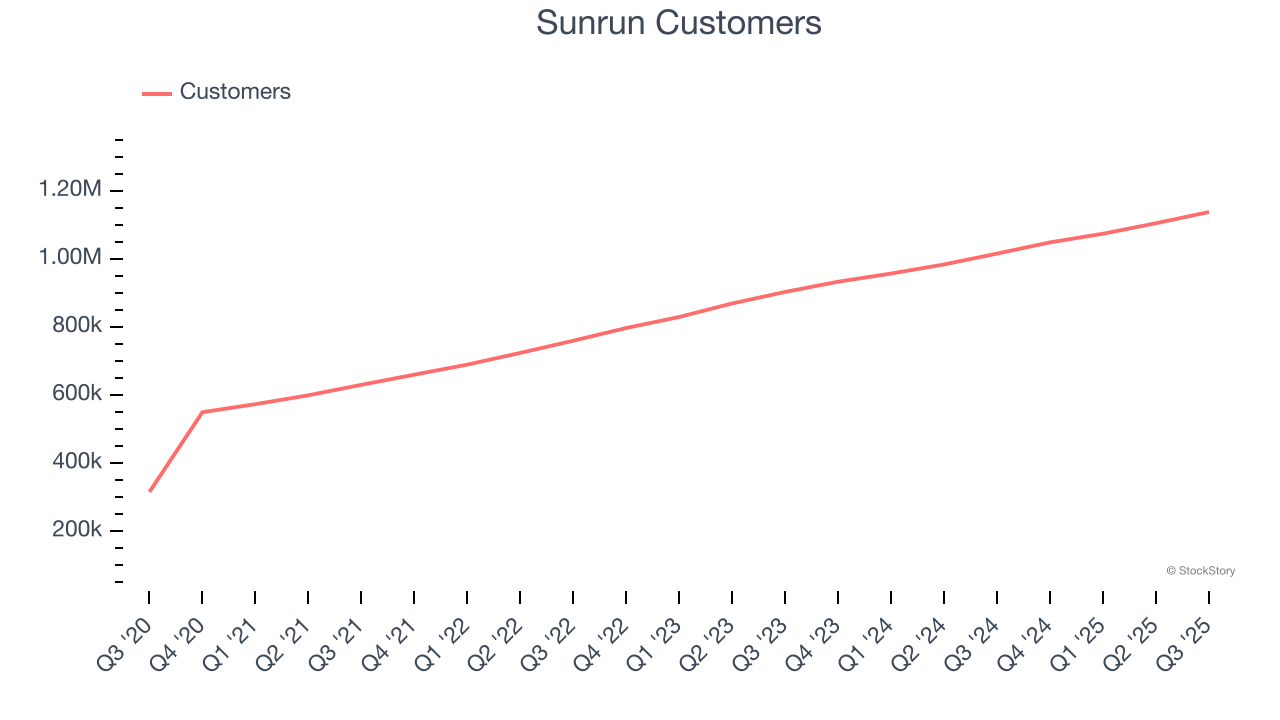

- Customers: 1.14 million, up from 1.11 million in the previous quarter

- Market Capitalization: $4.75 billion

“Our strategic focus on providing Americans a way to achieve energy independence is yielding strong results. We are generating cash while growing our customer base at a healthy rate. We are continuing to lead the industry with superior energy offerings for our customers, allowing them to power through grid outages and protect their households from rising energy costs, while we are also building critical energy infrastructure the country needs as energy demand grows at a rapid rate,” said Mary Powell, Sunrun’s Chief Executive Officer.

Company Overview

Helping homeowners use solar energy to power their homes, Sunrun (NASDAQ: RUN) provides residential solar electricity, specializing in panel installation and leasing services.

Revenue Growth

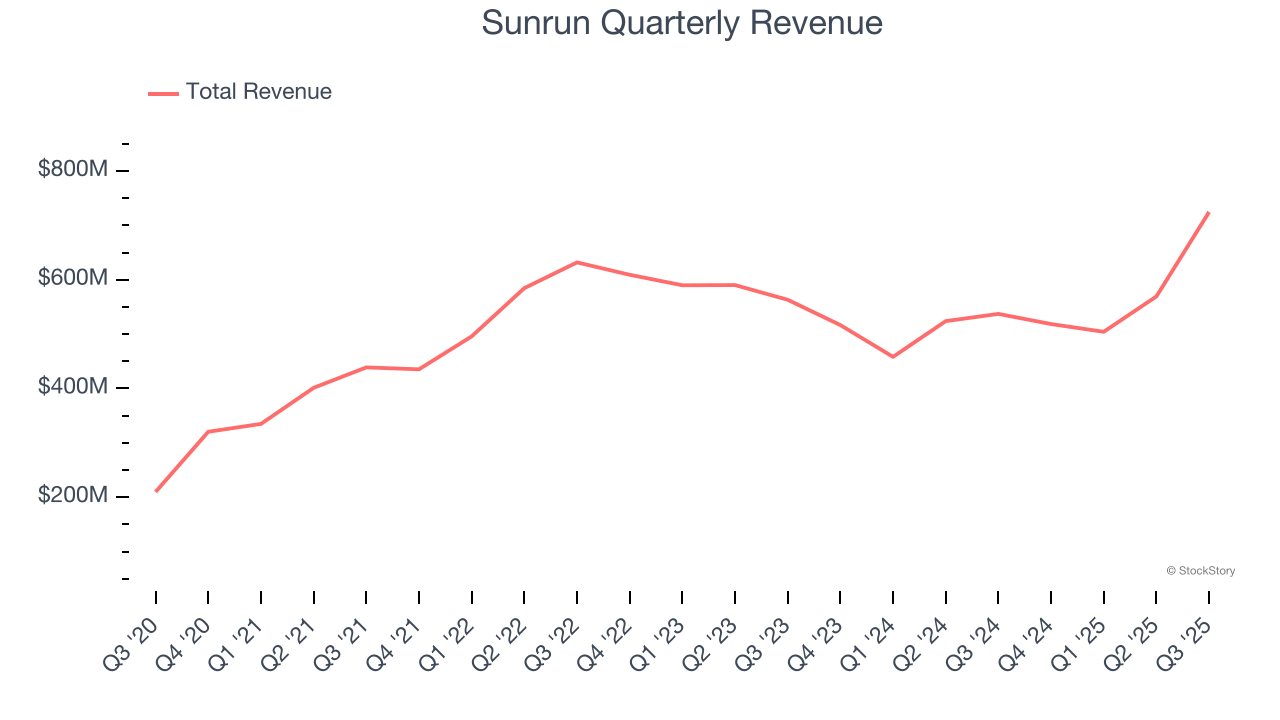

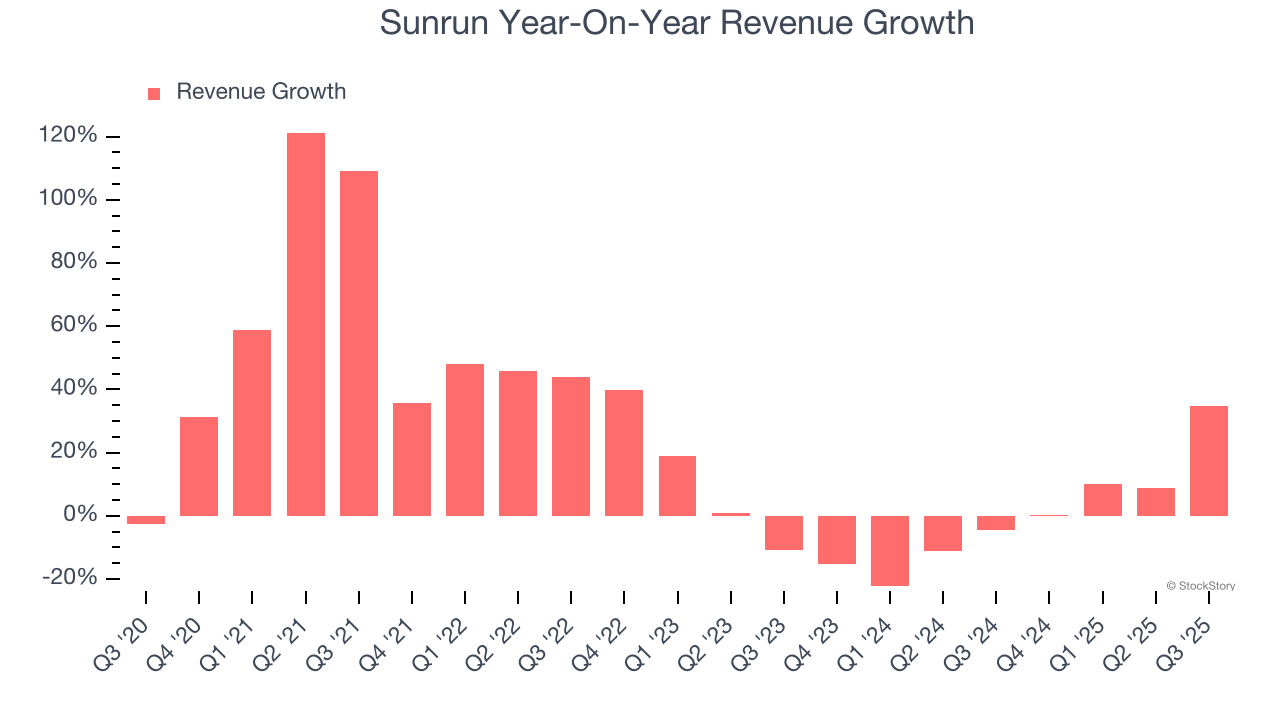

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Sunrun grew its sales at an incredible 22.3% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Sunrun’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 1.14 million in the latest quarter. Over the last two years, Sunrun’s customer base averaged 13.4% year-on-year growth. Because this number is better than its revenue growth, we can see the average customer spent less money each year on the company’s products and services.

This quarter, Sunrun reported wonderful year-on-year revenue growth of 34.9%, and its $724.6 million of revenue exceeded Wall Street’s estimates by 22.4%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

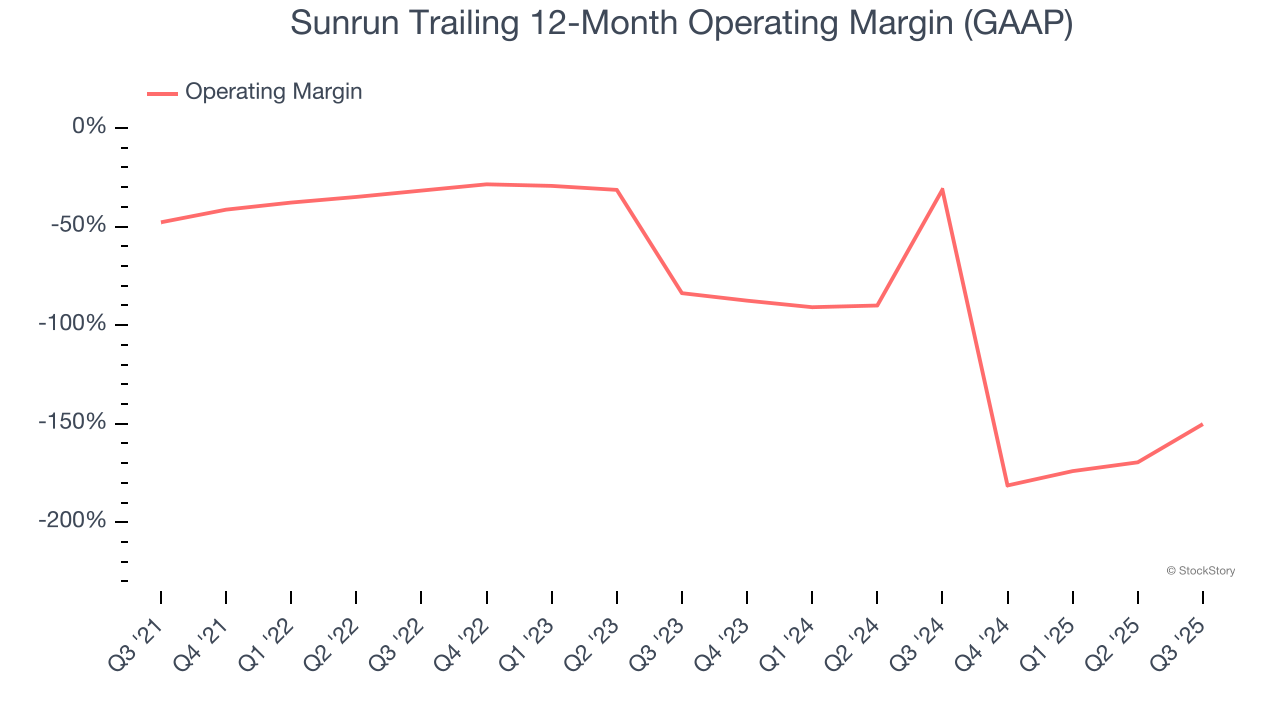

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Although Sunrun broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 72.3% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Sunrun’s operating margin decreased significantly over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Sunrun’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Sunrun’s breakeven margin was up 24.3 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

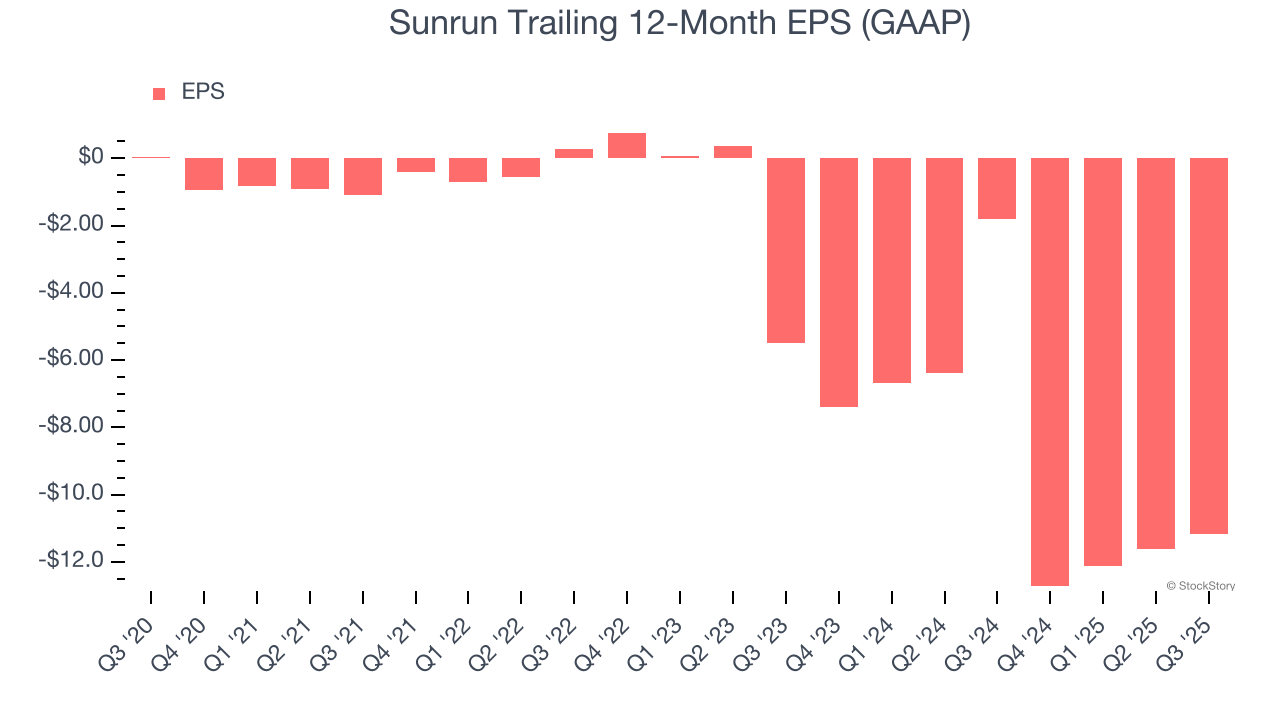

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

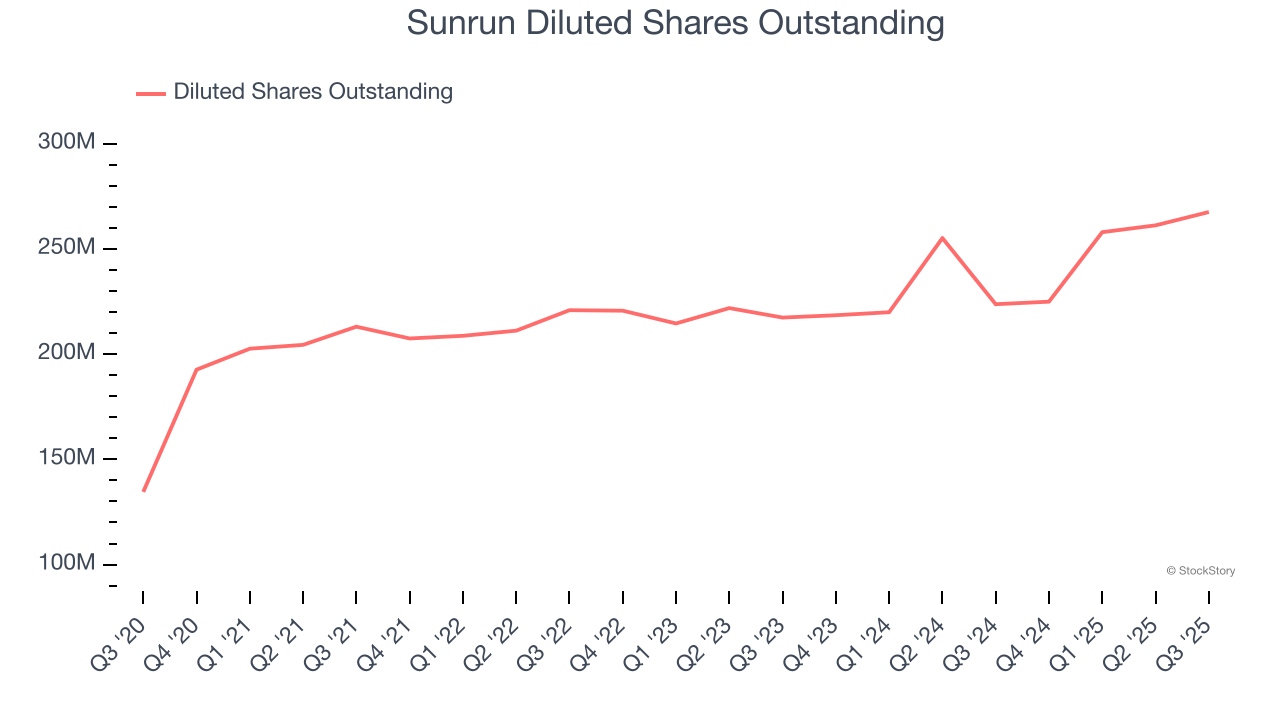

Sadly for Sunrun, its EPS declined by 208% annually over the last five years while its revenue grew by 22.3%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

We can take a deeper look into Sunrun’s earnings to better understand the drivers of its performance. As we mentioned earlier, Sunrun’s operating margin expanded this quarter but declined by 102.4 percentage points over the last five years. Its share count also grew by 98.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Sunrun, its two-year annual EPS declines of 42.6% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q3, Sunrun reported EPS of $0.06, up from negative $0.37 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Sunrun’s full-year EPS of negative $11.19 will flip to positive $0.95.

Key Takeaways from Sunrun’s Q3 Results

We were impressed by how significantly Sunrun blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its EPS missed. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 6% to $19.14 immediately after reporting.

So do we think Sunrun is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.