Great Ajax Corp. Common Stock (NY:AJX)

Price and Volume

Detailed Quote| Volume | 0 |

| Open | 3.020 |

| Bid (Size) | 2.980 (1) |

| Ask (Size) | 3.100 (100) |

| Prev. Close | 3.020 |

| Today's Range | 3.020 - 3.020 |

| 52wk Range | N/A - N/A |

| Shares Outstanding | 23,142,946 |

| Dividend Yield | N/A |

Top News

More NewsPerformance

More News

Read More

What's Next: Great Ajax's Earnings Preview ↗

October 18, 2024

Insights into Great Ajax's Upcoming Earnings ↗

October 18, 2024

Great Ajax: Dividend Insights ↗

November 09, 2023

Earnings Preview For Great Ajax ↗

November 01, 2023

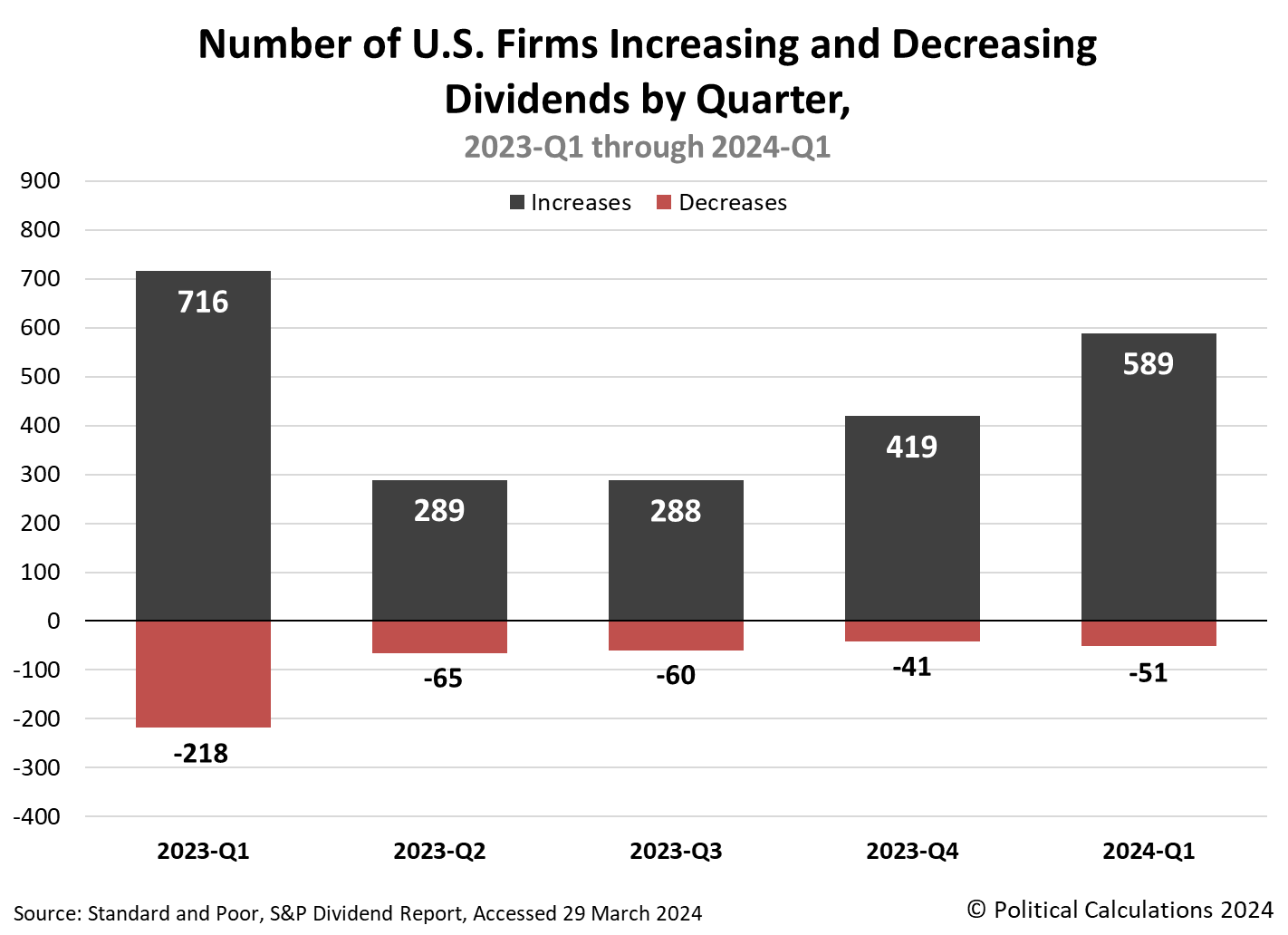

Dividends By the Numbers In March 2021 And 2024-Q1 ↗

April 03, 2024

Top 3 Financial Stocks That May Explode This Quarter ↗

March 18, 2024

Dividends By The Numbers In February 2024 ↗

March 05, 2024

Analyst Initiates Coverage On 8 Mortgage REITs ↗

December 06, 2023

Dividends By The Numbers In November 2023 ↗

December 05, 2023

Top 5 Financial Stocks That Could Lead To Your Biggest Gains In Q4 ↗

November 02, 2023

Frequently Asked Questions

Is Great Ajax Corp. Common Stock publicly traded?

Yes, Great Ajax Corp. Common Stock is publicly traded.

What exchange does Great Ajax Corp. Common Stock trade on?

Great Ajax Corp. Common Stock trades on the New York Stock Exchange

What is the ticker symbol for Great Ajax Corp. Common Stock?

The ticker symbol for Great Ajax Corp. Common Stock is AJX on the New York Stock Exchange

What is the current price of Great Ajax Corp. Common Stock?

The current price of Great Ajax Corp. Common Stock is 3.020

When was Great Ajax Corp. Common Stock last traded?

The last trade of Great Ajax Corp. Common Stock was at 12/02/24 07:00 PM ET

What is the market capitalization of Great Ajax Corp. Common Stock?

The market capitalization of Great Ajax Corp. Common Stock is 69.89M

How many shares of Great Ajax Corp. Common Stock are outstanding?

Great Ajax Corp. Common Stock has 70M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.