Amazon (AMZN) recently finalized a $38 billion partnership with OpenAI, securing priority access to hundreds of thousands of Nvidia's most advanced GPUs for the next seven years. The announcement landed just as Amazon crushed earnings expectations. The standout segment was AWS, which posted 20.2% growth to $33.01 billion in Q3 2025, its strongest performance in years.

All of this is happening as the AI infrastructure market is set to grow from $135.81 billion in 2024 to $394.46 billion by 2030, and the GPU as a Service (GPUaaS) market is projected to jump from $8.21 billion to $26.62 billion in the same period. These forward-looking numbers highlight the sheer scale of the opportunity Amazon is chasing with this landmark deal.

Given these developments, does this gigantic agreement truly signal a new era for Amazon shareholders and the broader tech landscape, or is it the opening move in Amazon's bigger push for AI dominance? Let's find out if it really does make sense to buy AMZN stock now.

Amazon's Q3 Operating Report

Amazon, the global e-commerce company with a market cap of $2.6 trillion, offers cloud infrastructure, online retail, advertising, and subscription services to customers and businesses worldwide. Its market price is $249, with a year-to-date (YTD) gain of 13.56% and a 52-week performance of 24.88%.

This places Amazon at a premium to its sector, with price/sales of 3.73x versus 0.94x and price/cash flow of 21.08x versus 11.30x, which signals investors are paying up for durable growth and cash generation.

Amazon's most recent quarterly operating proof points support that premium and the $38 billion thesis around accelerated AI capacity. This is because it delivered Q3 2025 adjusted EPS of $1.95 versus $1.58 expected and $1.43 last year, confirming expanding earnings power even as investments ramp.

The company posted revenue of $180.17 billion versus $158.88 billion a year ago, topping consensus by 1.29% and underscoring broad-based demand. It recorded operating income of $17.4 billion, flat year-over-year (YoY), which reflects both scale and reinvestment cadence tied to infrastructure and AI.

It is notable that AWS generated $33.01 billion in revenue, up 20.2% YoY, and continued to win enterprise AI workloads against Microsoft and Alphabet. This growth signals rising adoption of core compute and AI services at scale as customers migrate and modernize. This also connects directly to the urgency behind Amazon’s expanded access to Nvidia (NVDA) GPUs via the newly reported $38 billion OpenAI agreement, which positions capacity where demand is forming fastest.

Amazon Pushes New Frontiers

Amazon Web Services just locked in a transformative $5.5 billion, 15-year lease with Cipher Mining (CIFR), directly targeting digital infrastructure powering artificial intelligence workloads. The agreement stands out in 2025 for its scale and ambition.

The terms of the contract state that Cipher Mining will deliver 300 MW of capacity in 2026. The plan includes air and liquid cooling, with rent starting in August 2026. Delivery will occur in two phases, both starting and ending in 2026. This contract moves AWS deeper into AI infrastructure and expands Amazon’s footprint in enterprise computing.

Amazon is using this partnership to meet surging demand for computing power. The push by AWS shows its commitment to high-performance, specialized hosting for complex workloads. Companies like Cipher are moving their business model from Bitcoin (BTCUSD) mining into AI hosting. These contracts bring new streams of income and allow tech infrastructure firms to grow by serving Amazon’s growing need for compute scale.

On the advertising front, Amazon just deepened its programmatic push through an exclusive partnership with Roku (ROKU). The deal provides access to over 80 million U.S. connected TV households through Amazon’s demand-side platform (DSP). This collaboration piloted Amazon’s DSP for advertisers, resulting in a 40% jump in unique viewer reach for each campaign and nearly 30% fewer repetitive ad impressions.

Analysts’ Expectations for AMZN Stock

Amazon enters the final stretch of 2025 with expectations running high. For the current quarter ending in December, Wall Street predicts earnings of $1.97 per share and $6.98 for the full year. The numbers point to a significant comeback from last year, which closed at $1.86 for the quarter and $5.53 for the year. Analysts see growth rates of 5.91% for this quarter and a big 26.22% for the year, showing momentum that can’t be ignored.

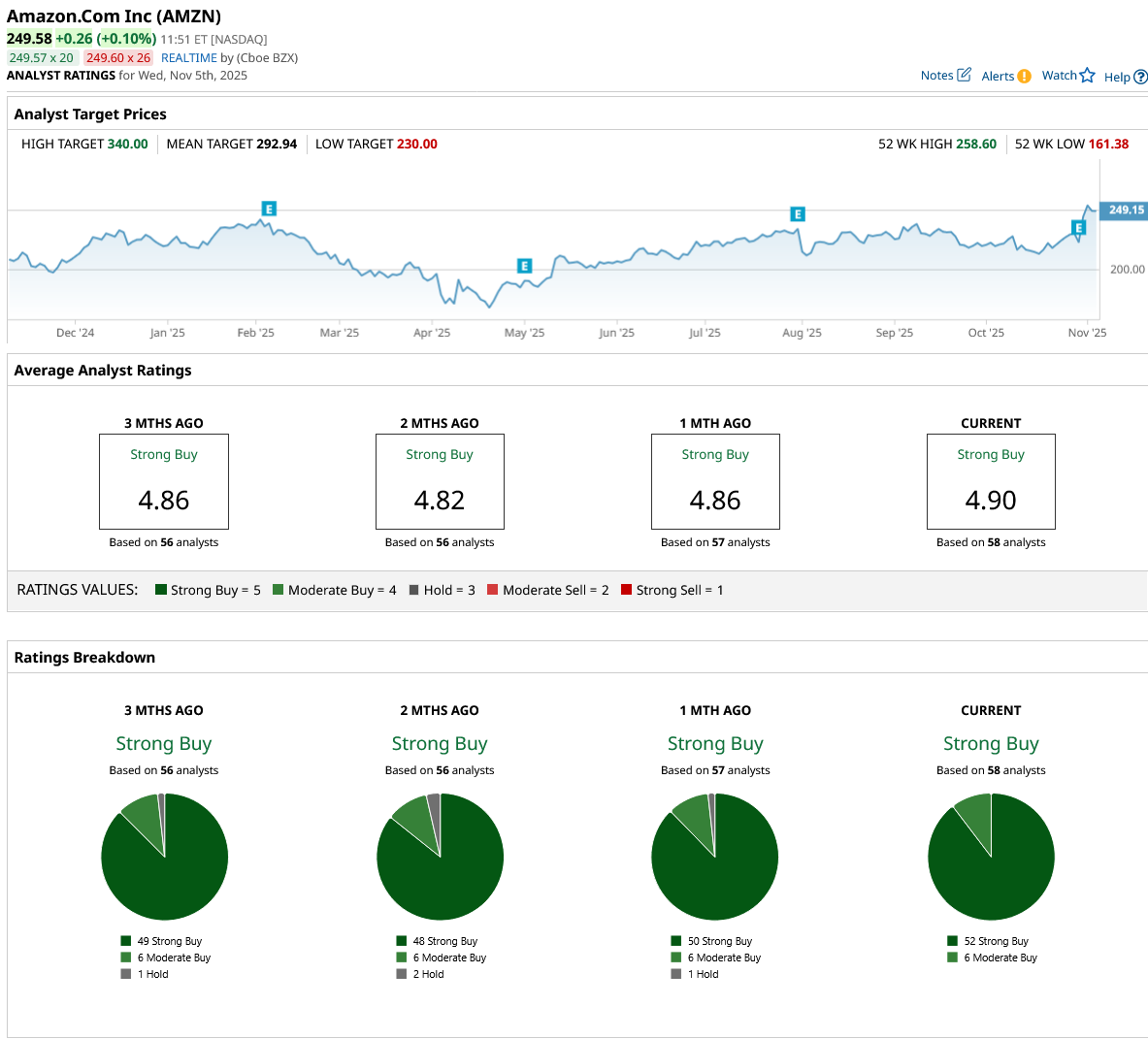

Confidence across the analyst community remains strong. The 58 experts tracked give AMZN stock a consensus “Strong Buy” rating. Every analyst gives it either a “Strong Buy” or “Moderate Buy” rating, with notably zero holds or sells. The average price target is $292.94. With the stock at $249 now, that’s a projected upside of roughly 17%.

Conclusion

Amazon looks ready for more upside. The company’s new AI and digital infrastructure deals have clearly raised the bar. Strong earnings, rising revenue, and bullish guidance are attracting support from both institutional and retail investors. Based on recent forecasts and analyst price targets, shares are most likely headed higher as growth continues. Unless there is a major surprise, holding AMZN stock for the next year feels like a solid bet. That $38 billion OpenAI partnership gives one more reason to stay long.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart