Palantir Technologies (PLTR) stock is in the spotlight as it heads into its third-quarter earnings release on Monday, Nov. 3. The data analytics and enterprise AI software company has seen its stock soar in recent months, gaining 25% over the past quarter and recently hitting a new all-time high of $199.85.

This impressive rally adds to an already remarkable year for Palantir. The stock has surged 162.49% year-to-date, and over the past 12 months, its value has skyrocketed by more than 354.38%, driven by growing enthusiasm for its Artificial Intelligence Platform (AIP) and its expanding government and commercial contracts.

This significant rally raises concerns about Palantir’s valuation. The company’s lofty price levels may leave limited room for further upside unless its upcoming financial results and guidance strongly outperform market expectations.

Still, Palantir has a solid track record of surprising on earnings. In three of the past four quarters, the stock has jumped following its results, averaging a post-earnings move of roughly 16.8%. If the company’s growth rate continues to accelerate, investors may find more reasons to remain bullish even at these elevated levels.

Palantir’s U.S. Business to Drive Q3 Financials

Palantir Technologies is heading into its third-quarter earnings with solid momentum, driven largely by the explosive growth of its U.S. operations and surging demand for its AIP.

The company reached a significant milestone in the second quarter, crossing the $1 billion mark in quarterly revenue for the first time. Revenue surged 48% year-over-year, reflecting continued acceleration in growth rate, driven by rapid customer adoption of Palantir’s AI-powered software solutions. Demand for AIP continues to expand across industries, helping the company deepen relationships with existing clients while adding new ones at a record pace.

Palantir’s bookings metrics show strong growth. In Q2, the company reported its highest-ever total contract value of $2.3 billion and annual contract value of $684 million. Deal activity remained robust, with 157 transactions worth at least $1 million each. Of these, 66 were valued at $5 million or more, and 42 at $10 million or more. This shows large-scale enterprises are increasingly integrating Palantir’s platforms into their operations.

Palantir’s customer base is not only expanding, but also spending more. The top 20 clients now generate an average of $75 million each in trailing 12-month revenue, up 30% from the prior year. This deepening engagement reflects growing confidence in Palantir’s technology and long-term value proposition.

Looking ahead to Q3, management expects revenue between $1.083 billion and $1.087 billion. However, given the strength in its U.S. commercial business, the company is likely to surpass expectations. Its U.S. commercial segment marked 93% year-over-year and 20% sequential growth in Q2. This trend will likely sustain. Moreover, the total contract value in this segment could hit a new high. Its U.S. government business is also likely to remain strong, driven by steady performance in existing programs and a healthy pipeline of new contracts.

Thanks to the strong momentum in its top line, the company’s profitability could get a solid boost. Analysts are anticipating Palantir to post earnings of $0.12 per share, double last year’s figure, reflecting its expanding margins and operational efficiency.

Is PLTR Stock a Buy, Sell, or Hold?

Palantir’s AIP is gaining rapid traction across both government and commercial sectors, and the company could continue to post impressive growth in the upcoming quarters, driven by an expanding customer base and contracts.

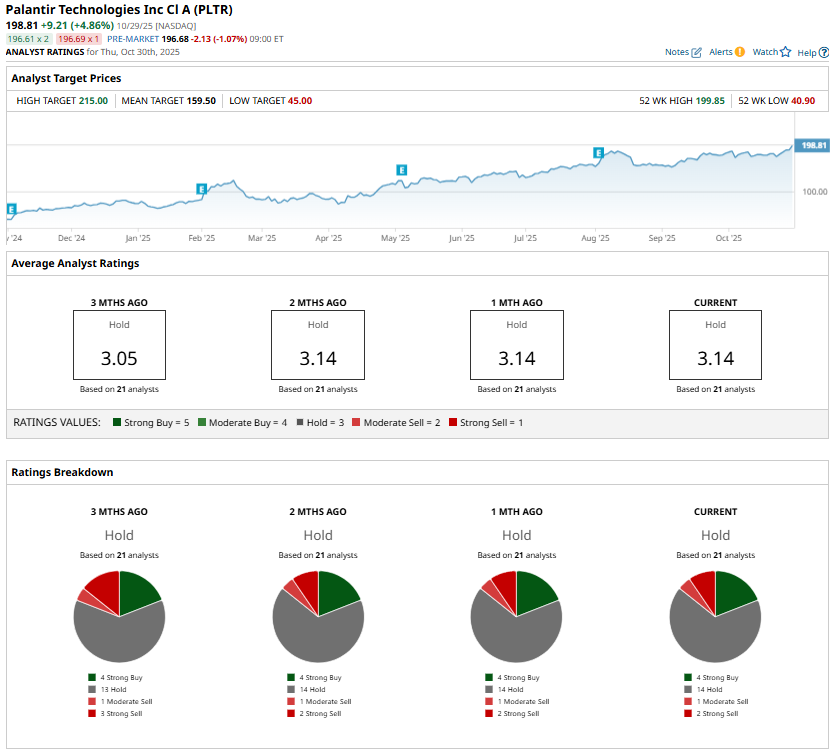

While Palantir’s business fundamentals appear promising, Wall Street remains cautious heading into the company’s third-quarter earnings report. The main concern lies in Palantir’s steep valuation. PLTR trades at a price-sales ratio of about 156.8 times, an exceptionally high level compared to industry peers.

In light of this, analysts have largely settled on a “Hold” consensus for PLTR stock. While Palantir’s long-term potential remains compelling, its steep valuation makes it difficult to justify new positions at current levels.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart