ProShares Short S&P500 (NY:SH)

Price and Volume

Detailed Quote| Volume | 3,953,367 |

| Open | 35.75 |

| Bid (Size) | 36.01 (600) |

| Ask (Size) | 36.13 (100) |

| Prev. Close | 35.76 |

| Today's Range | 35.75 - 36.04 |

| 52wk Range | 35.50 - 51.37 |

| Shares Outstanding | 303,384 |

| Dividend Yield | 4.59% |

Top News

More NewsPerformance

More News

Read More

Tariffs, Trump, Tumult: How To Trade The Volatility Surge ↗

March 04, 2025

Trump's Tariffs Shake Markets: ETFs To Watch ↗

February 03, 2025

Trading With Your Expectations ↗

September 14, 2024

When Stocks Tumble ↗

August 11, 2024

Are Stocks On The Verge Of A Major Correction? ↗

March 15, 2024

The Bull Market's Moment Of Truth ↗

October 13, 2023

7 Inverse ETFs for the Opportunistic Bear ↗

October 09, 2023

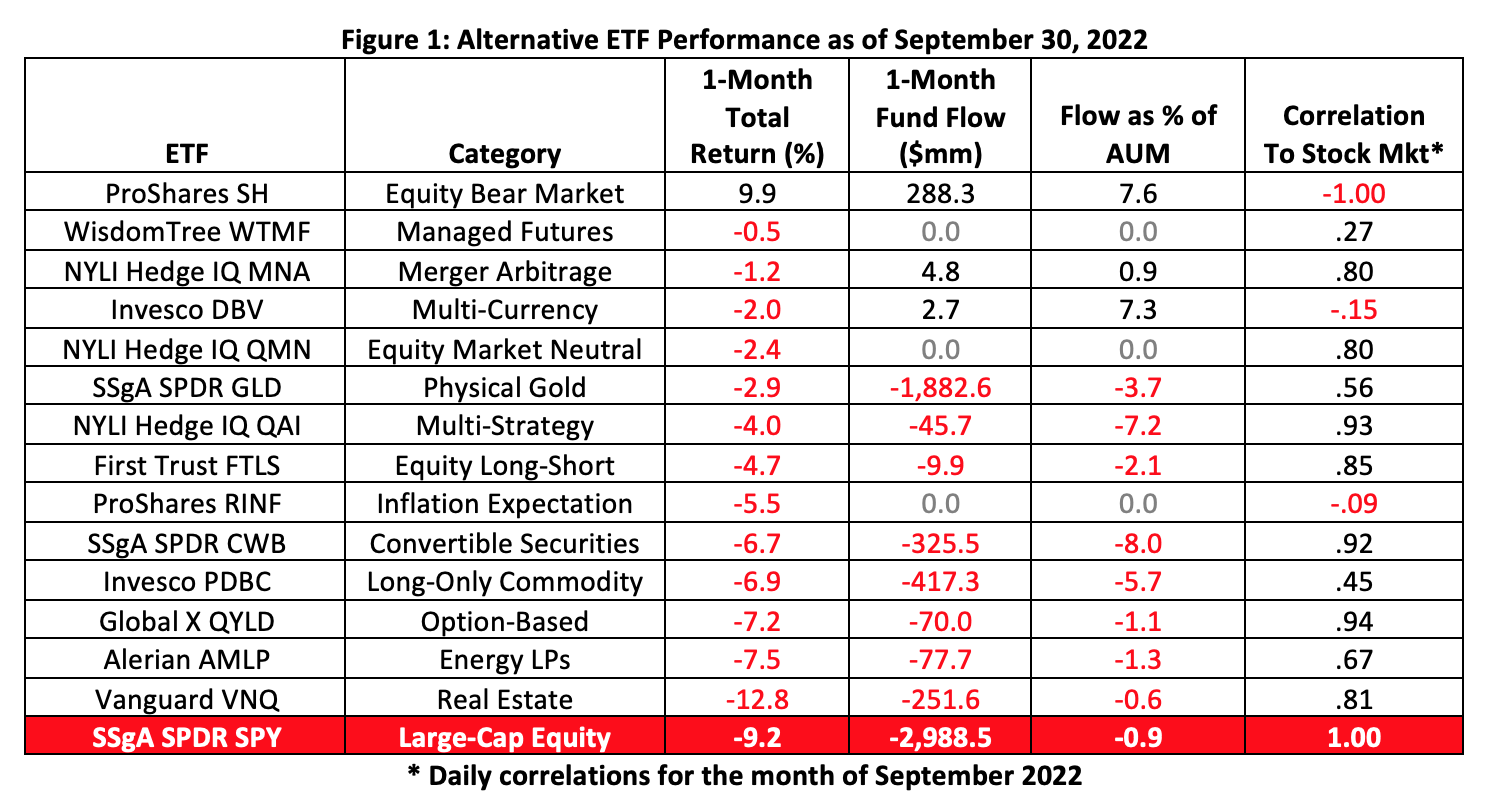

Alternative ETFs At Year’s End - And A Peek Into The Future ↗

January 04, 2023

Are Low-Vol Investments Good Hedges? ↗

October 10, 2022

Rare Economic/Technical Signal Has Only Flashed 9 Times In Last 54 Years ↗

September 24, 2022

Is It Finally Time To Buy Stocks? ↗

July 15, 2022

Alternative ETFs At Mid-Year ↗

July 08, 2022

10 Ways To Make Money In A Bear Market ↗

May 29, 2022

Zoltan Pozsar: The Fed Isn't Your Friend ↗

May 17, 2022

S&P 500 Near Bear Market: Inverse ETFs in Focus ↗

May 13, 2022

Frequently Asked Questions

Is ProShares Short S&P500 publicly traded?

Yes, ProShares Short S&P500 is publicly traded.

What exchange does ProShares Short S&P500 trade on?

ProShares Short S&P500 trades on the New York Stock Exchange

What is the ticker symbol for ProShares Short S&P500?

The ticker symbol for ProShares Short S&P500 is SH on the New York Stock Exchange

What is the current price of ProShares Short S&P500?

The current price of ProShares Short S&P500 is 36.03

When was ProShares Short S&P500 last traded?

The last trade of ProShares Short S&P500 was at 12/31/25 08:00 PM ET

What is the market capitalization of ProShares Short S&P500?

The market capitalization of ProShares Short S&P500 is 10.93M

How many shares of ProShares Short S&P500 are outstanding?

ProShares Short S&P500 has 11M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.