iShares MSCI USA Quality Factor ETF (NY:QUAL)

Price and Volume

Detailed Quote| Volume | 937,764 |

| Open | 200.22 |

| Bid (Size) | 198.67 (200) |

| Ask (Size) | 199.45 (2,600) |

| Prev. Close | 200.10 |

| Today's Range | 198.59 - 200.22 |

| 52wk Range | 148.34 - 201.65 |

| Shares Outstanding | 2,873,000 |

| Dividend Yield | 0.94% |

Top News

More NewsPerformance

More News

Read More

5 Quality ETFs For A Steady Ride In Wild Markets ↗

March 21, 2025

The Best Quality-Focused ETF to Invest $2,000 In Right Now ↗

February 28, 2025

Best Investment Strategies For 2025 ↗

January 26, 2025

Bull Run At Risk? Shield Your Portfolio With These ETFs ↗

October 06, 2024

5 Quality ETFs To Bet On Amid Volatile Markets ↗

August 16, 2024

5 ETF Zones To Keep Your Money Safe Amid Market Volatility ↗

April 15, 2024

Thoughts For Thursday: About Those Rate Cuts ↗

April 11, 2024

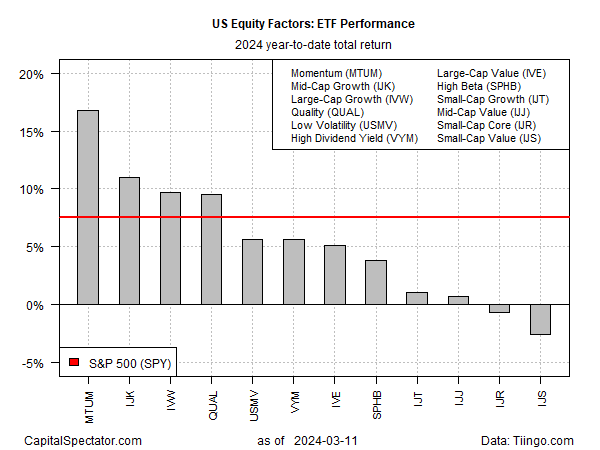

Small Cap And Value Stocks Lag In This Year’s Rally ↗

March 12, 2024

Frequently Asked Questions

Is iShares MSCI USA Quality Factor ETF publicly traded?

Yes, iShares MSCI USA Quality Factor ETF is publicly traded.

What exchange does iShares MSCI USA Quality Factor ETF trade on?

iShares MSCI USA Quality Factor ETF trades on the New York Stock Exchange

What is the ticker symbol for iShares MSCI USA Quality Factor ETF?

The ticker symbol for iShares MSCI USA Quality Factor ETF is QUAL on the New York Stock Exchange

What is the current price of iShares MSCI USA Quality Factor ETF?

The current price of iShares MSCI USA Quality Factor ETF is 198.62

When was iShares MSCI USA Quality Factor ETF last traded?

The last trade of iShares MSCI USA Quality Factor ETF was at 12/31/25 08:00 PM ET

What is the market capitalization of iShares MSCI USA Quality Factor ETF?

The market capitalization of iShares MSCI USA Quality Factor ETF is 570.64M

How many shares of iShares MSCI USA Quality Factor ETF are outstanding?

iShares MSCI USA Quality Factor ETF has 571M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.