- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

ARK 21Shares Bitcoin ETF (NY:ARKB)

All News about ARK 21Shares Bitcoin ETF

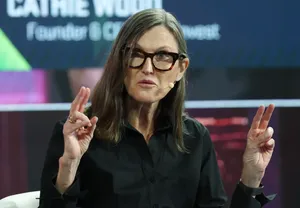

Ark Invest’s Cathie Wood Flags 3 Reasons Behind The Market Crash ↗

February 07, 2026

Via Stocktwits

Did a Hedge Fund’s IBIT Trades Trigger The Crypto Selloff? One Analyst Thinks So ↗

February 06, 2026

Via Stocktwits

Crypto ETFs Hold Firm As Bitcoin Slides: Bitwise, GraniteShares Push Back On Panic Selling Narrative ↗

February 10, 2026

Via Stocktwits

Topics

ETFs

Via Stocktwits

Topics

ETFs

Is Bitcoin Ready To Test $80K Again? Traders Are Watching Liquidation Signals, US Economic Data ↗

February 03, 2026

Via Stocktwits

Topics

Economy

Bitcoin ETFs Kick Off February With $560 Million Inflows After $1.5 Billion Selloff ↗

February 03, 2026

Via Stocktwits

Topics

ETFs

Via Stocktwits

Topics

Economy

Via MarketMinute

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.