Temporary space provider WillScot (NASDAQ: WSC) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 4.7% year on year to $559.6 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $2.38 billion at the midpoint. Its non-GAAP profit of $0.24 per share was 11.1% below analysts’ consensus estimates.

Is now the time to buy WillScot Mobile Mini? Find out by accessing our full research report, it’s free.

WillScot Mobile Mini (WSC) Q1 CY2025 Highlights:

- Revenue: $559.6 million vs analyst estimates of $562.4 million (4.7% year-on-year decline, 0.5% miss)

- Adjusted EPS: $0.24 vs analyst expectations of $0.27 (11.1% miss)

- Adjusted EBITDA: $228.8 million vs analyst estimates of $229.2 million (40.9% margin, in line)

- The company reconfirmed its revenue guidance for the full year of $2.38 billion at the midpoint

- EBITDA guidance for the full year is $1.05 billion at the midpoint, in line with analyst expectations

- Operating Margin: 21.3%, in line with the same quarter last year

- Free Cash Flow Margin: 25.9%, down from 34.3% in the same quarter last year

- Market Capitalization: $4.60 billion

Brad Soultz, Chief Executive Officer of WillScot, commented, “Our first quarter financial results were consistent with our expectations and support reaffirming our previously issued full year 2025 outlook. We delivered $145 million of Adjusted Free Cash Flow at a 26% margin, returned $45 million to shareholders, and progressed our acquisition pipeline. In addition to our focus on day-to-day execution, we continued investing in the business to support our medium-to-longer term margin expansion and organic revenue growth plans discussed at our Investor Day on March 7, 2025."

Company Overview

Originally focusing on mobile offices for construction sites, WillScot (NASDAQ: WSC) provides ready-to-use temporary spaces, largely for longer-term lease.

Sales Growth

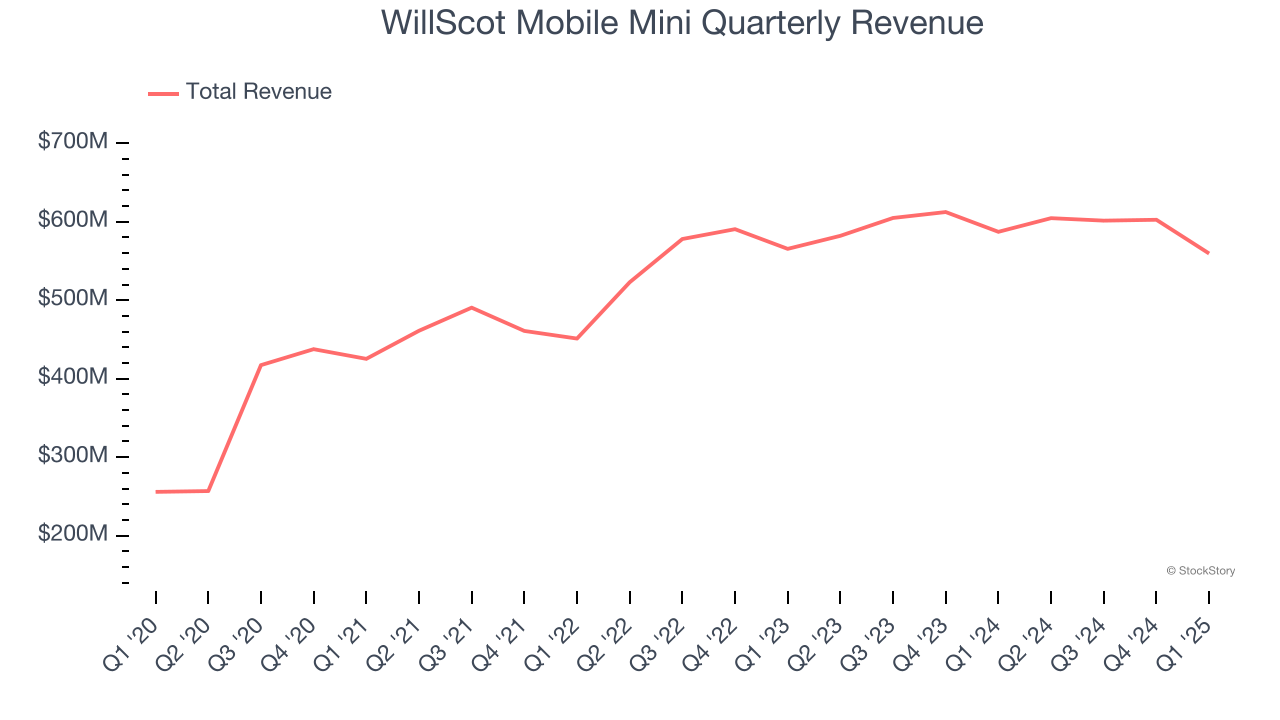

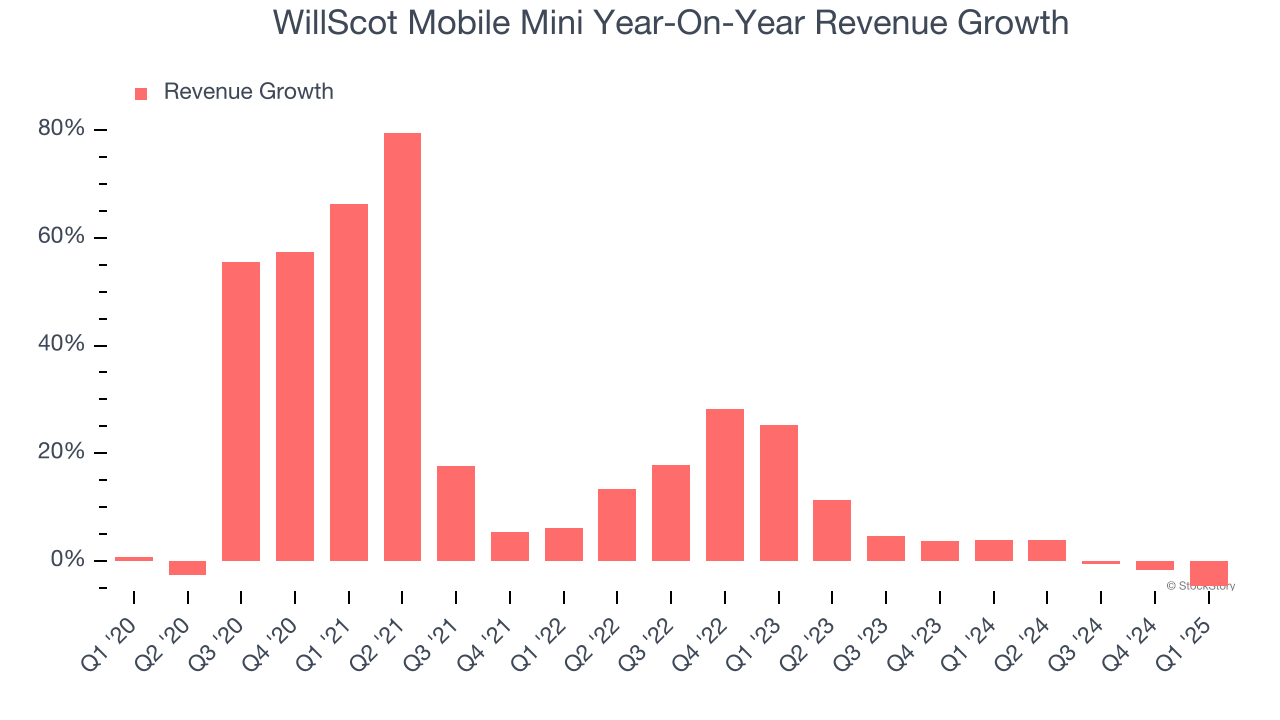

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, WillScot Mobile Mini’s 17.3% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. WillScot Mobile Mini’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 2.4% over the last two years was well below its five-year trend.

WillScot Mobile Mini also breaks out the revenue for its most important segments, Leasing and Delivery and Installation, which are 77.6% and 15.8% of revenue. Over the last two years, WillScot Mobile Mini’s Leasing revenue (recurring) averaged 3.3% year-on-year growth. On the other hand, its Delivery and Installation revenue (non-recurring) averaged 4.9% declines.

This quarter, WillScot Mobile Mini missed Wall Street’s estimates and reported a rather uninspiring 4.7% year-on-year revenue decline, generating $559.6 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.4% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

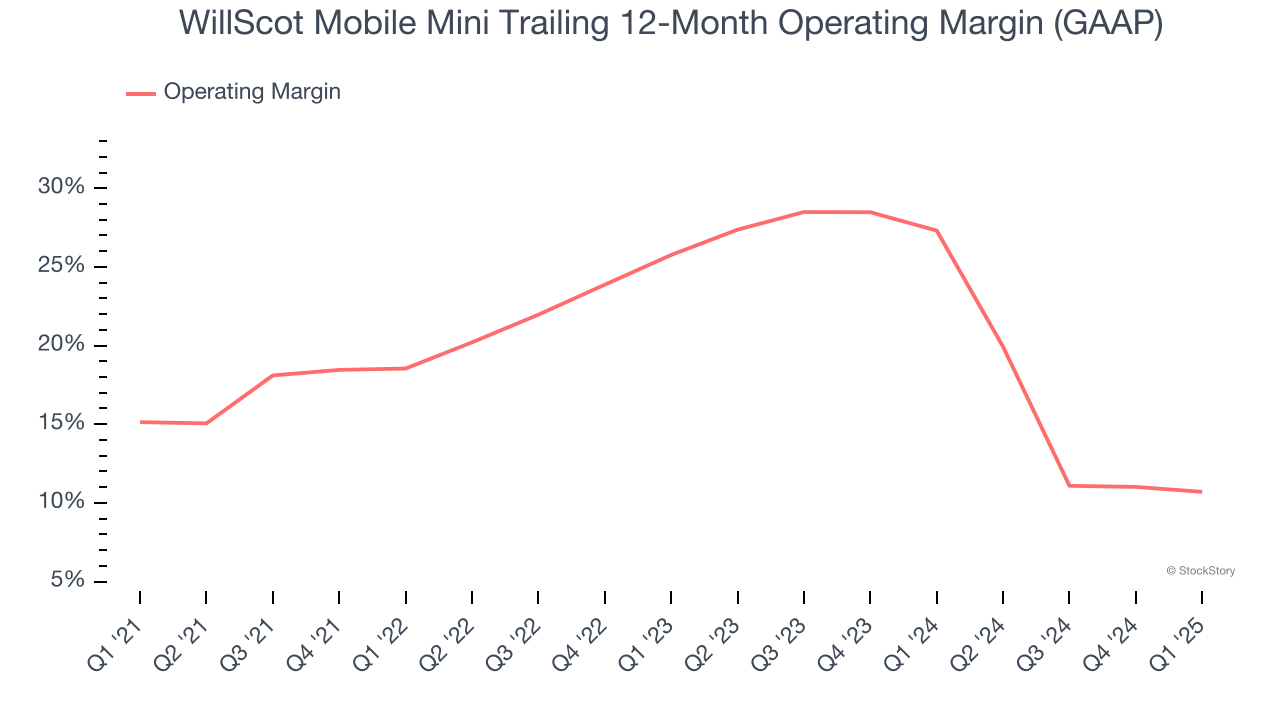

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

WillScot Mobile Mini has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 19.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, WillScot Mobile Mini’s operating margin decreased by 4.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, WillScot Mobile Mini generated an operating profit margin of 21.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

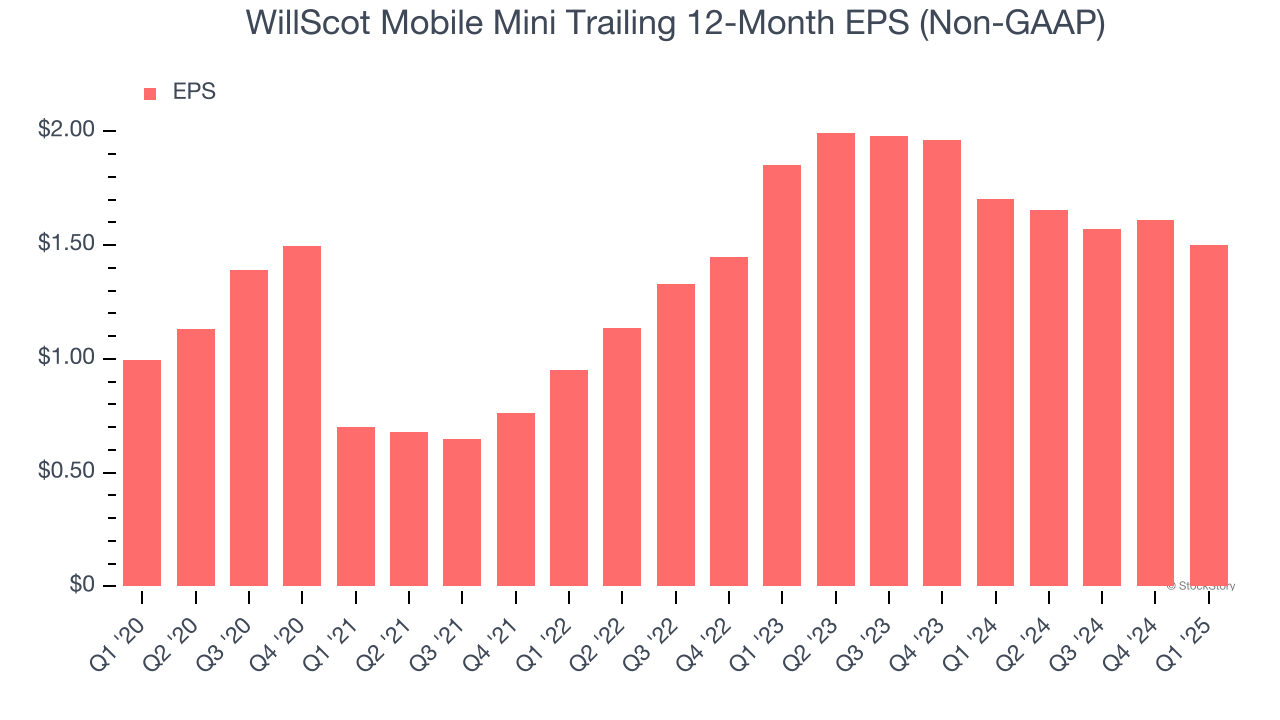

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

WillScot Mobile Mini’s EPS grew at a decent 8.6% compounded annual growth rate over the last five years. However, this performance was lower than its 17.3% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

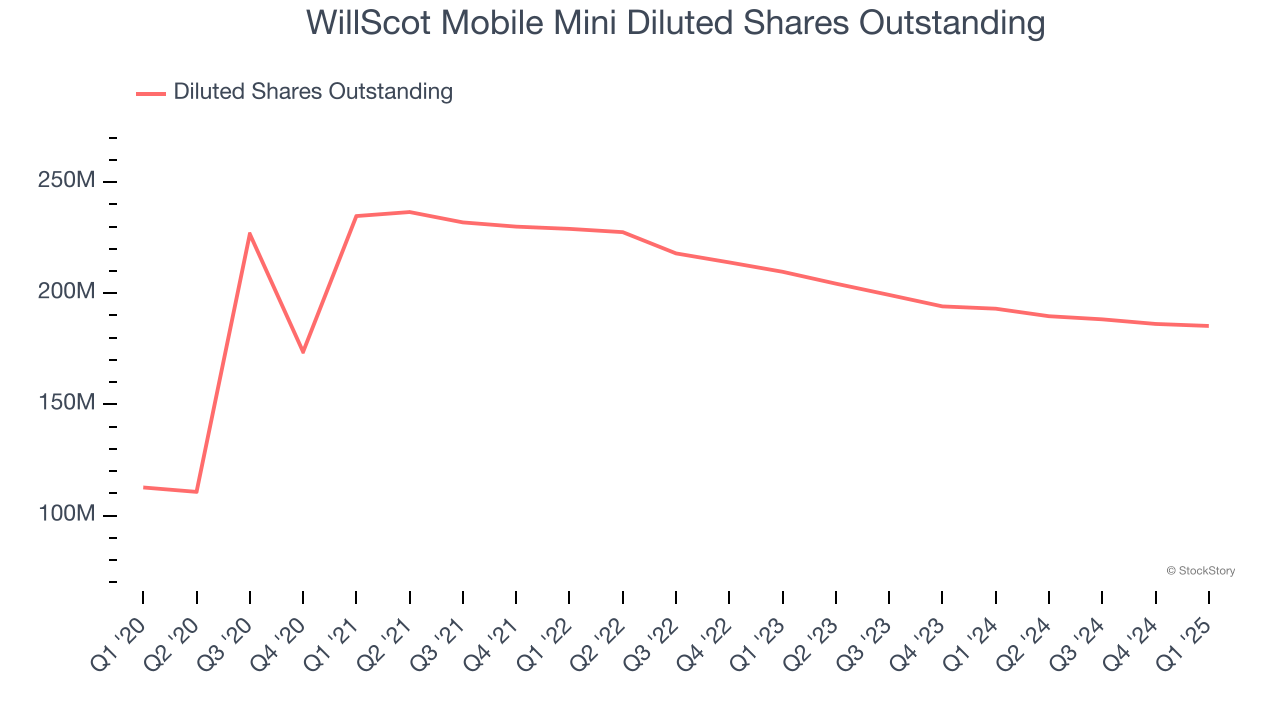

Diving into the nuances of WillScot Mobile Mini’s earnings can give us a better understanding of its performance. As we mentioned earlier, WillScot Mobile Mini’s operating margin was flat this quarter but declined by 4.4 percentage points over the last five years. Its share count also grew by 64.5%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For WillScot Mobile Mini, its two-year annual EPS declines of 10% mark a reversal from its five-year trend. We hope WillScot Mobile Mini can return to earnings growth in the future.

In Q1, WillScot Mobile Mini reported EPS at $0.24, down from $0.35 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects WillScot Mobile Mini’s full-year EPS of $1.50 to grow 10.7%.

Key Takeaways from WillScot Mobile Mini’s Q1 Results

We struggled to find many positives in these results. Its EPS missed significantly and its Leasing revenue fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $25.63 immediately following the results.

So should you invest in WillScot Mobile Mini right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.