Headline News about Ultra Bloomberg Crude Oil 2X ETF

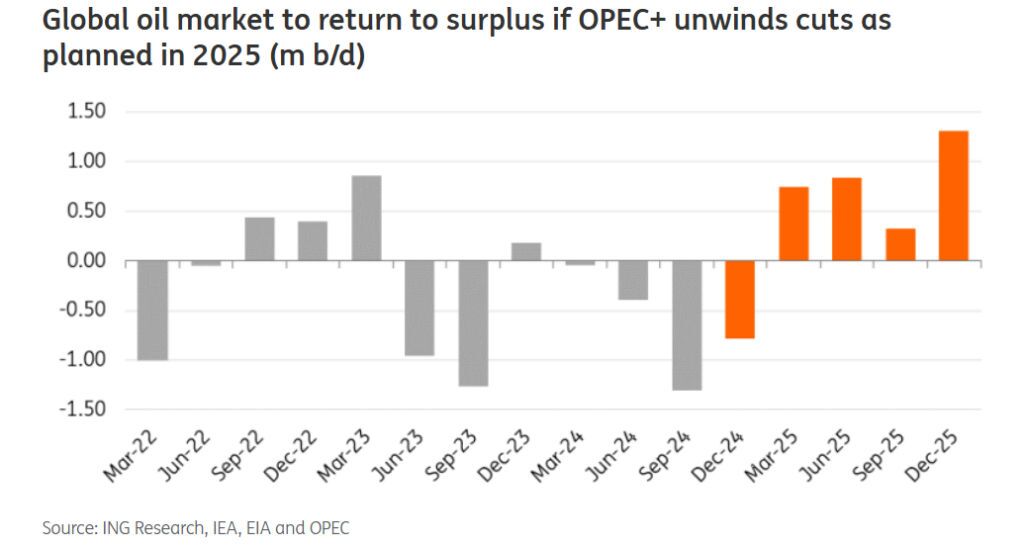

WTI Drops To Near $68.00 As OPEC Cuts Demand View

November 12, 2024

Via Talk Markets

Exposures

Fossil Fuels

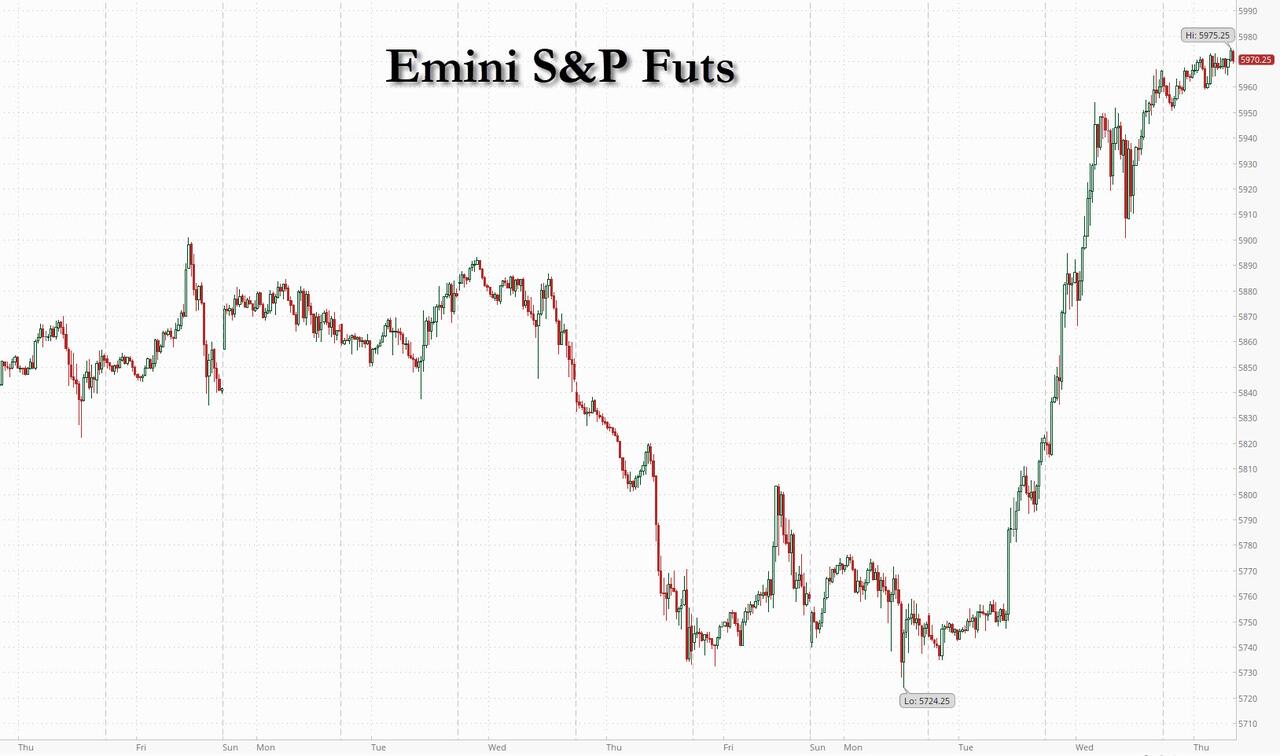

Asia Open: Higher Treasury Yields Finally Put The Brakes On The Sizzling Post Election Rally

November 12, 2024

Via Talk Markets

Topics

Bonds

Exposures

Debt Markets

The Energy Report: Peace Dividend

November 10, 2024

Via Talk Markets

Topics

Government

Exposures

Political

World Central Banks Continue To Cut Interest Rates. Us Stock Indices Break Records Again

November 08, 2024

Via Talk Markets

Topics

Stocks

Exposures

US Equities

S&P Futures Extend Gains As Trump Trades Cool

November 07, 2024

Via Talk Markets

Crude Oil Sets Forth Winning Streak With Aramco Earnings Sign On The Wall For OPEC+ To Step Up Efforts

November 05, 2024

Via Talk Markets

Exposures

Fossil Fuels

Why The Trinity Trade Will Send Oil To $47

November 01, 2024

Via Talk Markets

Exposures

Fossil Fuels

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Free News Feed

Get our RSS Feed!

© Copyright 2008 StreetInsider.com

Custom Website Design by Active Media Architects

Custom Website Design by Active Media Architects