Enterprise AI software company C3.ai (NYSE: AI) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 20.3% year on year to $75.15 million. The company expects next quarter’s revenue to be around $76 million, close to analysts’ estimates. Its non-GAAP loss of $0.25 per share was 24.8% above analysts’ consensus estimates.

Is now the time to buy C3.ai? Find out by accessing our full research report, it’s free for active Edge members.

C3.ai (AI) Q3 CY2025 Highlights:

- Revenue: $75.15 million vs analyst estimates of $75.03 million (20.3% year-on-year decline, in line)

- Adjusted EPS: -$0.25 vs analyst estimates of -$0.33 (24.8% beat)

- Adjusted Operating Income: -$42.22 million vs analyst estimates of -$52.63 million (-56.2% margin, 19.8% beat)

- Revenue Guidance for the full year is $299.5 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: -149%, down from -79.8% in the same quarter last year

- Free Cash Flow was -$46.88 million compared to -$34.3 million in the previous quarter

- Market Capitalization: $1.98 billion

Company Overview

Named after the three Cs of its original focus—carbon, cloud computing, and customer relationship management—C3.ai (NYSE: AI) provides enterprise AI software that helps organizations develop, deploy, and operate large-scale artificial intelligence applications across various industries.

Revenue Growth

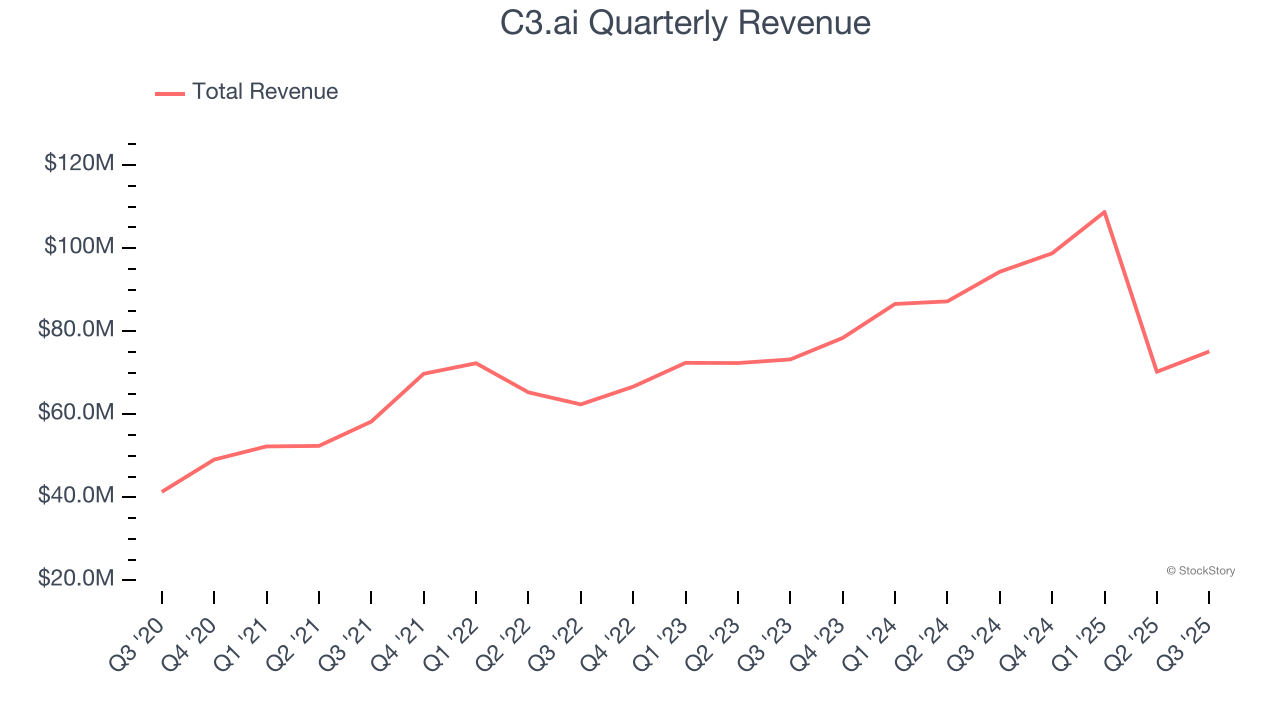

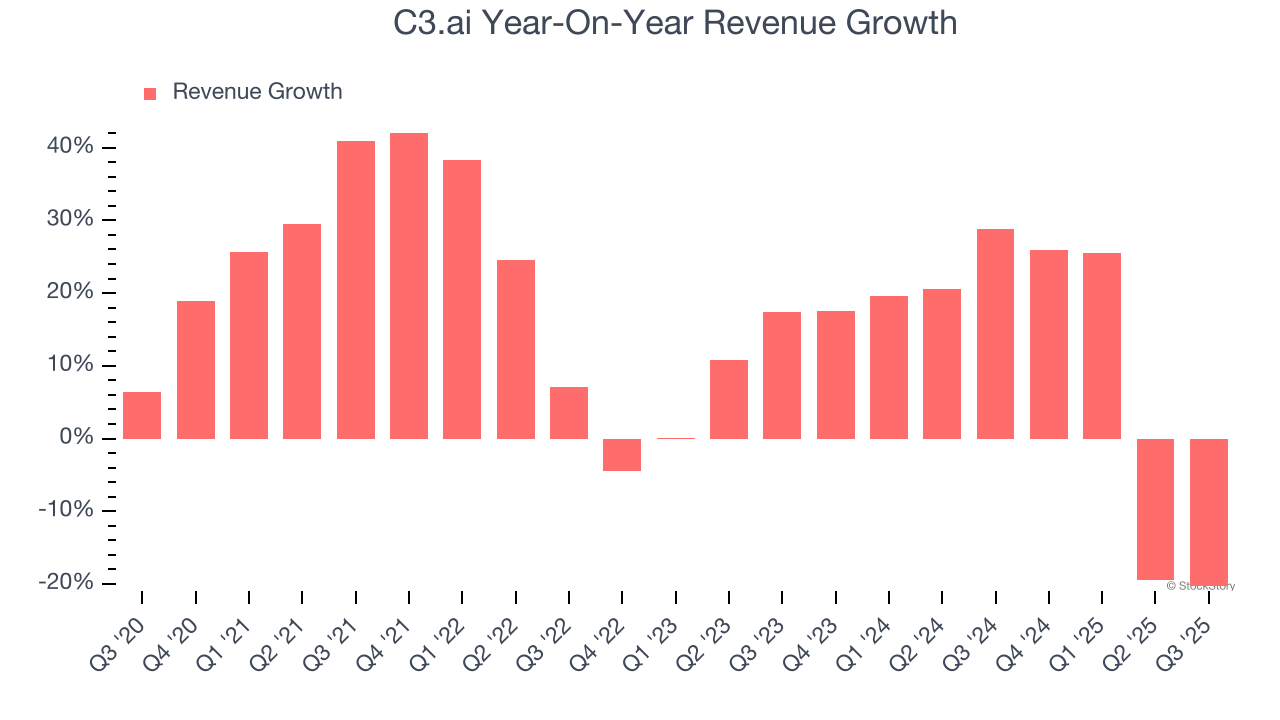

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, C3.ai grew its sales at a 16.5% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. C3.ai’s recent performance shows its demand has slowed as its annualized revenue growth of 11.3% over the last two years was below its five-year trend.

This quarter, C3.ai reported a rather uninspiring 20.3% year-on-year revenue decline to $75.15 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 23.1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 10.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

C3.ai does a decent job acquiring new customers, and its CAC payback period checked in at 43.4 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

Key Takeaways from C3.ai’s Q3 Results

We struggled to find many positives in these results. Overall, this quarter could have been better. The stock remained flat at $15.06 immediately following the results.

Is C3.ai an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.