Ford Motor (NY:F)

Price and Volume

Detailed Quote| Volume | 1,402 |

| Open | 13.59 |

| Bid (Size) | 13.61 (600) |

| Ask (Size) | 13.63 (1,000) |

| Prev. Close | 13.59 |

| Today's Range | 13.59 - 13.59 |

| 52wk Range | 8.441 - 14.50 |

| Shares Outstanding | 4,028,000,000 |

| Dividend Yield | 4.42% |

Top News

More NewsPerformance

More News

Read More

Looking for the most active stocks in the S&P500 index on Monday? ↗

February 09, 2026

How Ford and GM's Worst Nightmare Is Actually a Massive Opportunity ↗

February 09, 2026

Ford Earnings: What To Look For From F

February 08, 2026

Will Tariffs & EVs Destroy This Top Stock's Bottom Line in 2026? ↗

February 08, 2026

Ford and Rivian Announce Big Developments -- but Are They Buys Now? ↗

February 07, 2026

Could Buying Ford Stock Today Set You Up for Life? ↗

February 07, 2026

What's going on in today's session: S&P500 most active stocks ↗

February 06, 2026

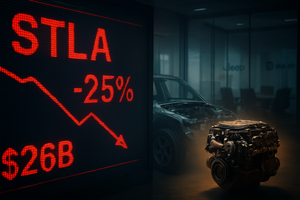

How Should You Play the Bloodshed in Stellantis Stock Today?

February 06, 2026

What General Motors Really Wants Investors to Know About Q4 ↗

February 06, 2026

Frequently Asked Questions

Is Ford Motor publicly traded?

Yes, Ford Motor is publicly traded.

What exchange does Ford Motor trade on?

Ford Motor trades on the New York Stock Exchange

What is the ticker symbol for Ford Motor?

The ticker symbol for Ford Motor is F on the New York Stock Exchange

What is the current price of Ford Motor?

The current price of Ford Motor is 13.59

When was Ford Motor last traded?

The last trade of Ford Motor was at 02/09/26 07:00 PM ET

What is the market capitalization of Ford Motor?

The market capitalization of Ford Motor is 54.74B

How many shares of Ford Motor are outstanding?

Ford Motor has 55B shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.