L'Oreal Unsp/Adr (OP:LRLCY)

Price and Volume

Detailed Quote| Volume | 237,238 |

| Open | 91.85 |

| Bid (Size) | N/A (0) |

| Ask (Size) | N/A (0) |

| Prev. Close | 93.55 |

| Today's Range | 85.20 - 93.98 |

| 52wk Range | 68.95 - 95.10 |

| Shares Outstanding | N/A |

| Dividend Yield | N/A |

Top News

More NewsPerformance

More News

Read More

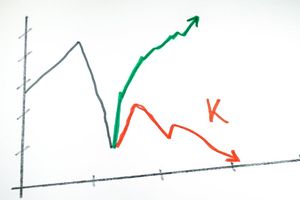

K-Shaped Economy Fuels Luxury Boom: 10 Stocks To Watch Now ↗

November 13, 2025

Smart Companies Don't Just Endure — They Grow, Too ↗

September 26, 2025

Giorgio Armani, Legendary Italian Fashion Designer, Dies At 91 ↗

September 04, 2025

Sanofi Buys Back ~$3 Billion In Shares From L'Oréal: Details ↗

February 03, 2025

5 Top European Stocks to Buy Before 2025 ↗

December 16, 2024

Down 40%, Is This Growth Beast a No-Brainer Buy Right Now? ↗

October 23, 2024

1 Growth Stock Down 30% to Buy Right Now ↗

September 01, 2024

Move Over Magnificent 7, Say Hello to the GRANOLAS ↗

February 22, 2024

3 high yield stock ETFs that make any income portfolio better

January 17, 2024

L'Oreal Adds Glamour To CES 2024 With Hair, Skin Care Gadgets ↗

January 09, 2024

'AI Is The Story Of The Show': What To Expect From CES 2024 ↗

January 03, 2024

Frequently Asked Questions

Is L'Oreal Unsp/Adr publicly traded?

Yes, L'Oreal Unsp/Adr is publicly traded.

What exchange does L'Oreal Unsp/Adr trade on?

L'Oreal Unsp/Adr trades on the OTC Traded

What is the ticker symbol for L'Oreal Unsp/Adr?

The ticker symbol for L'Oreal Unsp/Adr is LRLCY on the OTC Traded

What is the current price of L'Oreal Unsp/Adr?

The current price of L'Oreal Unsp/Adr is 86.72

When was L'Oreal Unsp/Adr last traded?

The last trade of L'Oreal Unsp/Adr was at 02/12/26 03:59 PM ET

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.