With a market cap of $1.3 trillion, Tesla, Inc. (TSLA) is a global leader in electric vehicles and sustainable energy solutions. Headquartered in Austin, Texas, the company operates through two primary segments: Automotive, and Energy Generation and Storage.

Companies worth more than $200 billion are generally labeled as “mega-cap” stocks, and Tesla fits this criterion perfectly. Tesla designs, manufactures, and sells electric cars, solar products, and energy storage systems to consumers, businesses, and utilities worldwide.

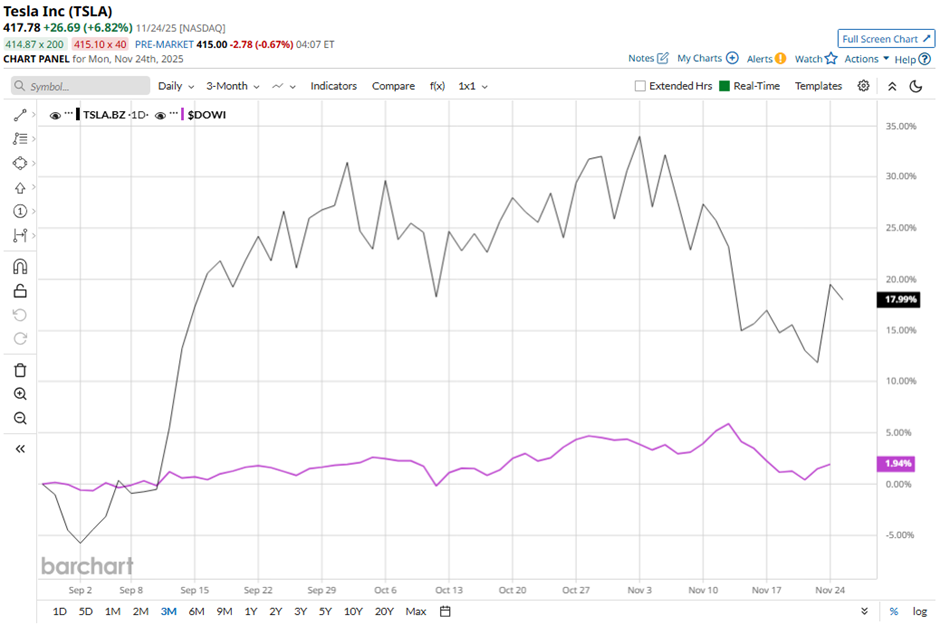

Despite this, shares of the electric vehicle maker have declined 14.5% from its 52-week high of $488.54. TSLA stock has increased 22.9% over the past three months, outperforming the broader Dow Jones Industrials Average's ($DOWI) 2.3% rise over the same time frame.

Longer term, shares of Tesla have returned 18.5% over the past 52 weeks, outpacing DOWI’s 3.8% gain over the same time frame. However, the stock is up 3.5% on a YTD basis, lagging behind DOWI's 9.2% rise.

Despite recent fluctuations, TSLA stock has been trading above its 50-day and 200-day moving averages since early August.

Shares of Tesla rose 2.3% following its Q3 2025 results on Oct. 22 as Tesla reported record performance, producing over 447,000 vehicles, delivering 497,000 vehicles, and deploying 12.5 GWh of energy storage. Investors reacted positively to stronger-than-expected financial momentum, including 12% year-over-year revenue growth to $28.1 billion and a significant increase in free cash flow that boosted Tesla’s cash position to $41.6 billion, up $4.9 billion sequentially.

Nevertheless, rival General Motors Company (GM) has outpaced TSLA stock. GM stock has climbed 21.3% over the past 52 weeks and 33.3% on a YTD basis.

Despite the stock’s outperformance relative to the Dow over the past year, analysts remain cautious on Tesla. The stock has a consensus rating of “Hold” from 41 analysts in coverage, and as of writing, it is trading above the mean price target of $386.63.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart