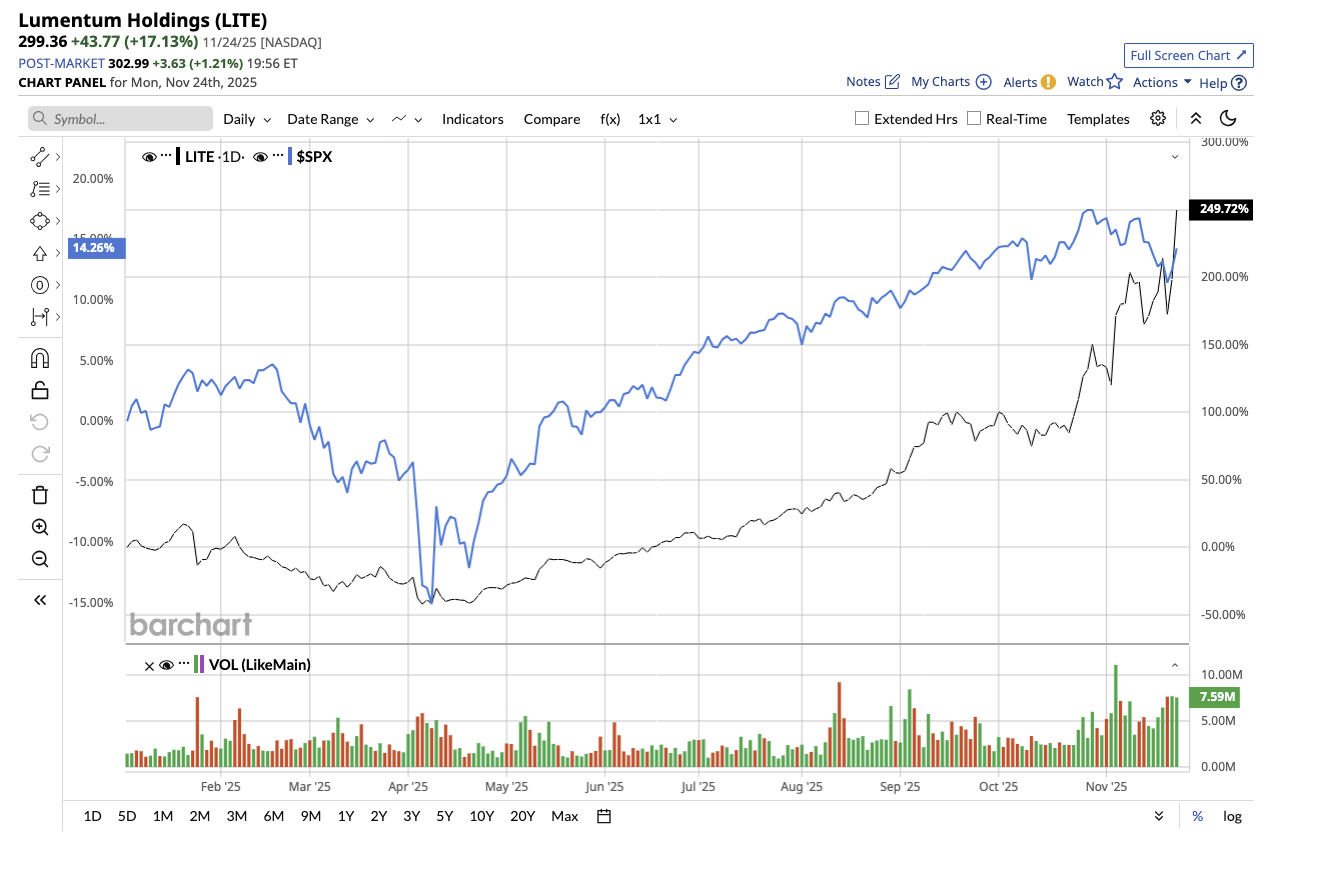

Lumentum Holding (LITE) stock has skyrocketed 240% this year, fueled by a surge in AI-driven demand that has transformed the once-telecom-focused supplier into one of the fastest-growing cloud infrastructure companies. After achieving the strongest quarter in its history and pointing to yet another record quarter ahead, the question at hand now is: after a 240% run, is there still room for more?

AI Infrastructure Fuels Record Revenue

Valued at $21.1 billion, Lumentum is a tech business that develops the laser chips, optical components, and high-speed transceivers that power AI data centers, cloud networks, and long-haul fiber networks. This year, Lumentum has emerged as one of the clearest winners of the worldwide AI infrastructure boom. The first quarter of fiscal 2026 not only shattered company records, but also paved the way for faster growth in the coming quarters.

In Q1, the company recorded $533 million in revenue, up 58% year over year. Adjusted earnings per share increased to $1.10 from $0.18 in the prior year quarter. This $533 million in revenue also marked the highest in Lumentum’s 10-year history, and momentum is accelerating. Even more impressive is that Lumentum is pulling forward its growth targets. The company had previously planned to cross $600 million in quarterly revenue by mid-2026. Now, its Q2 outlook points to a midpoint of roughly $650 million, beating that timeline by two full quarters.

More than 60% of total revenue came from cloud and AI infrastructure, reflecting both direct hyperscale demand and indirect pull-through from network equipment and optical transceiver manufacturers. The company's transition from a telecom subsystem provider to a primary supplier of AI-scale optics is now well underway. Margins expanded with gross margin landing at 39.4%, as a result of improved manufacturing utilization and increased data center laser chip volumes. Management believes Lumentum is still in the early phases of its AI-powered expansion cycle. It predicts cloud transceivers, optical circuit switches, and co-packaged optics to be the three main growth drivers in the next years.

Components: The Powerhouse of Q1 Growth

To align with its AI-driven shift, Lumentum will now break out revenue using two categories, namely Components, which will include laser chips, laser assemblies, line subsystems, and wavelength management building blocks. The second one is Systems, which includes standalone transceivers, optical circuit switches, and industrial lasers.

In Q1, Components revenue reached $379 million, up 18% sequentially and 64% year-over-year, owing to strong demand inside AI data centers and across long-haul networks. Meanwhile, Systems revenue hit $155 million, down 4% sequentially but up 47% from last year. Lumentum expects Components to account for half of its sequential growth in Q2, with Systems accounting for the other half, driven primarily by high-speed cloud transceivers.

The company forecasts revenue in the second quarter to range between $630 million and $670 million, with the midpoint setting a new company record. Adjusted EPS might range from $1.30 to $1.50. The company ended Q1 with cash and short-term investments totaling $1.12 billion.

A Rally Backed by Fundamentals, But Is There More?

Lumentum’s 240% stock surge this year is a reflection of its key role in AI infrastructure. The company is hitting record revenue, expanding margins, accelerating production, and pulling forward future milestones. If AI data centers continue scaling at today’s pace, Lumentum’s optical technologies will remain indispensable. While there may be short-term volatility, the fundamentals indicate that Lumentum's surge may still have more room to run.

Owing to the stock run this year, LITE has already surpassed both its average target price and the high price estimate. Given its explosive growth and strengthening fundamentals, analysts may revise the price targets. On Wall Street, LITE stock holds an overall rating of “Moderate Buy.” Among the 20 analysts covering the stock, 12 rate it as a “Strong Buy,” two rate it a “Moderate Buy,” and six recommend a “Hold.”

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This ‘Strong Buy’ Retail Stock Has Great Earnings Growth and Has Doubled This Year

- Our Top Chart Strategist Analyzes the 'Generational Buying Opportunity' in Meta Stock

- Corporate Insiders Have Sold $25 Billion in Stock in Just 60 Days. Before You Panic and Sell Your Shares, Read This.

- Top 100 Stocks to Buy: Argan Moves Up 40 Spots. Time to Buy?