State Street SPDR Portfolio Europe ETF (NY:SPEU)

Price and Volume

Detailed Quote| Volume | 110,518 |

| Open | 54.62 |

| Bid (Size) | 52.75 (100) |

| Ask (Size) | 59.54 (100) |

| Prev. Close | 54.91 |

| Today's Range | 54.41 - 54.89 |

| 52wk Range | 38.99 - 55.53 |

| Shares Outstanding | 188,003 |

| Dividend Yield | 4.30% |

Top News

More NewsPerformance

More News

Read More

Why Is Genius Group Stock Rising Today? ↗

September 15, 2025

How Europe Could Pull Swiftly Ahead ↗

May 19, 2024

European Central Bank Lowers Interest Rates, Fourth Cut In 2024 ↗

December 12, 2024

Week Ahead: Does The Dollar Have Legs? ↗

May 13, 2023

Sovereign Spreads: How Big Exactly Is The ECB’s Bazooka? ↗

August 02, 2022

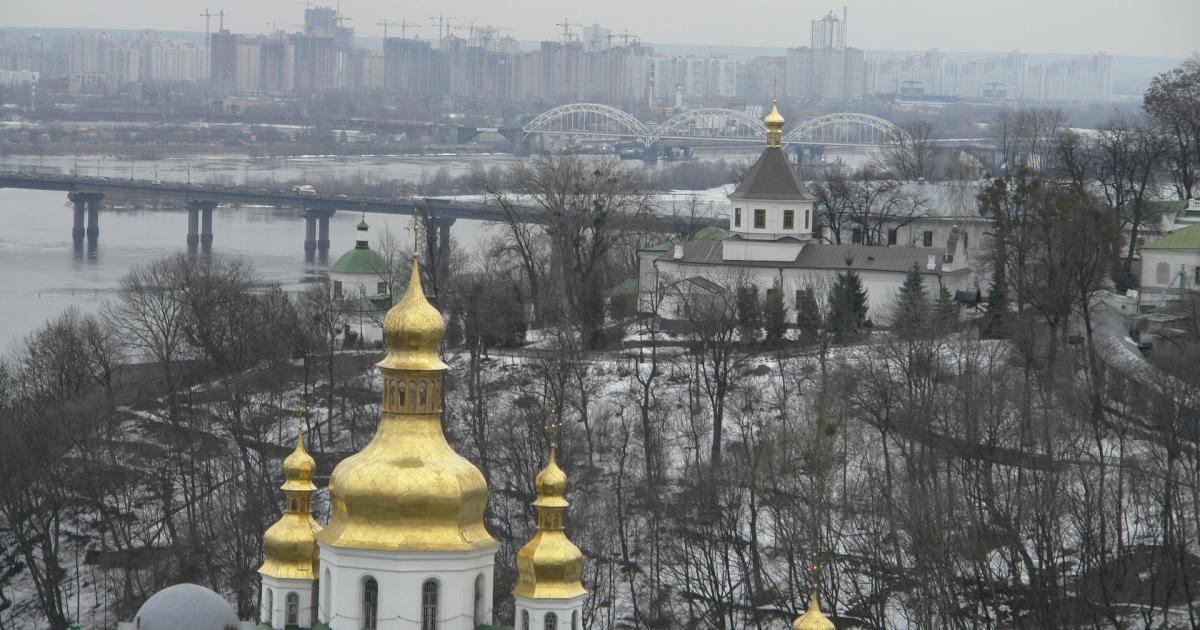

6 US ETFs With Significant Ukraine Exposure ↗

February 25, 2022

6 US ETFs With Significant Ukraine Exposure ↗

February 25, 2022

Fascinated By History? Europe In 1444 ↗

June 27, 2021

Frequently Asked Questions

Is State Street SPDR Portfolio Europe ETF publicly traded?

Yes, State Street SPDR Portfolio Europe ETF is publicly traded.

What exchange does State Street SPDR Portfolio Europe ETF trade on?

State Street SPDR Portfolio Europe ETF trades on the New York Stock Exchange

What is the ticker symbol for State Street SPDR Portfolio Europe ETF?

The ticker symbol for State Street SPDR Portfolio Europe ETF is SPEU on the New York Stock Exchange

What is the current price of State Street SPDR Portfolio Europe ETF?

The current price of State Street SPDR Portfolio Europe ETF is 54.73

When was State Street SPDR Portfolio Europe ETF last traded?

The last trade of State Street SPDR Portfolio Europe ETF was at 02/03/26 04:10 PM ET

What is the market capitalization of State Street SPDR Portfolio Europe ETF?

The market capitalization of State Street SPDR Portfolio Europe ETF is 10.29M

How many shares of State Street SPDR Portfolio Europe ETF are outstanding?

State Street SPDR Portfolio Europe ETF has 10M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.