Toyota Motor Corporation Common Stock (NY:TM)

Price and Volume

Detailed Quote| Volume | 337,665 |

| Open | 244.76 |

| Bid (Size) | 242.00 (100) |

| Ask (Size) | 249.00 (100) |

| Prev. Close | 237.19 |

| Today's Range | 241.86 - 246.36 |

| 52wk Range | 155.00 - 246.36 |

| Shares Outstanding | 2,795,948,660 |

| Dividend Yield | 2.83% |

Top News

More NewsPerformance

More News

Read More

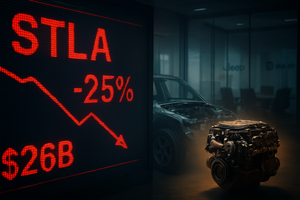

How Should You Play the Bloodshed in Stellantis Stock Today?

February 06, 2026

Toyota Taps CFO Kenta Kon As Next CEO In Leadership Reset ↗

February 06, 2026

What BYD Needs to Prove in 2026 ↗

February 06, 2026

Elliott Management Raises Stake In Toyota To Block Buyout ↗

February 06, 2026

What's Driving the Market Sentiment Around Toyota Motor Corp? ↗

February 04, 2026

The 55-Point Gap: Measuring What Matters in Automotive Impact

February 04, 2026

Cathie Wood Keeps Buying Joby Aviation Stock. Should You?

February 03, 2026

3 Wealth-Building Vanguard ETFs to Buy Hand Over Fist in 2026 ↗

January 29, 2026

China Has Officially Overtaken Tesla In The Global EV Race ↗

January 25, 2026

Frequently Asked Questions

Is Toyota Motor Corporation Common Stock publicly traded?

Yes, Toyota Motor Corporation Common Stock is publicly traded.

What exchange does Toyota Motor Corporation Common Stock trade on?

Toyota Motor Corporation Common Stock trades on the New York Stock Exchange

What is the ticker symbol for Toyota Motor Corporation Common Stock?

The ticker symbol for Toyota Motor Corporation Common Stock is TM on the New York Stock Exchange

What is the current price of Toyota Motor Corporation Common Stock?

The current price of Toyota Motor Corporation Common Stock is 244.22

When was Toyota Motor Corporation Common Stock last traded?

The last trade of Toyota Motor Corporation Common Stock was at 02/06/26 07:00 PM ET

What is the market capitalization of Toyota Motor Corporation Common Stock?

The market capitalization of Toyota Motor Corporation Common Stock is 682.83B

How many shares of Toyota Motor Corporation Common Stock are outstanding?

Toyota Motor Corporation Common Stock has 683B shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.