VANCOUVER, BC / ACCESSWIRE / June 1, 2022 / Musk Metals Corp. ("Musk Metals") ("Musk" or the "Company") (CSE:MUSK) (OTC PINK:EMSKF) (FSE:1I30) is pleased to announce it has entered into an Option Agreement (the "Option") with Zeal Exploration Inc. ("Zeal") to earn up to 100% interest in the Lawyers East, West and North properties (the "Properties") located in BC's famous "Golden Horseshoe" region contiguous to Benchmark Metal's (BNCH - TSX.V) "Lawyers" Gold and Silver Project as well as Thesis Gold's (TAU - TSX.V) Ranch Project that both recently reported significant drilling intercepts and extensive ongoing drilling campaigns.

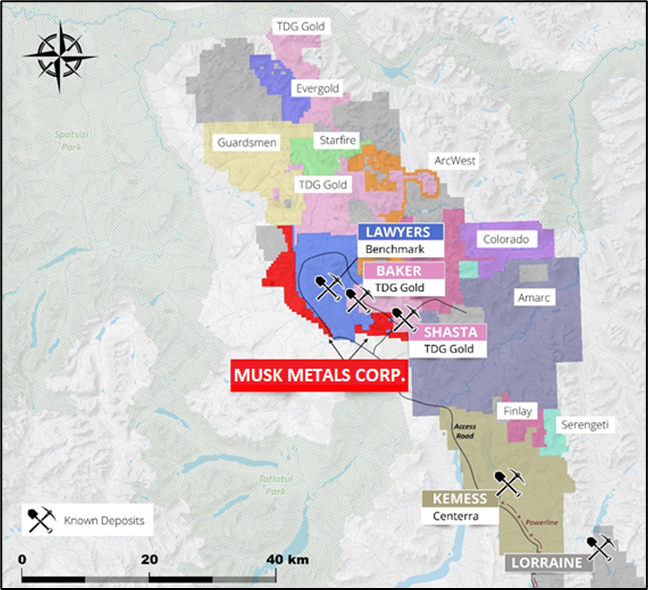

The Properties cover approximately 15,469 acres. These prospective properties are on trend with several mines found in the region, located at the south-eastern side of Benchmarks' "Lawyers" property, below TDG Gold Corp's "Baker" Mine and "Shasta" Mine and in line with the "Kemess" Mine further Southeast. Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Properties.

Zeal intends on ustilizing a compilation of historic work and airborne survey data, recently flown by Musk Metals to plan a 2022 exploration program. This exploration program will be designed to complement historic work and recent discoveries in the area and will be focused on geologic mapping and prospecting the properties for highly prospective and mineralized areas and may include geochemical surveying. Samples will be taken from mineralized areas and analyzed for precious metals content shortly after field work is completed.

Lawyers East, West, and North Properties in relation to Benchmark's "Lawyers" property and nearby deposits

Terms of the Option Agreement

The Optionee may exercise the First Option and earn a 50% undivided interest in the Property by (i) paying to the Optionor CAD$70,000 in cash and issuing 800,000 common shares in the capital of the Optionee at a deemed price of $0.05 per share; and (iii) making certain exploration expenditures on the Property, on or before the dates specified below:

DATE FOR COMPLETION | CASH PAYMENT | COMMON SHARES | WORK EXPENDITURES AND OTHER EXPENDITURES |

|---|---|---|---|

| Upon execution of this Option Agreement (non-refundable) | CAD$20,000 | 400,000 | CAD$25,000 towards completion of technical report |

| Within 12 months of execution of this Option Agreement | CAD$25,000 | 200,000 | Min Work to Maintain Good Standing |

| Within 24 months of execution of this Option Agreement | CAD$25,000 | 200,000 | Min Work to Maintain Good Standing |

| TOTAL | CAD$70,000 | 800,000 |

The Optionee may exercise the Second Option within 36 months of the date of the Option Agreement and earn an additional 50% undivided interest in the Property for a total of 100% interest, by paying to the Optionor: (i) CAD$90,000; (ii) issuing 800,000 common shares in the capital of the Optionee at a deemed price of $0.05 per share; (iii) and granting a 2% Net Smelter Royalty (the "Royalty") with 1% of the Net Smelter Royalty purchasable for $1,000,000 by Optionee.

Should the Properties collectively achieve an estimate of mineral resources (a "Resource Estimate") prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Properties ("NI 43-101") by a Qualified Person (as defined in NI 43-101) in the measured and indicated category with 250,000- 1,000,000 ounces of gold (the "Target Resource Estimate"), and provided the Optionee has exercised the Second Option, the Optionee will pay to the Optionor $1.00 CAD per ounce of gold in cash, shares or a combination of cash and shares at the Optionee's election within 180 days of completion of the Resource Estimate up to a maximum aggregate payment $1,000,000 in cash and/or shares. After the Optionee's exercise of the Second Option, the Optionee and Optionor agree that either party may request a Resource Estimate be performed within 180 days of such request. Subsequent Resource Estimates shall be performed (i) at any time at the option of the Optionee, or (ii) at the request of the Optionor within 180 days of the earlier of the completion of any drill program with at least 20,000 meters of drilling or after three years has elapsed since the previous Resource Estimate, provided exploration work has occurred since the last Resource Estimate and the claims have not been abandoned. The Optionee shall pay for the preparation of the first Resource Estimate and any further Resource Estimates prepared at the Optionee's option pursuant to subsection (i). The Optionor shall reimburse the Optionee for 50% of the cost of any Resource Estimate prepared at the Optionee's request pursuant to subsection (ii). The Optionee and Optionor acknowledge that the Target Resource Estimate may be achieved over multiple years. For greater certainty, any amounts owing to the Optionor pursuant to a subsequent Resource Estimate under this paragraph 3.5 shall be calculated by subtracting the ounces of gold under the prior Resource Estimate or Resources Estimates from the ounces of gold under the subsequent Resource Estimate (i.e. if the prior Resource Estimate was 250,000 ounces of gold and a subsequent Resource Estimate is 300,000 ounces of gold, the amount owing to the Optionor shall be $50,000).

Musk Metals CEO and Director, Nader Vatanchi states, "With a focus on multiple active lithium projects, Musk is optioning these world class prospective claims to Zeal Exploration in order to unlock additional value from this world class gold and silver camp. We are bullish on gold prices for 2022 and find confirmation of our sentiment with recent investments in the neighboring lawyers camp."

The Company has also entered into investor relations consulting agreement with Brent Rusin to provide investor relations and capital markets advisory services to the company. Mr. Rusin will initiate and strengthen relationships with the financial community including shareholders, investors, and other stakeholders for the purpose of increasing awareness of the company, its multiple highly prospective mining properties, and its exploration activities.

The agreement with Mr. Rusin is on an ongoing month to month basis, for which Mr. Rusin will be paid a monthly fee of $2,500. Mr. Rusin has also been granted 250,000 stock options at an exercise price of $0.055 for a one-year term pursuant to its Stock Option Plan.

Qualified Person: Luke van der Meer (P.Geo) is a Qualified Person ("QP") as defined by National Instrument 43-101 guidelines, and he has reviewed and approved the technical content of this news release.

About Musk Metals Corp.

Musk Metals is a publicly traded exploration company focused on the development of highly prospective, discovery-stage mineral properties located in some of Canada's top mining jurisdictions. The current portfolio of mineral properties exhibit favorable geological characteristics in underexplored areas within the prolific "Electric Avenue" pegmatite field of northwestern Ontario, the "Abitibi Lithium Camp" of southwestern Quebec, the "Golden Triangle" district of British Columbia, the Mineral Rich "Red Lake" mining camp of Northwestern Ontario and the "Chapais-Chibougamau" mining camp, the second largest mining camp in Quebec, Canada.

Make sure to follow the Company on Twitter, Instagram and Facebook as well as subscribe for Company updates at http://www.muskmetals.ca/

ON BEHALF OF THE BOARD

___Nader Vatanchi___

CEO & Director

For more information on Musk Metals, please contact:

Phone: 604-717-6605

Corporate e-mail: info@muskmetals.ca

Website: www.muskmetals.ca

Corporate Address: 2905 - 700 West Georgia Street, Vancouver, BC, V7Y 1C6

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements. All statements, other than statements of historical fact that address activities, events, or developments that the Company believes, expects or anticipates will or may occur in the future are forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements regarding the intended use of proceeds of the Offering and other matters regarding the business plans of the Company. The forward-looking statements reflect management's current expectations based on information currently available and are subject to a number of risks and uncertainties that may cause outcomes to differ materially from those discussed in the forward-looking statements including that the Company may use the proceeds of the Offering for purposes other than those disclosed in this news release; adverse market conditions; and other factors beyond the control of the Company. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, undue reliance should not be put on such statements due to their inherent uncertainty. Factors that could cause actual results or events to differ materially from current expectations include general market conditions and other factors beyond the control of the Company. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents or accuracy of this press release.

SOURCE: Musk Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/703487/Musk-Metals-Options-Lawyers-Properties-to-Zeal-Exploration-Inc